In a Bloomberg News article by Jess Menton and Farah Elbahrawy that was published on February 18, it was reported that Goldman Sachs Group Inc. has revised its S&P 500 target upwards for the second time in 2024, signaling Wall Street’s growing confidence in earnings potential.

According to Bloomberg, this optimism is driven by increased profit estimates, with Goldman’s team, led by David Kostin, noting record-high 12-month forward earnings expectations for the index.

Bloomberg details that Kostin’s revised forecast now positions the S&P 500 to reach 5,200 by year-end, marking a 3.9% increase from its recent closing, an adjustment from the previously projected 5,100 level in mid-December.

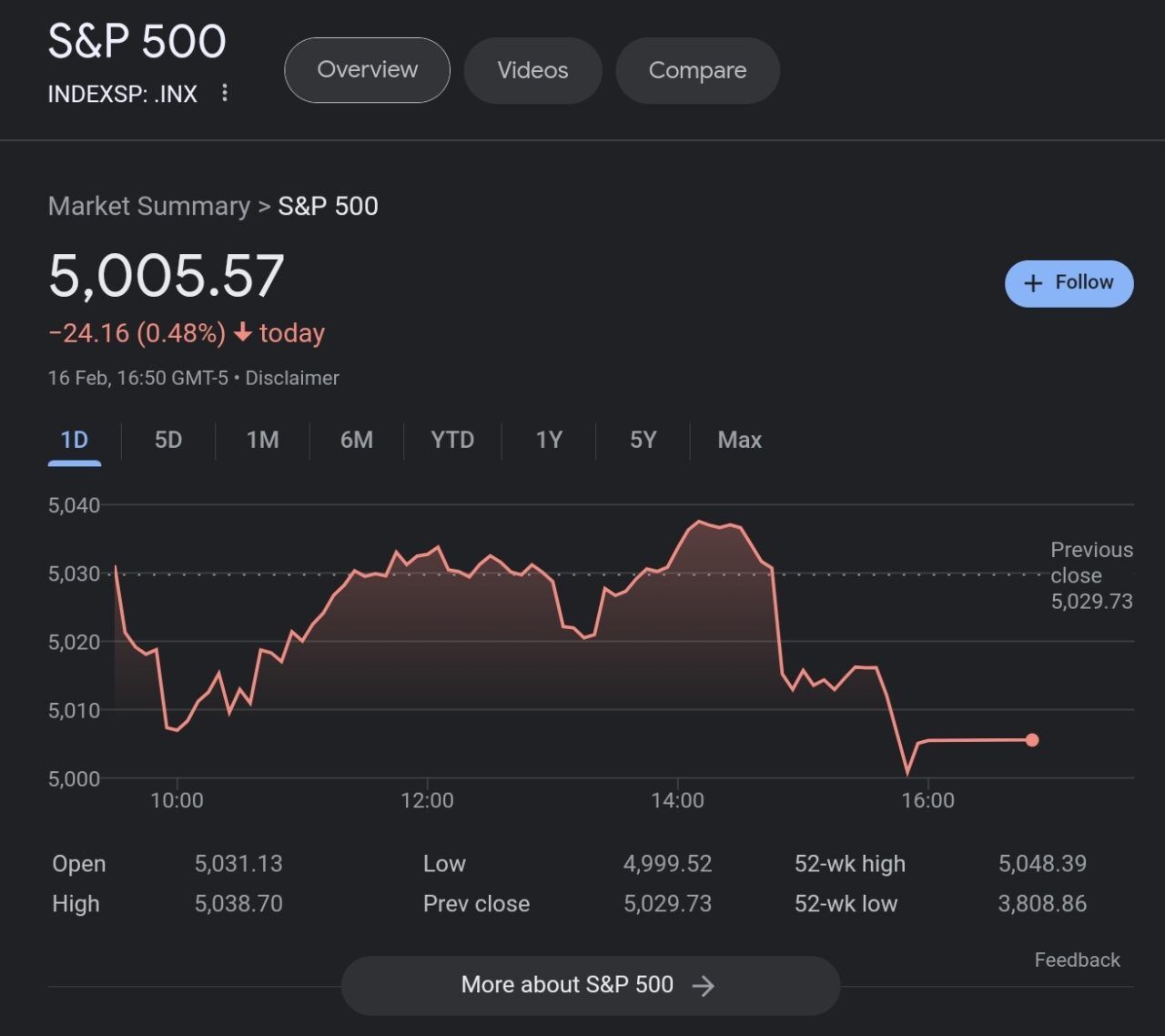

Bloomberg says that initially, in November 2023, Goldman had set a target of 4,700 for the index by the end of the year, a figure already surpassed with the S&P 500 crossing the 5,000 milestone earlier this month.

As reported by Bloomberg, Goldman’s new 5,200 target aligns with the bullish outlooks of other Wall Street figures like Tom Lee of Fundstrat Global Advisors and Oppenheimer Asset Management’s John Stoltzfus. This places Goldman among the highest forecasts for the S&P 500 in 2024.

Bloomberg also mentions that Goldman’s strategists have increased their earnings-per-share predictions for 2024 to $241 and $256 for 2025, up from their earlier forecasts. This adjustment reflects anticipated stronger economic growth and higher profits, particularly in the information technology and communication-services sectors, which include major players like Apple Inc. and Microsoft Corp.

According to Bloomberg, the ongoing earnings season has reinforced bullish sentiments, with a significant portion of the S&P 500 companies beating expectations. This performance has led to a positive market reaction, with stocks outperforming the benchmark on the day of their results announcement.

Bloomberg highlights mixed outcomes for the “Magnificent Seven” stocks during the reporting period, with companies like Meta and Microsoft surpassing expectations, while Tesla and Apple faced challenges. The market is keenly awaiting Nvidia’s earnings, given the high expectations fueled by the artificial intelligence boom.

The article by Bloomberg further explains that Goldman strategists anticipate valuation multiples for the S&P 500 to remain steady, emphasizing earnings growth as the key driver for the index’s upward trajectory this year. The S&P 500’s performance has been robust, buoyed by Federal Reserve policy shifts and enthusiasm around artificial intelligence, leading to an 8.8% expected profit growth in 2024.

Bloomberg also mentions that the S&P 500 recently achieved a new all-time high, a milestone mirrored by the Nasdaq 100, as signals from the Fed suggest an end to aggressive rate hikes. This development has prompted other Wall Street analysts to consider revising their year-end targets upwards, reflecting a broader optimism not fully captured in current forecasts.

Featured Image via Pixabay