El Salvador is a very compact country, covering approximately 21,041 square kilometers (8,124 square miles). This makes it the smallest country in mainland Central America, roughly comparable in size to the U.S. state of New Jersey. El Salvador sits nestled along the Pacific coast of Central America. It shares borders with Guatemala to the west and Honduras to the north and east. Its southern coastline provides ample access to trade routes through the Pacific Ocean.

El Salvador has a developing economy, transitioning from a reliance on agriculture to a greater focus on manufacturing and services. The U.S. dollar is the official currency, adopted in 2001. Key industries include textiles, food processing, and tourism. Remittances, or money sent back by Salvadorans working abroad (primarily in the United States), play a significant role in the economy.

El Salvador’s 2021 decision to make Bitcoin legal tender was a bold move aiming to attract investment and modernize its financial system, though the real-world impact is still being debated. This groundbreaking experiment, spearheaded by President Nayib Bukele, has garnered global attention, sparking both praise and intense criticism.

The government’s stated goals include boosting financial inclusion for the unbanked, attracting foreign investment, and reducing reliance on remittances sent from overseas. To facilitate this, they launched the official Chivo wallet, offering incentives to citizens for adoption.

However, the rollout has been met with challenges. Technical glitches with the Chivo wallet, public skepticism, and Bitcoin’s ongoing volatility have led to limited everyday use. Critics argue the move prioritizes image over practicality, exposing El Salvador to further financial risk. Additionally, concerns have been raised about the potential for money laundering and the impact on already strained relations with international bodies like the IMF.

Despite these issues, President Bukele remains bullish. Plans for a tax-free “Bitcoin City” and the issuance of volcano-powered Bitcoin bonds signal El Salvador’s intention to double down on its crypto gamble.

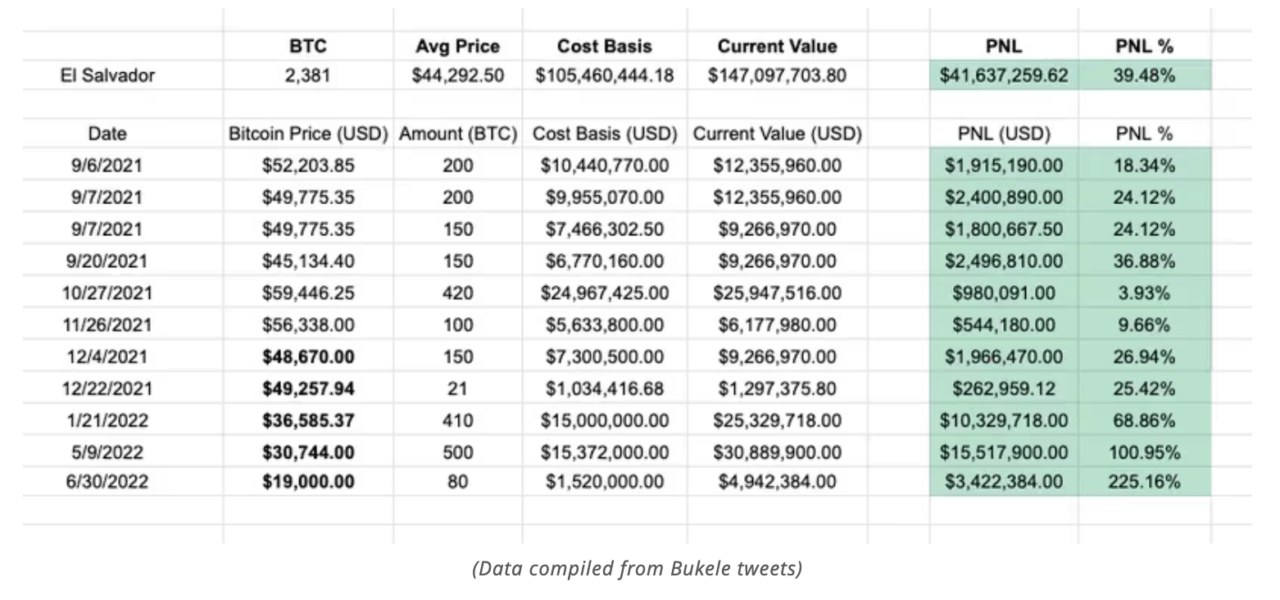

On February 28, as Bitcoin hovered around the $61,000 mark, President Bukele took to social media platform X to address the nation’s cryptocurrency strategy and the silence of its critics amidst the current market surge. The Salvadoran president highlighted the contrast between past criticisms and the current financial outcome of El Salvador’s Bitcoin holdings.

President Bukele pointed out that during periods when Bitcoin’s market price was lower, numerous articles and reports were published focusing on El Salvador’s supposed financial losses due to its investment in the flagship cryptocurrency. He noted the extensive coverage by authors, analysts, and journalists, which he referred to as “hit pieces,” that speculated on the negative impact of the country’s Bitcoin adoption.

However, with the recent surge in Bitcoin’s value, President Bukele underscored that if El Salvador were to sell its Bitcoin holdings now, the country would realize a profit of over 40% from its market purchases alone. He also revealed that El Salvador’s primary source of Bitcoin has become its citizenship program, rather than direct market purchases.

Despite the potential for profit, President Bukele affirmed El Salvador’s commitment to not sell its Bitcoin holdings, emphasizing the principle that “1 BTC = 1 BTC.” This statement reflects a belief in the inherent value of Bitcoin, independent of its current market price.

President Bukele’s message concluded with a reminder to consider the current silence of critics the next time negative narratives emerge about El Salvador’s Bitcoin strategy.

As an article by Sam Reynolds for CoinDesk noted yesterday, “El Salvador’s holdings were accumulated at an average price of $44,292,” and “in total, the country has 2,381 bitcoins in its treasury.”

Featured Image via Pixabay