According to Bloomberg, citing a research report by Deutsche Bank, Bitcoin’s recent price correction has sparked a wave of concern among retail investors, many of whom anticipate a further decrease in its value by the end of the year.

According to the survey findings, over one-third of the respondents foresee Bitcoin’s value plummeting below $20,000 by January 2025. In contrast, approximately 15% of those surveyed maintain a more optimistic view, predicting that Bitcoin’s price will stabilize between $40,000 and $75,000 by the year’s end.

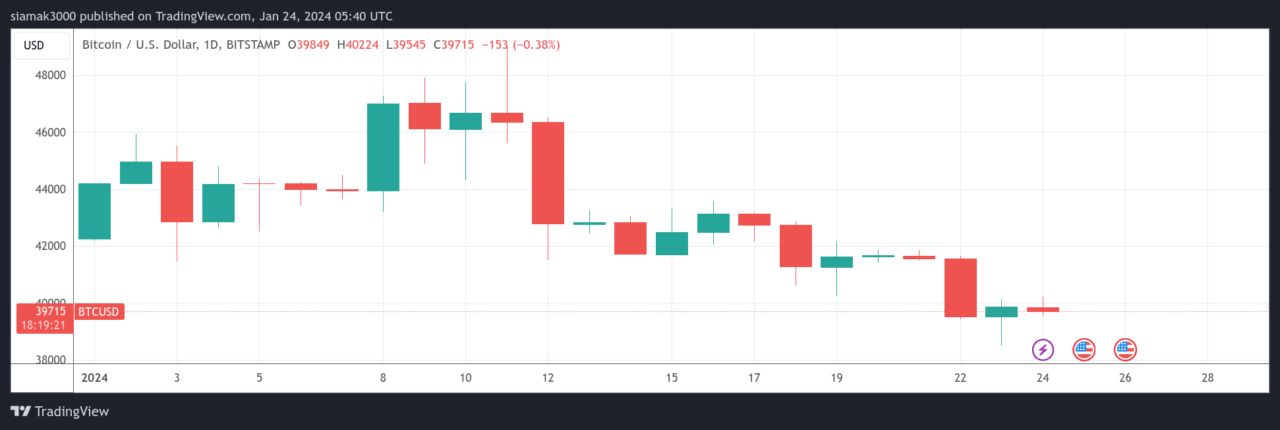

The report also sheds light on the recent surge in Bitcoin’s price to $49,000 on January 11, attributed to the excitement surrounding the launch of spot Bitcoin Exchange-Traded Funds (ETFs) in the U.S. This peak marked the highest value of Bitcoin since March 2022. However, subsequent sell-offs have led to a more than 18% decline in its price, bringing it down to around $39,791 as of 4:32 a.m. UTC on January 24.

Marion Laboure and Cassidy Ainsworth-Grace, the Deutsche Bank analysts mentioned in the report, suggest that the introduction of new spot Bitcoin ETFs could further institutionalize this pioneering digital asset. Despite this, the report indicates that the majority of ETF flows have originated from retail investors.

The survey, conducted from 15 January to 19 January, gathered insights from 2,000 individuals across the United States, the United Kingdom, and the Eurozone, focusing on their perspectives regarding Bitcoin’s price fluctuations and volatility.

Jim Cramer has been quite vocal about Bitcoin in the past couple of weeks on both CNBC and social media platform X (formerly known as Twitter):

On January 2, during a conversation on CNBC’s “Squawk on the Street,” with Bitcoin trading at $45,658, above the $45K level for the first time since April 2022, Cramer told co-chost David Faber that Bitcoin’s rally to this level had been driven by the calmness in the market following the collapse of FTX (i.e., a bad actor being driven out of the crypto space) and the optimism over the potential approval of spot Bitcoin ETFs by the U.S. SEC.

He added:

“It could be a ‘Waiting for Godot’… no, there will be an ETF. I do think that the people who are in it for that are going to use that as a chance to sell. This thing is, you can’t kill it. And the late Charlie Munger, who was so brilliant on so many things, was blind to this …

“But look, I mean, it’s a reality, and it’s a technological marvel. And I think people have to start recognizing that it’s here to stay. The SEC has been against it almost the whole time … I do think that this is a remarkable comeback that was unexpected, except for all the bull who turned out to be right.“

On January 22, as Bitcoin struggled to maintain its position above the $40,000 mark, Cramer took to social media platform X to say:

On January 23, Cramer reaffirmed his viewpoint, predicting a vigorous yet ultimately futile attempt to maintain this price level, attributing this to an inadequate influx of capital:

Featured Image via Deutsche Bank