On January 25, Bryn Talkington, Managing Partner at Requisite Capital Management, appeared on CNBC’s “Halftime Report” to discuss Tesla’s Q4 2023 earnings call.

Here are the key points from her analysis:

- Earnings and Revenue Miss: Talkington noted that Tesla missed market expectations regarding revenues and earnings. This shortfall contributed to approximately one-third of the reasons behind the stock’s decline.

- Guidance and Margins Concerns: A significant concern for investors, according to Talkington, is the lack of clarity in Tesla’s guidance for 2024, particularly regarding profit margins. She expressed skepticism about Elon Musk’s honesty in this aspect, highlighting that the market is averse to such uncertainty.

- Volume Growth and Stock Valuation: The lack of positive guidance and reduced numbers led Talkington to believe that Tesla’s stock is currently in a precarious position. She advised against purchasing Tesla stock immediately, suggesting that it might be “dead money” in the short term. However, she remains long-term bullish due to Tesla’s manufacturing prowess.

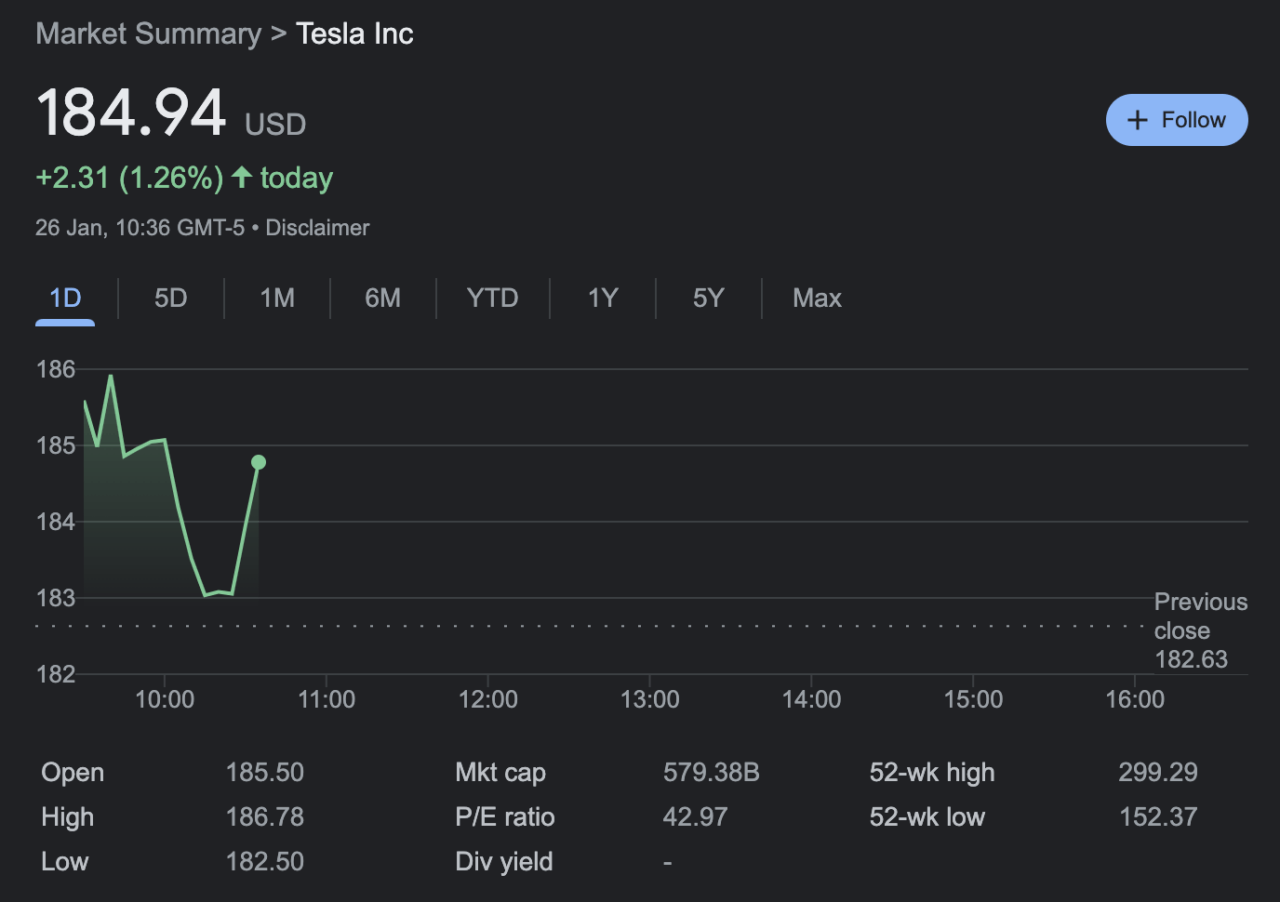

- Stock Price Predictions: Talkington anticipates that Tesla’s stock needs to stabilize at around $180. If it fails to do so, it might drop to the $160s. She shared her personal investment strategy, having entered around $120 and exited at a higher price through call options.

- Elon Musk’s Role and Future Projects: Addressing speculation about Elon Musk potentially shifting his focus to other ventures like Starlink, SpaceX, or The Boring Company, Talkington believes this is unlikely. She emphasized the significance of Tesla’s full self-driving (FSD) technology, where most of the AI advancements are concentrated. She considers it improbable that Musk will divert his attention from Tesla, given the intertwined nature of his identity with the company.

- Musk’s Influence and Control: Talkington touched upon Musk’s desire to maintain influence rather than control over Tesla. This stance comes in response to concerns about activist shareholders exerting more control than Musk. She anticipates that the board will need to address this issue, considering the inseparable link between Musk and Tesla.

TSLA is currently (as of 3:37 p.m. UTC on January 26) trading at $184.94, up 1.26% on the day. In the year-to-date period, TSLA is down 25.55%.