In a recent interview with Fox Business host Maria Bartiromo on “Mornings With Maria,” former President Donald Trump provided a comprehensive overview of his perspectives on various issues, ranging from economic policies to the potential dangers of artificial intelligence (AI). Trump, who is anticipated to be named the Republican Party’s nominee for the 2024 United States presidential election, did not hold back in expressing his views on the current administration, the Federal Reserve, why he is against CBDCs, and his recent scary experience with a deep fake video of him.

Economic Policies and the Federal Reserve

Trump criticized the current economic direction under President Biden, particularly targeting the administration’s push toward electric vehicles (EVs). He argued that this mandate is impractical, citing the high costs, limited range of EVs, and the dependency on China for necessary materials. Trump emphasized the importance of consumer choice in the automotive market, advocating for the availability of internal combustion, hybrid, and electric vehicles without government mandates.

Addressing the issue of immigration, Trump claimed that his administration had a “very strong border,” contrasting it with Biden’s policies, which he believes have led to an influx of millions of people into the country. He warned that the continuation of Biden’s presidency would be detrimental to the United States, labeling Biden as “incompetent” and “the worst president in the history of our country.”

Jay Powell and Interest Rates

Trump expressed skepticism about Federal Reserve Chairman Jay Powell’s ability to achieve a “soft landing” for the economy, suggesting that Powell might lower interest rates to assist the Democratic Party in upcoming elections. Trump predicted that such actions could lead to massive inflation, especially if conflicts in the Middle East escalate, affecting oil prices. He openly accused Powell of being political and indicated that he would not reappoint Powell as Fed Chairman if he returned to the White House, hinting at other candidates for the position without naming them.

Central Bank Digital Currency and Artificial Intelligence

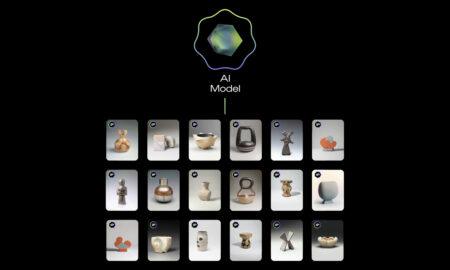

The former president voiced strong opposition to the idea of a central bank digital currency (CBDC), citing concerns over surveillance and the potential for individuals to suddenly find their accounts empty. He highlighted this as a significant danger, alongside the rapid advancements in AI. Trump shared an anecdote about being misrepresented in a fake endorsement created with AI technology, emphasizing the difficulty in distinguishing between real and fabricated content. He stressed the urgent need for solutions to address the security risks posed by AI, suggesting that the technology’s power and accuracy in mimicking reality could lead to misinformation and even conflict.

In recent weeks, Trump has vocally opposed the concept of CBDCs, a position he first articulated during a campaign event in New Hampshire on January 18. This stance is part of Trump’s wider economic and political strategy, finding particular resonance among his conservative supporters.

Trump has made several key points against CBDCs, highlighting his commitment to preventing what he views as government overreach. He has articulated a commitment to “protect Americans from government tyranny,” specifically citing the potential dangers of CBDCs in enabling government control over individual finances.

On January 18, Trump stated:

“As your president, I will never allow the creation of a central bank digital currency… Such a currency would give a federal government — our federal government — absolute control over your money. They could take your money, and you wouldn’t even know it’s gone.”

A CBDC represents the digital version of a nation’s official currency, like the dollar or euro. In contrast to the decentralized nature of cryptocurrencies, CBDCs are centralized, being governed and regulated by the country’s central banking authorities. The primary aim behind the creation of CBDCs is to improve the efficiency, security, and ease of access to financial transactions.

Featured Image via Pixabay