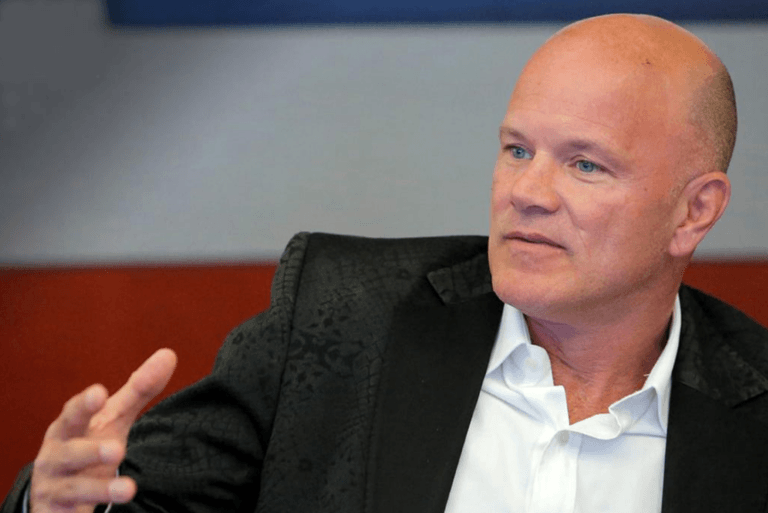

On January 11, 2024, Michael Novogratz, the CEO of Galaxy Digital, joined the team on CNBC’s “Squawk Box” to discuss a range of topics of interest to Bitcoin investors.

Differentiation of Bitcoin ETFs

Novogratz emphasized that in the long run, there would likely be two or three Bitcoin ETFs that emerge as market leaders rather than a single dominant player. He cited his experience with the CI Group in Canada, where they started in second place and rose to become the largest ETF, achieving less than 1% tracking error compared to their largest competitor’s 11%. He stressed the importance of accurately tracking Bitcoin’s price and the hidden fees that can come with ETFs.

Challenges on Launch Day

Novogratz predicted chaos on the launch day of these ETFs due to the intense competition among sales forces to attract investments. He also anticipated significant redemptions from Grayscale, as people who bought at a discount would likely seize the opportunity to sell at par value.

Accessibility of Bitcoin Investment

Novogratz discussed how the new ETFs make investing in Bitcoin more accessible to the average person, contrasting it with the past when buying Bitcoin required more technical knowledge and conviction. He suggested that while early adopters have made substantial profits, it’s not too late for new investors to benefit from Bitcoin’s potential growth.

Bitcoin’s Long-Term Appreciation

While he hopes Bitcoin doesn’t reach $750,000 soon (as it would indicate severe economic distress), Novogratz believes in its long-term appreciation. He pointed out Bitcoin’s limited supply and the strong belief of its holders, many of whom are not willing to sell, which could drive up its price.

Competition Among ETF Providers

Novogratz predicted a fierce competition among major players like Invesco, Fidelity, and BlackRock. He emphasized that the winning factor would be which ETF has the least tracking error. He also mentioned that for consumers and institutions, these products are excellent due to low fees.

Impact of the New Spot ETFs on Bitcoin’s Market Cap

Novogratz addressed the potential impact of these spot ETFs on Bitcoin’s market cap, which stands around $950 billion. He believes that the spot Bitcoin ETFs will significantly increase Bitcoin’s price since demand for BTC will go up and many long-term Bitcoin holders are not inclined to sell.

Global Economic Context

Highlighting the broader economic backdrop, Novogratz pointed out the excessive debt issuance by governments and excessive money printing as key reasons for Bitcoin’s rising value. He described the approval of spot Bitcoin ETFs in the U.S. as a historic day, underscoring its significance in the financial world.