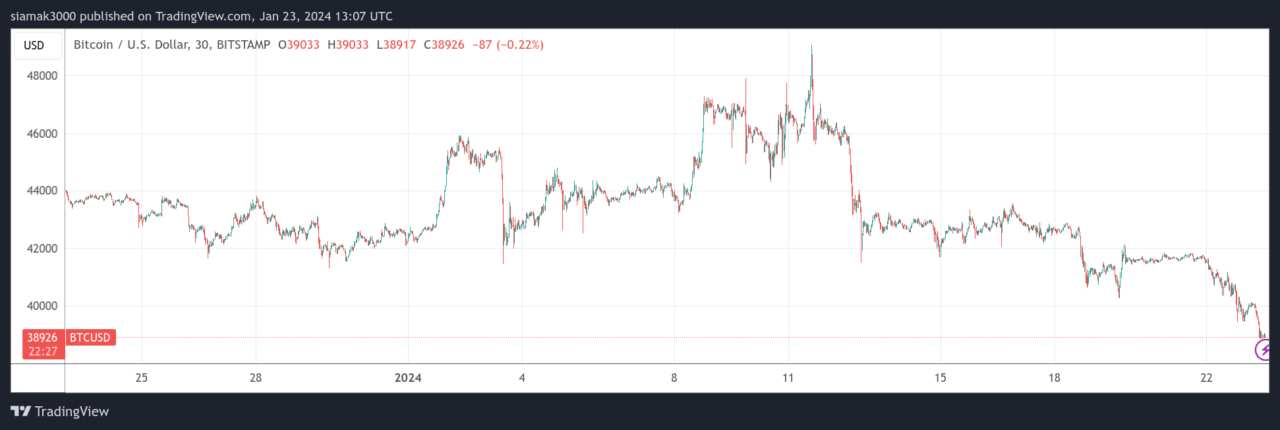

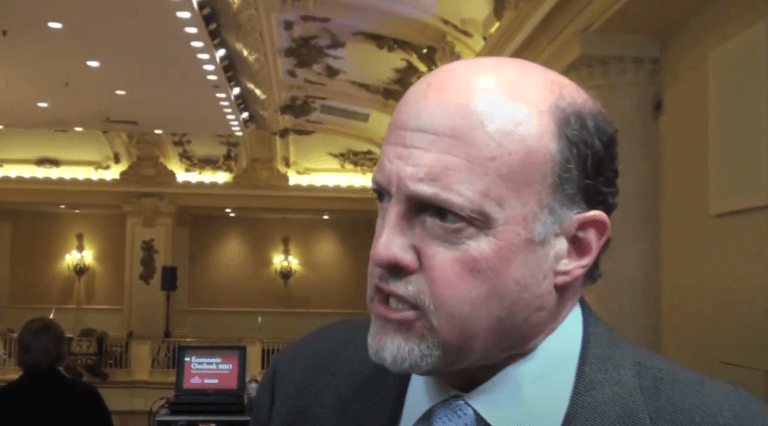

On January 23, with his confidence growing due to correctly predicting that there would be lots of BTC selling after the launch of multiple SEC-approved spot Bitcoin ETFs on January 11, for the second day in a row, CNBC’s Jim Cramer decided to comment on Bitcoin’s price action.

Former hedge fund manager Jim Cramer is the host of the CNBC show “Mad Money w/ Jim Cramer. “ He is also a co-anchor of CNBC’s “Squawk on the Street, “as well as a co-founder of financial news website TheStreet. His career in finance includes managing his own hedge fund and several years at Goldman Sachs. Cramer’s approach to investing and his energetic TV persona have made him a notable figure in financial media.

On January 2, during a conversation on CNBC’s “Squawk on the Street,” with Bitcoin trading at $45,658, above the $45K level for the first time since April 2022, Cramer told co-chost David Faber that Bitcoin’s rally to this level had been driven by the calmness in the market following the collapse of FTX (i.e., a bad actor being driven out of the crypto space) and the optimism over the potential approval of spot Bitcoin ETFs by the U.S. SEC.

He added:

“It could be a ‘Waiting for Godot’… no, there will be an ETF. I do think that the people who are in it for that are going to use that as a chance to sell. This thing is, you can’t kill it. And the late Charlie Munger, who was so brilliant on so many things, was blind to this …

“but look, I mean, it’s a reality, and it’s a technological marvel. And I think people have to start recognizing that it’s here to stay. The SEC has been against it almost the whole time … I do think that this is a remarkable comeback that was unexpected, except for all the bull who turned out to be right.“

Yesterday, as Bitcoin struggled to maintain its position above the $40,000 mark, Cramer took to social media platform X to say:

Well, earlier today, Cramer reaffirmed his viewpoint, predicting a vigorous yet ultimately futile attempt to maintain this price level, attributing this to an inadequate influx of capital. He coined a new phrase, “Number Go Down,” to encapsulate his pessimistic view on Bitcoin’s near-term prospects.

In the Bitcoin and broader cryptocurrency community, the phrase “number go up” has become a popular meme or catchphrase. It’s often used by Bitcoin enthusiasts and influencers on social media, especially during times when the price of Bitcoin is rising. The phrase is a simplistic way of celebrating and drawing attention to the increasing value of Bitcoin, often used to convey the optimism and bullish sentiment in the community.

Given this context, Jim Cramer’s use of the phrase “Number Go Down” can be seen as a play on this popular meme, but with a twist to reflect a bearish outlook. By inverting the well-known bullish catchphrase, Cramer is not only commenting on the current state of Bitcoin’s price but also potentially critiquing the sometimes overly simplistic and optimistic views within the Bitcoin community. This inversion adds a layer of irony and critique to his statement, making it more poignant, especially to those familiar with the original “number go up” sentiment in the crypto world.

At the time of writing (i.e. as of 1:05 p.m. UTC on 23 January 2024), Bitcoin is trading at approximately $38,962, marking a 4.80% decline over the past 24 hours. This follows a peak of $48,733 on January 11, indicating a 20% correction since the spot ETFs’ introduction in the U.S.