Background of the Incident

The SEC’s official X (formerly known as Twitter) account erroneously stated on 9 January 2024 that the commission had approved all spot Bitcoin ETF applications.

This announcement led to a significant reaction in the Bitcoin market, with the BTC price momentarily surging from around $46,605 to $47,886.

SEC’s Clarification and Market Impact

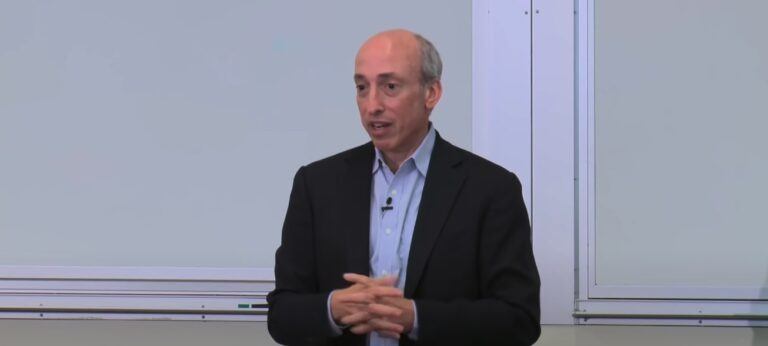

However, the initial excitement was short-lived. SEC Chair Gary Gensler quickly addressed the situation, clarifying that the SEC’s social media account had been compromised and that the announcement was unauthorized. He confirmed that the commission had not approved any Bitcoin-related ETFs for listing and trading.

Despite this clarification, the initial false announcement had already caused substantial market disruption, with over $300 million in BTC liquidations, as reported by Santiment.

Investigation into the Security Breach

X’s safety team confirmed that the SEC’s account was compromised due to someone gaining control over a phone number associated with the account. The platform’s security team conducted a preliminary investigation, concluding that the breach was not due to any system failure on their part but rather a third-party issue. Notably, the SEC had not enabled two-factor authentication for its account at the time of the breach.

Ripple Executives’ Reactions

Ripple CEO Brad Garlinghouse commented on the development, suggesting that the SEC should investigate itself for multiple issues. He also praised the crypto community on the platform for their humorous memes.

Ripple’s Chief Legal Officer (CLO), Stuart Alderoty, also reacted to the incident, referencing the SEC’s cybersecurity rule adopted in July 2023. This rule mandates companies to disclose cybersecurity incidents within four business days. Alderoty emphasized that the SEC should disclose the nature and scope of the incident, its market impact, and measures to prevent future cybersecurity threats, in line with its own rule.

Expectations for Launch of Spot Bitcoin ETFs in the U.S.

Despite the confusion, there is widespread anticipation that all U.S. spot Bitcoin ETFs will likely receive approval from the SEC later today, with trading expected to commence on 11 January 2024.