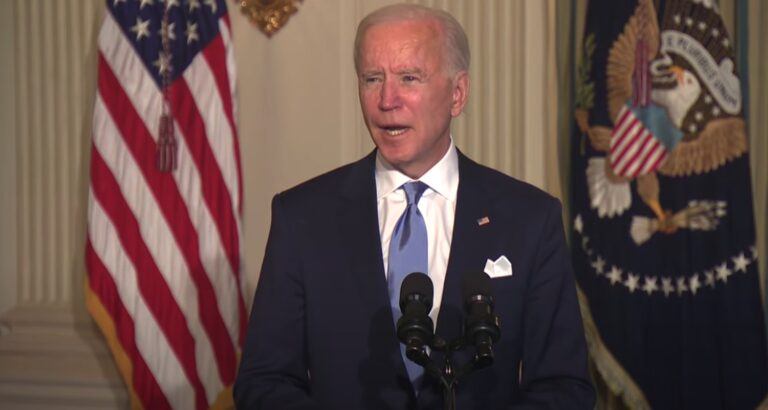

In a recent opinion piece for The New York Times (NYT), Nobel laureate economist Paul Krugman delivers a robust analysis of the current U.S. economy, challenging the pervasive narrative of economic doom with a compelling defense of its vitality under President Joe Biden’s administration.

Federal Reserve Chair Jerome Powell spoke to the public in a post-FOMC press conference on January 31, addressing the Federal Reserve’s strategies for managing inflation and economic activity. Powell highlighted that although inflation has slightly decreased from previous highs, it remains above the desired 2% target, signaling uncertainty about future progress in reducing inflation. He reiterated the Federal Reserve’s commitment to achieving stable prices, mentioning the decision to maintain the policy interest rate unchanged and continue reducing securities holdings.

Powell acknowledged the significant tightening of monetary policy over the past two years and its impact on economic activity and inflation. He noted recent economic indicators indicating strong activity, with solid GDP growth in the last quarter and throughout the year, driven by consumer demand and improved supply conditions. However, he also pointed out subdued activity in the housing sector and the restraining effect of high interest rates on business investment.

Regarding the labor market, Powell stated that while it remains tight, there are signs of a better balance between supply and demand. He mentioned moderate average monthly job gains and a low unemployment rate, along with easing nominal wage growth and a narrowing gap between job vacancies and available workers. However, he acknowledged that labor demand still surpasses supply.

Powell discussed inflation, noting a significant decrease over the past year but emphasized the need for sustained evidence of inflation moving toward the Fed’s goal. He assured that the Federal Reserve’s actions are guided by its mandate to promote stable prices and maximum employment, recognizing the challenges high inflation poses, especially for vulnerable populations.

Regarding monetary policy, Powell suggested that the current policy rate is likely at its peak for this tightening cycle, with potential adjustments contingent on economic developments. He underscored the Fed’s readiness to maintain or modify its policy stance as necessary, aiming to ensure progress toward the 2% inflation goal while managing the risks of weakening economic activity and employment.

The following day, the NYT published Krugman’s article about the better-than-Goldilocks U.S. economy.

A Thriving Economy Misunderstood

Krugman begins by echoing Federal Reserve Chair Jerome Powell’s optimistic assessment of the economy, noting the disconnect between public perception and economic reality. Despite skepticism, indicators suggest that the economy is thriving on multiple fronts, posing a unique dilemma for monetary policy: how to navigate a scenario where almost all economic news is positive.

Understanding the ‘Goldilocks Economy’

Before diving deeper into the current economic landscape, it’s crucial to understand what economists mean by a “Goldilocks economy.” This term is borrowed from the children’s story “Goldilocks and the Three Bears,” where Goldilocks prefers conditions that are “just right,” neither too hot nor too cold. In economic terms, a Goldilocks economy refers to an ideal state where the economic conditions are balanced perfectly. Growth is steady, not so rapid as to cause inflation, nor so slow as to lead to recession; employment rates are high without overheating the job market; and inflation is low and stable. It’s a scenario where the economy operates in an optimal zone, avoiding the extremes of economic boom and bust cycles.

Debunking the ‘Goldilocks Economy’ Myth

Krugman argues that the current U.S. economy surpasses the traditional “Goldilocks economy” by being simultaneously “piping hot” in terms of growth and job creation and “refreshingly cool” in terms of inflation. This dual success challenges the Federal Reserve’s strategy, especially regarding interest rates in a post-inflationary environment.

The Political Implications of Economic Success

Highlighting the political implications, Krugman points out that the economy’s robust performance under Biden’s presidency has led to a noticeable shift in Republican messaging, with Trump insisting that unemployment numbers are fake and ludicrously claiming credit for the stock market’s rise. This reaction, Krugman suggests, indicates a form of backpedaling in the face of economic success that contradicts previous criticisms.

Bidenomics Vindicated

Despite predictions of disaster from critics, including notable economists like Larry Summers, the U.S. has not only weathered a burst of inflation but has also outperformed its peers in growth and employment. Krugman suggests that this outcome vindicates Biden’s economic policies, demonstrating that progressive initiatives can coexist with economic prosperity.

Hyperpartisanship and Economic Perception

Krugman observes that hyperpartisanship may dilute the electoral advantages of economic success. Many voters, especially Republicans, perceive the economy through the lens of their political affiliations rather than objective indicators. Despite overwhelming evidence of economic improvement, a significant portion of Republicans believe the economy is deteriorating.