On February 26, Mark Mahaney, the esteemed head of internet research at Evercore ISI, made an appearance on CNBC’s “Squawk Box” to share his expert analysis on a range of topics concerning the tech industry. He talked to co-anchor Joe Kernen about Amazon’s recent stock performance, its notable inclusion in the Dow 30, the broader Big Tech rally, and his top stock picks.

Understanding the Dow 30 and Its Significance

Before diving into the specifics of Amazon’s inclusion in the Dow 30 and its implications, it’s crucial to understand what the Dow 30 represents and why it matters. The Dow Jones Industrial Average (Dow 30) is a prestigious stock market index that includes 30 of the most significant and financially robust companies in the United States. Being part of the Dow 30 is a testament to a company’s market leadership, financial health, and pivotal role in the economy. For Amazon, joining this elite group marks a milestone, highlighting its massive influence and stability in the market.

Amazon Joins the Dow 30

Mahaney kicked off the discussion by reflecting on Amazon’s addition to the Dow 30, replacing Walgreens. This move, according to Mahaney, signifies Amazon’s broad representation in the economy and its consistent track record. He highlighted several key factors contributing to Amazon’s bullish outlook, including the expectation of record free cash flow margins and an acceleration in AWS revenue growth. Mahaney praised Amazon for its global leadership in online retail, its burgeoning $50 billion ad revenue, and its status as the third-largest ad platform and cloud platform worldwide.

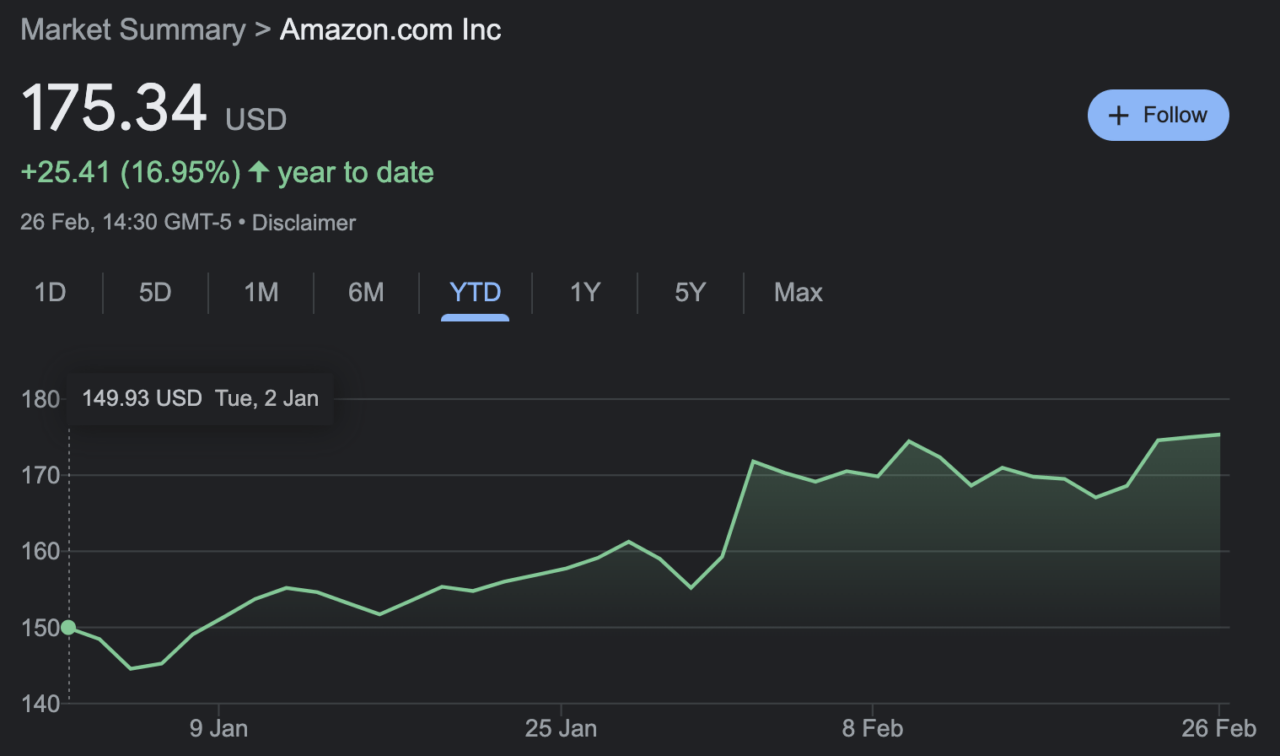

Amazon’s Stock Performance and Valuation

Mahaney expressed optimism about Amazon’s stock, noting an increase in the price target from 180 following the company’s earnings report two weeks prior. He pointed out that Amazon had emerged from a major investment cycle, which had previously impacted its free cash flow margins due to aggressive investments in delivery capabilities. With the company now past this cycle, Mahaney believes Amazon’s valuation on free cash flow multiples is more realistic and appealing.

Mahaney’s Top Stock Picks

Beyond Amazon, Mahaney shared his enthusiasm for Meta and introduced some contrarian picks, including Expedia as an online travel play and DoorDash, which he believes is turning the corner towards achieving Uber-like valuation caps. He predicted DoorDash’s potential entry into the S&P 500 within the next year.

The Least Appealing Stocks

When asked about stocks he’s less inclined to recommend, Mahaney expressed caution towards eBay and, to some extent, Expedia, marking a significant shift in his stance, especially compared to Airbnb. Among the major names, he prioritized Amazon, followed by Meta, with Alphabet trailing due to its lack of strong cost discipline, a critical factor for financial markets today.

Amazon’s Economic Impact and Inclusion in the Dow 30

Mahaney concluded by reflecting on Amazon’s journey and its comprehensive impact on various sectors, from consumer strength and advertising to business-to-business logistics and pharmacy. He noted that Amazon’s broad market coverage makes it highly sensitive to economic shifts, such as inflation, positioning it to benefit as inflationary pressures start to wane.

Featured Image via Unsplash