In a striking declaration on his “Truth Social” platform, former President Donald Trump has attributed the recent upswing in the stock market to the positive polling numbers he holds against President Joe Biden. Trump’s assertion suggests that investor confidence is buoyed by the prospect of his victory in the upcoming election, a claim made without presenting any supporting evidence.

As CNBC reported, on 29 January 2024, in a post on Truth Social, Trump emphatically stated:

“THIS IS THE TRUMP STOCK MARKET BECAUSE MY POLLS AGAINST BIDEN ARE SO GOOD THAT INVESTORS ARE PROJECTING THAT I WILL WIN, AND THAT WILL DRIVE THE MARKET UP – EVERYTHING ELSE IS TERRIBLE (WATCH THE MIDDLE EAST!), AND RECORD SETTING INFLATION HAS ALREADY TAKEN ITS TOLL. MAKE AMERICA GREAT AGAIN!!!”

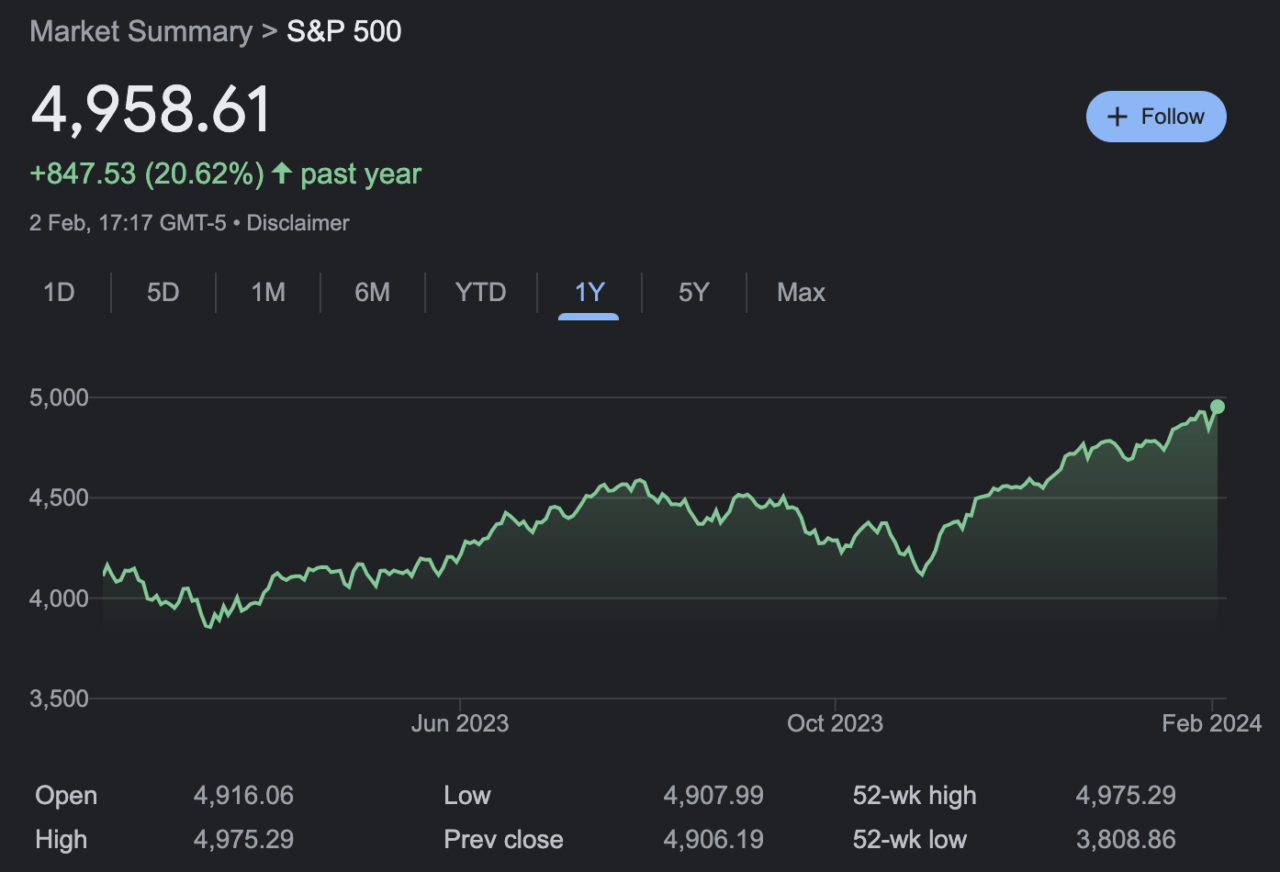

The stock market has indeed seen significant gains, with the Dow Jones Industrial Average reaching 38,000 for the first time on January 22, marking a rapid 1,000-point increase in just 40 days. Similarly, the S&P 500 achieved a record high on January 19, signaling the onset of a new bull market. On February 2, the S&P 500 closed the week at 4,958.61, up 4.55% in the year-to-date period and up 20.62% in the past year.

Polls indicate a close race between Trump and Biden, with some, like a recent Reuters/Ipsos survey, showing Trump slightly ahead. As the 2024 election approaches, Trump has emerged as the frontrunner for the Republican nomination, bolstered by his claims that the stock market’s performance is directly linked to his political fortunes.

As Brett Samuels reported for The Hill, during a Fox News town hall in Iowa on January 10, when questioned by moderator Bret Baier about his earlier remarks wishing for an economic downturn within the next year to avoid a Herbert Hoover-like legacy, who entered office during economic stability but witnessed the onset of the Great Depression, Trump clarified his position.

“You’re not suggesting you wish for an economic downturn, just to clarify?” Baier inquired.

“No. Here’s what I believe: the economy is in a terrible state, with the sole exception being the stock market’s rise. And my belief is that the stock market is climbing because I’m ahead of Biden in all the polls,” Trump responded.

He further predicted, “If I don’t win, I anticipate a crash.” Trump emphasized, “And I state this not wanting to be compared to Herbert Hoover.”

This mirrors his prediction prior to the 2020 election, where he warned of a market collapse if Biden were victorious—a claim that the Biden camp revisited on January 29 with a touch of irony, given the market’s current strength.

Contrary to predictions of an economic downturn due to the Federal Reserve’s interest rate hikes aimed at controlling inflation, the U.S. economy has shown resilience. The latest economic indicators, including a robust jobs report for December, a low unemployment rate, and a 3.3% increase in GDP in the last quarter of 2023, suggest a stronger economy than anticipated. Furthermore, signs of cooling inflation, although prices remain high, contribute to a more optimistic economic outlook, challenging the narrative of an impending recession.

During a Bloomberg TV interview on February 2, Jeffrey Rosenberg, a senior portfolio manager at BlackRock Inc., offered his analysis in the wake of the January 2024 U.S. employment report and the Federal Reserve’s latest meeting on monetary policy.

Rosenberg advised viewers to approach the jobs report with a nuanced perspective, emphasizing the need to delve beyond surface-level interpretations. He highlighted the seasonal adjustments typical of January’s employment data, cautioning that these factors often lead to a broad range of expectations and a history of positive surprises for the month. Such seasonal dynamics, Rosenberg suggested, could potentially exaggerate the perceived robustness of the job market as reflected in the payroll figures.

Further dissecting the jobs report, Rosenberg urged a careful examination of the payroll increase, pointing out the complexity of current labor market shifts. He noted the disproportionate impact of higher-tier job roles in the recent figures and a decrease in average working hours, factors that might artificially enhance the payroll data’s appearance. Importantly, Rosenberg brought attention to the recent Employment Cost Index (ECI), which indicated a trend toward wage disinflation. This, he argued, should moderate any overly optimistic interpretations of the employment report’s strength.

During a recent conversation on “Mornings With Maria” with host Maria Bartiromo, Trump shared his views on Jerome Powell, the Federal Reserve Chair. Trump, who is expected to secure the Republican nomination for the 2024 presidential race, voiced doubts about Powell’s capability to navigate the economy to a stable slowdown, hinting at a possibility that Powell could reduce interest rates to favor the Democratic Party in the forthcoming elections.

Trump speculated that such measures might trigger significant inflation, particularly if turmoil in the Middle East leads to increased oil prices. He directly criticized Powell for being partisan and made it clear that he would not consider Powell for reappointment as Fed Chairman should he win the presidency again, alluding to alternative choices for the role without specifying any names.

Featured Image via Unsplash