In an appearance on CNBC’s “Closing Bell” yesterday, Sara Naison-Tarajano, the global head of Private Wealth Management Capital Markets at Goldman Sachs, shared her outlook for the U.S. stock market in 2024.

The Market’s Bullish Trajectory

Naison-Tarajano expressed a constructive outlook on the market, buoyed by strong economic data and earnings reports. With over half of the companies exceeding earnings expectations, the foundation for continued growth appears solid. However, she tempered expectations for returns, suggesting that while the market remains on an upward trajectory, the pace of gains since November might not be sustained.

The Magnificent 7 and Investment Longevity

A key strategy highlighted by Naison-Tarajano involves staying invested in the “Magnificent 7,” a reference to major tech-driven stocks that have led market rallies. For taxable investors, particularly, who have realized significant gains, the advice is to maintain these positions rather than trying to time the market or realize taxable gains. This approach underscores the importance of large-cap allocations within a core portfolio, balancing the pursuit of growth with tax efficiency.

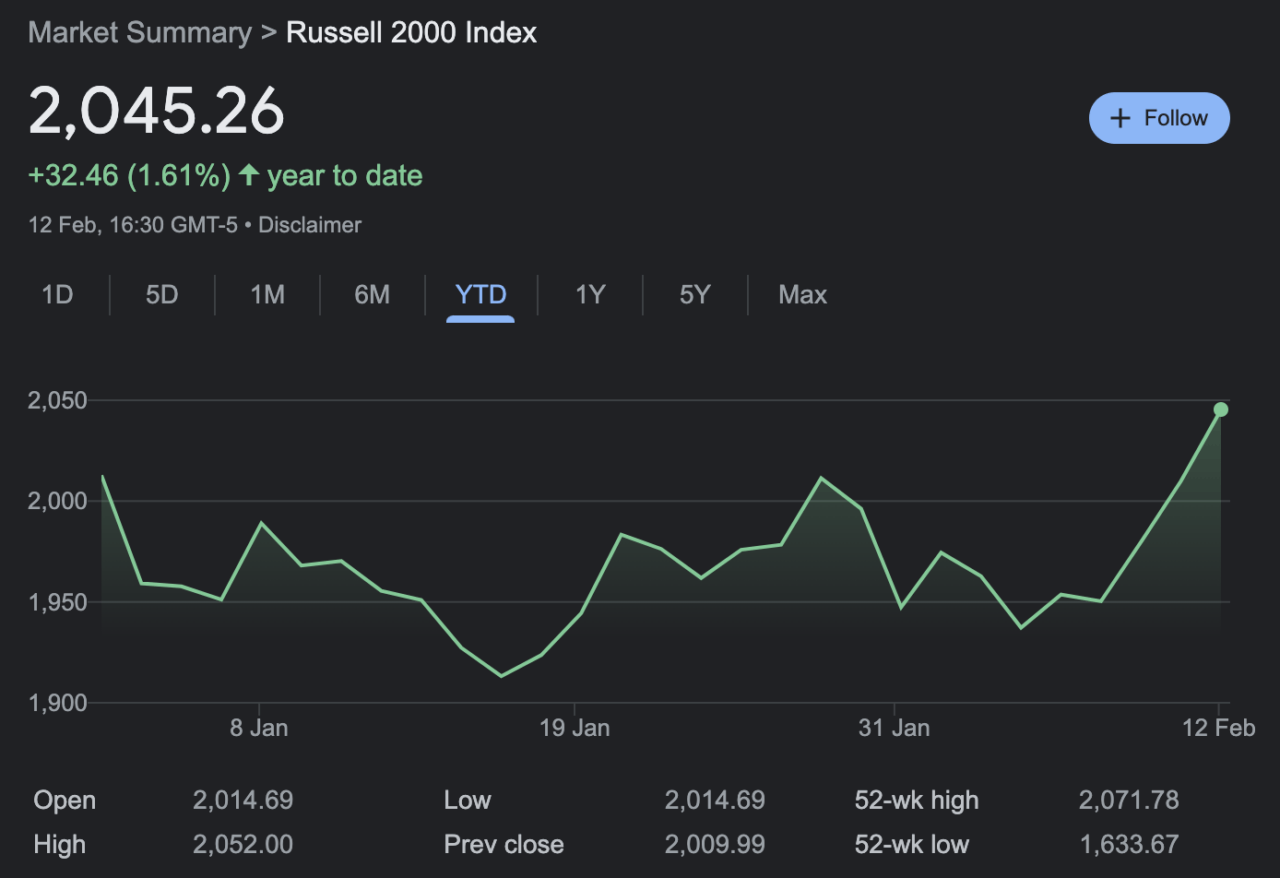

Cyclical Stocks and the Russell 2000’s Potential

Naison-Tarajano also pointed to the potential in more cyclical stocks and the Russell 2000 index. With economic numbers supporting a shift towards more cyclical sectors and an expectation of interest rate cuts, these areas of the market offer attractive valuation opportunities. The Russell 2000, trading at a discount compared to its historical average, presents an interesting proposition for investors looking to diversify beyond the dominant tech stocks.

Market Volatility and Election Year Dynamics

Looking ahead, Naison-Tarajano anticipates some volatility as the U.S. heads into an election year. Historical patterns suggest that markets can experience turbulence in the lead-up to elections, but she advises investors to view any dips as opportunities to add to their positions. This perspective is particularly relevant for long-term investors aiming to capitalize on temporary market dislocations.

Interest Rate Cuts and Economic Outlook

The discussion also touched on the Federal Reserve’s interest rate policy. With inflation trending below the Fed’s 2% target, Naison-Tarajano expects five rate cuts, potentially starting as early as May. While the timing of these cuts could shift, the overall direction of monetary policy is poised to support continued market growth, reinforcing the bullish outlook for investors.

Featured Image via Pixabay