On February 15, during an appearance on Bloomberg TV, Anthony Scaramucci, founder of SkyBridge Capital, shared his insights on the crypto market’s recovery, Coinbase’s profitability, and his perspectives on SEC Chair Gary Gensler’s stance on cryptocurrency.

Bitcoin’s Rally and Coinbase’s Milestone

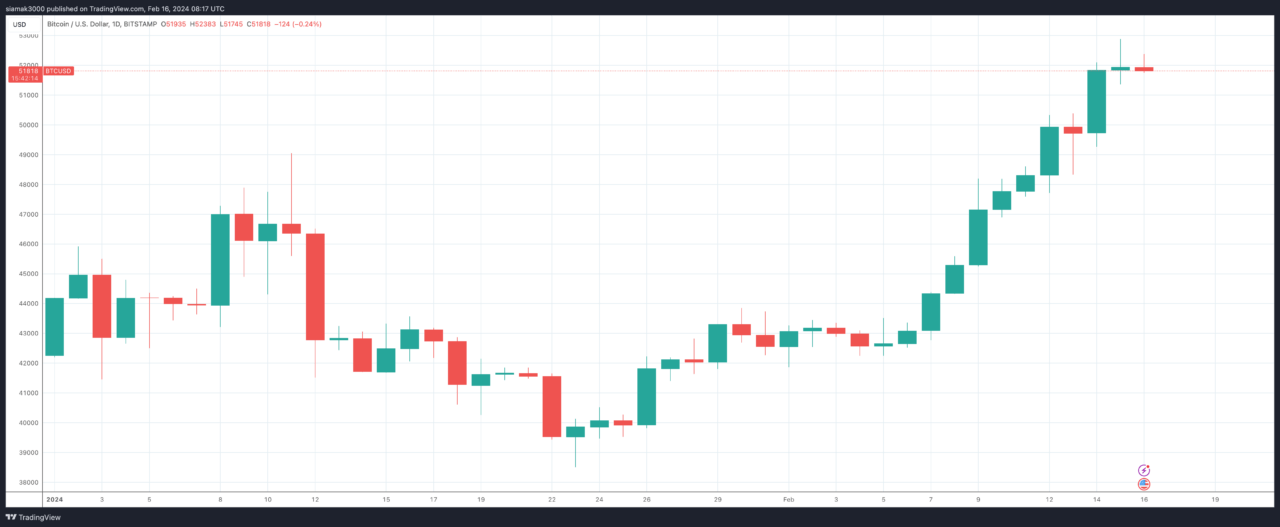

Scaramucci began by reflecting on the recent surge in Bitcoin’s price, which has seen a remarkable recovery from its lows in late 2022. He highlighted the cryptocurrency’s resilience and its rebound to around $52,000, signaling a positive momentum shift for the market.

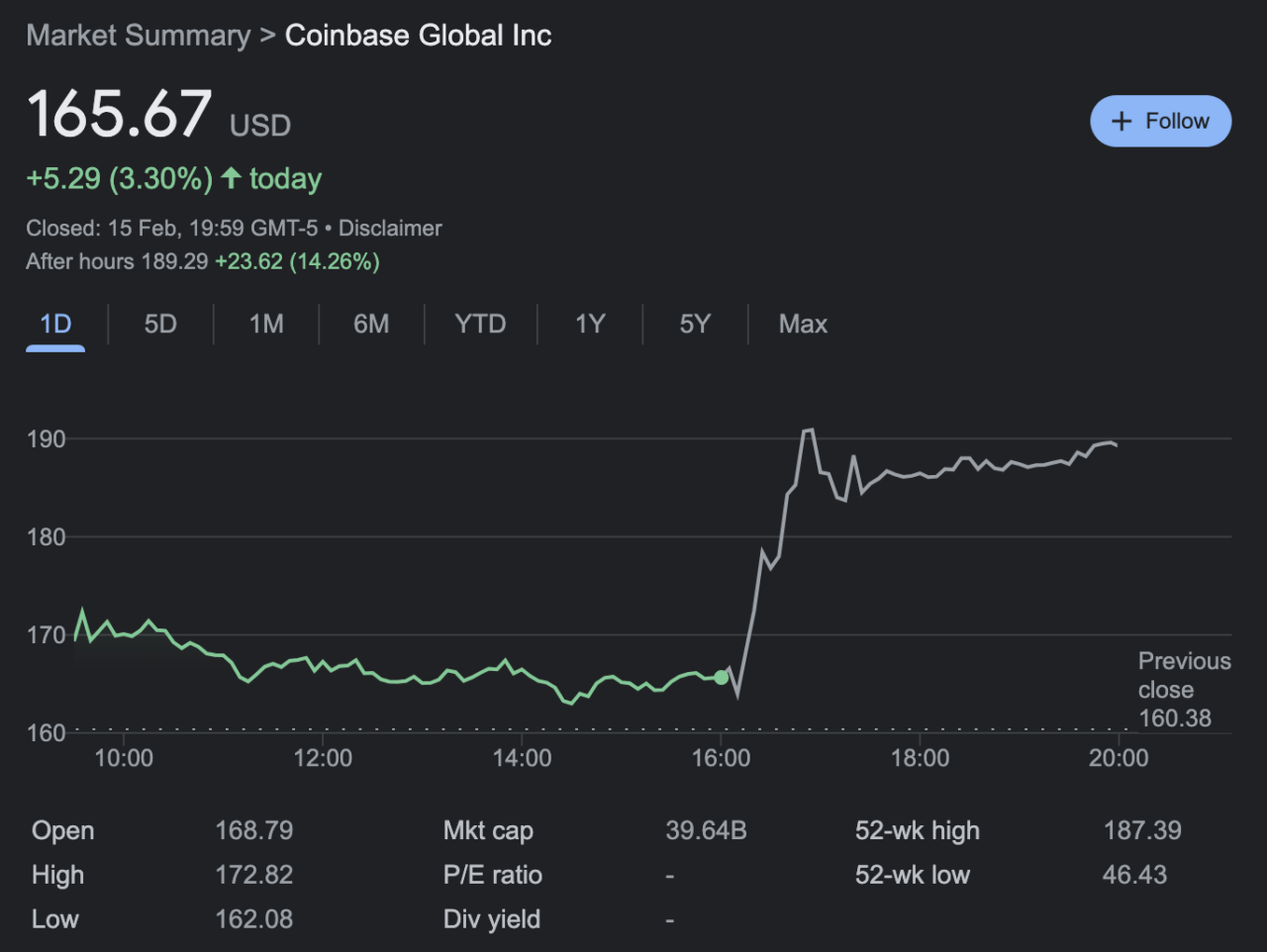

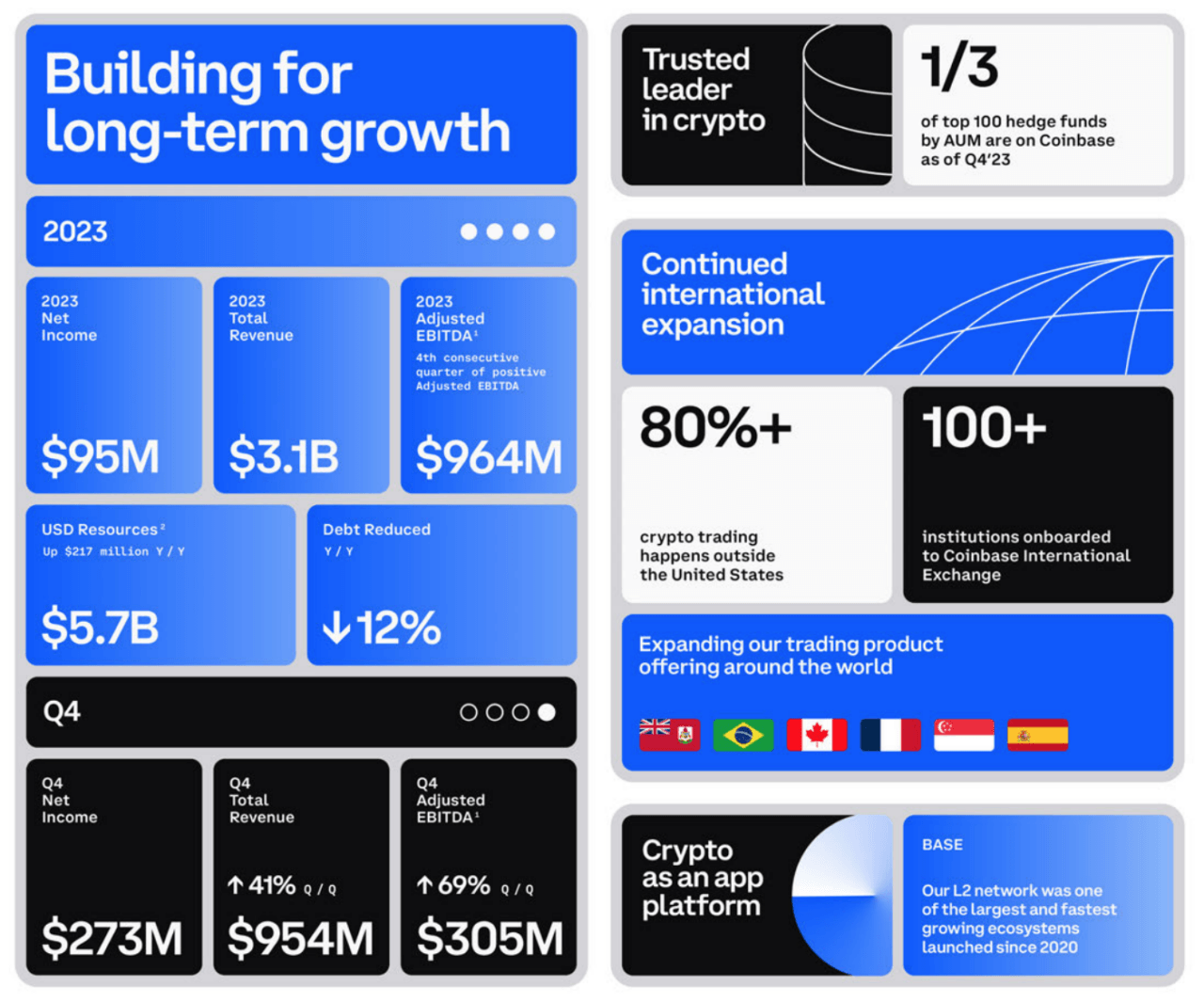

This recovery is particularly noteworthy for platforms like Coinbase, which posted a profit for the first time in two years. Scaramucci attributed this success to the overall uplift in the crypto market, emphasizing the role of staking on altcoins and the substantial margins it brings. Despite potential losses from exchange-traded funds (ETFs), the revenue boost from the market’s capitalization uplift is undeniable.

The Ripple Effect Beyond Bitcoin

Scaramucci discussed the broader impact of Bitcoin’s resurgence on the crypto ecosystem. He observed that as Bitcoin, the “grandfather of cryptos,” swells, it spills over into other assets. This dynamic leads to profits in Bitcoin being redeployed into riskier assets, which are not necessarily riskier relative to Bitcoin, such as Ethereum and Solana, now considered part of the “big boys club.”

The Safety of Coinbase and Regulatory Challenges

Highlighting Coinbase’s status as one of the best-run cryptocurrency exchanges globally, Scaramucci pointed out the safety and regulatory compliance that the platform offers. This assurance is crucial for investors navigating the volatile crypto market. However, he also touched upon the challenges posed by SEC Chair Gary Gensler’s cautious approach to crypto regulation, particularly regarding the approval of spot Bitcoin ETFs and the potential for ETFs backed by other cryptocurrencies like Ethereum.

Scaramucci’s Bitcoin Forecast

Despite the regulatory hurdles, Scaramucci remains bullish on Bitcoin, sticking with his forecast of a significant price increase. He bases his prediction on technical analysis over the past 14 years, suggesting that the price at the time of Bitcoin’s halving, multiplied by four, indicates where Bitcoin’s price could head in that cycle. This methodology leads him to believe that his $170,000 price prediction is conservative given the current momentum.

Wall Street’s Evolving Relationship with Crypto

Scaramucci also commented on the changing dynamics between Wall Street and the crypto market. He noted the shift in attitudes among Wall Street leaders, who are increasingly recognizing the value and potential of Bitcoin and other cryptocurrencies. He believes this growing acceptance is driven by deeper understanding and research into the decentralized properties and immutability of the Bitcoin network.

Yesterday, Coinbase Global, Inc. (NASDAQ: COIN) announced the release of its fourth quarter and full year 2023 shareholder letter.

Featured Image via Pixabay