Web3 investment firm DFW Labs is making a renewed commitment to the ecosystem of the meme-inspired cryptocurrency Floki Inu through a $10 million purchase of $FLOKI tokens. This follows their initial investment of $5 million in May 2023, marking its continued support for the meme coin’s ecosystem.

The funds, according to a recent announcement, for the latest acquisition will be drawn from the Floki Treasury, with the investment spread over the next two years. DFW Labs aims to solidify FLOKI’s position within the meme coin space and contribute to its growth as a leader.

The announcement details that FLOKI’s partnership with DWF Labs has seen the Web3 investment firm contribute to “helping boost Floki adoption by facilitating key exchange listings, helping boost adoption of our utility by facilitating introductions to key industry projects, and publicly supporting our progress and accomplishments.”

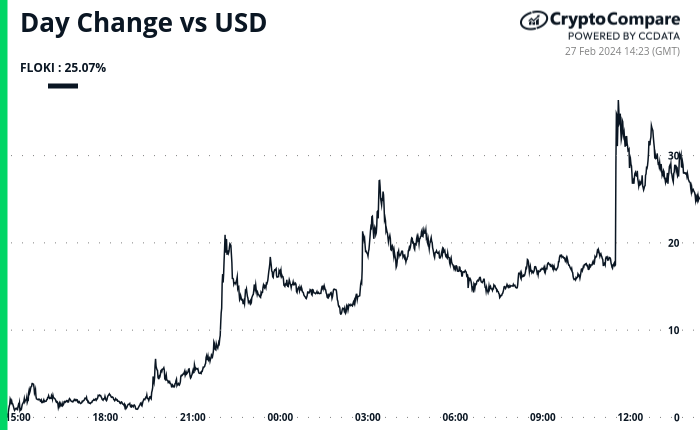

News of the investment sent FLOKI’s price soaring by as much as 35% within minutes, reaching its highest point in ten months, before the price of the cryptocurrency corrected slightly to still be up over 25% over the last 24-hour period, according to CryptoCompare data. Market capitalization also neared the $500 million mark for the first time since the first quarter of 2023.

This upswing coincides with a broader cryptocurrency market rally, with Bitcoin (BTC) exceeding $57,000 and Ethereum (ETH) surpassing $3,200 as demand from spot Bitcoin exchange-traded funds (ETFs) puts pressure on BTC’s circulating supply, while expectations surrounding the potential approval of spot ETH ETFs in the United States grow.

Bitcoin also has an upcoming halving event in April, which will cut the coinbase reward miners receive for finding blocks in half, while Ethereum is set to undergo its Dencun upgrade, which will improve its efficiency, next month.

DWF Labs, it’s worth noting, is also the main institutional partner and market maker for TokenFi, a FLOKI ecosystem platform focused on crypto and asset tokenization that aims to become a global leader in the tokenization industry, which is expected to be worth $16 trillion by 2030