On 11 January 2024, Reuters reported significant trading activity in the newly approved U.S.-listed Bitcoin exchange-traded funds (ETFs), with $4.6 billion worth of shares traded as of Thursday afternoon, according to LSEG data. This surge in trading came a day after the U.S. Securities and Exchange Commission (SEC) approved these landmark products, marking a potential shift in the mainstream acceptance of crypto for investment purposes.

Eleven spot Bitcoin ETFs, including notable ones, such as BlackRock’s iShares Bitcoin Trust, the Grayscale Bitcoin Trust, and ARK 21Shares Bitcoin ETF, began trading on Thursday morning. This event marked a watershed moment for the cryptocurrency industry, testing digital assets’ broader acceptance among professional investors.

Grayscale, BlackRock, and Fidelity dominated the trading volumes, according to the LSEG data. Todd Rosenbluth, a strategist at VettaFi, commented on the strong trading volumes but noted that the real test extends beyond a single day’s trading.

The SEC’s approval came after a decade-long tussle with the crypto industry. Despite this breakthrough, some executives still view Bitcoin as a high-risk investment. Vanguard, for instance, stated it had no plans to offer these new ETFs to its brokerage clients. SEC Chair Gary Gensler emphasized that the approval does not constitute an endorsement of Bitcoin, which he described as a “speculative, volatile asset.”

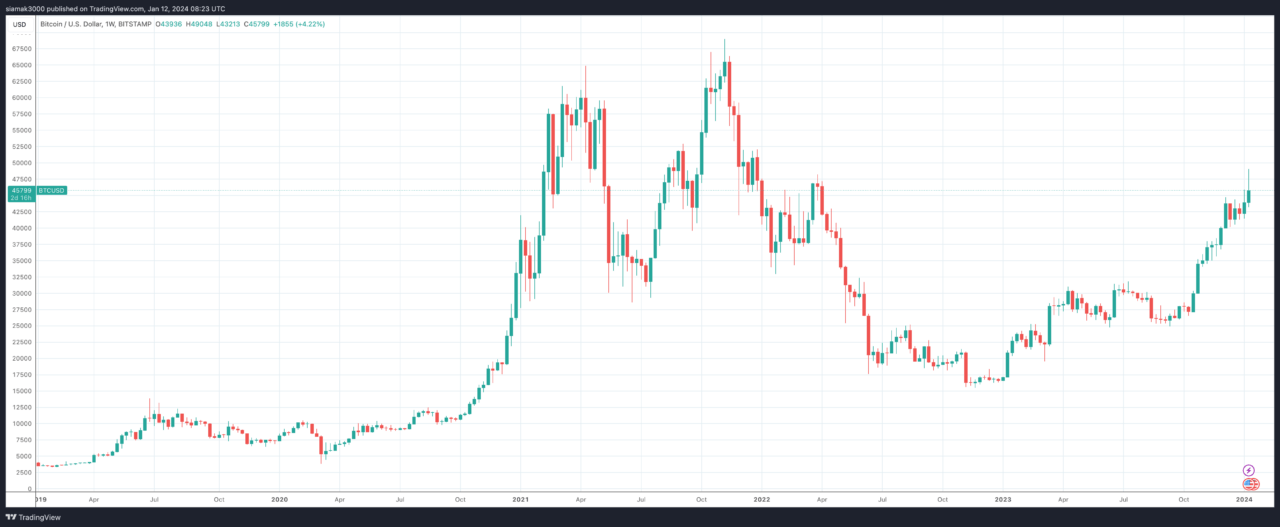

The ETF launches positively impacted Bitcoin’s price, driving it to $49,048, its highest level since December 2021. At the time of writing, Bitcoin is trading at around $45,790, up 2.9% in the past 24-hour period.

The approval sparked intense competition among issuers, with some slashing fees well below the industry standard. For instance, Valkyrie reduced its fees to 0.25% and waived them for the first three months.

Grayscale was approved to convert its existing bitcoin trust into an ETF, creating the world’s largest bitcoin ETF with over $28 billion in assets under management.

Analysts’ estimates on the potential inflows into spot bitcoin ETFs vary widely, ranging from $10 billion to $100 billion for the year.

According to Reuter’s report, as trading commenced, market participants closely monitored bid-ask spreads, a key indicator of an ETF’s desirability. Invesco’s Jason Stoneberg highlighted the importance of trading volume and market participants in driving spreads.

Despite the enthusiasm, some analysts cautioned that the broader investment community still views cryptocurrencies as risky, citing incidents like the FTX implosion in 2022.

Sharmin Mossavar-Rahmani of Goldman Sachs expressed skepticism about cryptocurrencies as an investment class. Meanwhile, Grayscale CEO Michael Sonnenshein revealed plans to file for a covered call ETF to allow income generation from options on its spot bitcoin product.

Cryptocurrency-related stocks experienced mixed results on the same day. Bitcoin miners Riot Platforms and Marathon Digital saw significant drops, while the ProShares Bitcoin Strategy ETF, which tracks bitcoin futures, gained slightly.

Featured Image via Pixabay