On January 23, On Bloomberg TV’s “Bloomberg Crypto,” Pomp Investments Founder Anthony Pompliano talked about Coinbase’s market mispricing and its evolving business model.

Here are the key takeaways from this interview:

Coinbase’s Evolving Business Model

- Pompliano emphasized that the public markets significantly undervalue companies like Coinbase. He pointed out that while Coinbase is known for its exchange and custody services, it has been transitioning towards a Web3 and crypto-native revenue model.

- He suggested that investors should evaluate companies based on the percentage of their revenue that is crypto-native. The higher this percentage, the more likely the company is mispriced in the public markets, with Coinbase being a prime example.

The Value in Crypto Investments

- Discussing investment strategies, Pompliano sees Bitcoin as the leader in monetary competition within the crypto sector. He views the entire sector as a macro asset class that should be considered for investment.

- He noted that young investors are increasingly putting their capital into this sector, which has shown significant outperformance, even considering recent downturns. Pompliano believes that investors who ignore this trend risk being left behind.

Coinbase’s Role in the ETF Trend

- Pompliano highlighted Coinbase’s status as the number one regulated exchange in America. He argued that bullishness on the crypto sector should extend to Coinbase, especially given its role as a custody provider for many of the SEC-approved spot bitcoin ETFs launched in the U.S. on January 11.

- He described Coinbase as effectively ‘taxing’ the ETF trend and sees its continued leadership as beneficial for both the industry and Wall Street. He believes that Wall Street benefits from having access to crypto assets through publicly traded companies like Coinbase.

According to an article by Will Canny for CoinDesk published yesterday, JPMorgan, in a recent research report, expressed concerns that the key driver of last year’s crypto market growth – the introduction of spot bitcoin (BTC) exchange-traded funds (ETFs) – might lead to investor disillusionment in 2024.

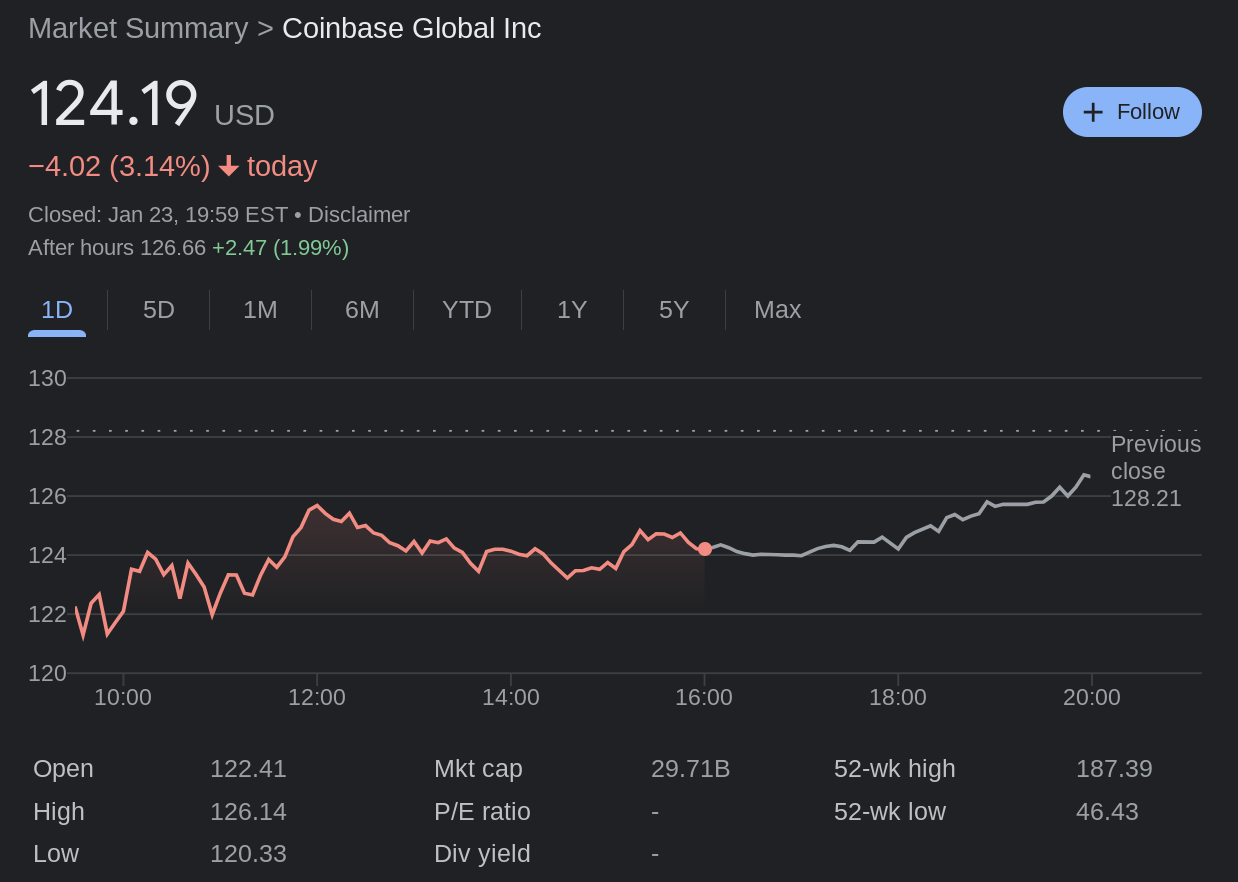

Consequently, the bank downgraded Coinbase stock to underweight from its previous neutral stance, maintaining a steady price target of $80. This announcement saw Coinbase’s shares drop by 4.1% to $122.90 during premarket trading.

Despite a significant 390% surge in the stock last year, JPMorgan anticipates a tougher year ahead for Coinbase, even with the exchange’s advancements in several key areas.

JPMorgan analysts, including Kenneth Worthington, acknowledge Coinbase’s leading position in the U.S. crypto exchange market and its global prominence in cryptocurrency trading and investment. However, they caution that the initial enthusiasm generated by the US-listed spot Bitcoin ETFs, which helped revive the crypto sector, might not meet market expectations going forward.

Featured Image via Coinbase