Recent discussions on platform X have sparked interest in Ethereum’s market trajectory, with a particular focus on its potential to reach new heights in value.

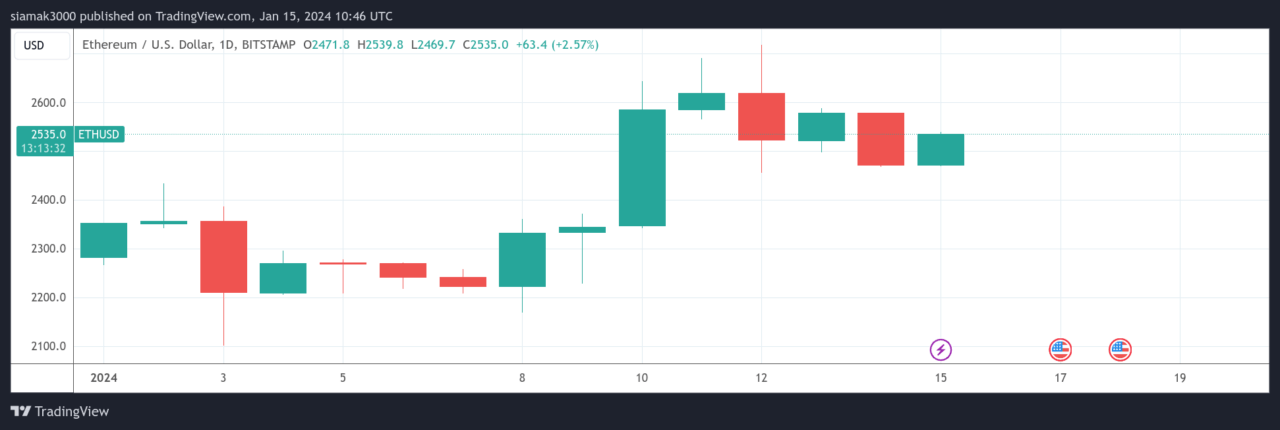

CrediBULL Crypto’s analysis, shared on January 10, highlights Ethereum’s steady upward movement, overcoming sell orders and attracting fresh bids. A notable observation was the emergence of a substantial block of bids, equal in size to the combined sell orders Ethereum had recently absorbed. This development signals robust market support and a bullish sentiment among investors.

The analyst pointed out the formation of a “higher low” in Ethereum’s price chart, a technical indicator often associated with a positive market trend. This observation comes in the wake of the uncertainty surrounding the ETF catalyst, suggesting that any dips in Ethereum’s price are opportunities for buying. With a clear target of $3600 in sight, CrediBULL Crypto’s stance is an optimistic one, indicating a strong belief in Ethereum’s market resilience and growth potential.

In addition to CrediBULL Crypto’s market analysis, other voices on platform X, such as DCinvestor, have also weighed in on Ethereum’s broader potential. DCinvestor emphasized Ethereum’s foundational role as a global platform for trustless communication and value exchange, likening its current state to the early days of the internet and suggesting vast untapped potential.

At the time of writing, Ethereum is trading at around $2,536, down 0.31% in the past 24-hour period.

On January 12, during a conversation with CNBC’s Andrew Ross Sorkin, Larry Fink, CEO of BlackRock, the world’s largest asset manager, expressed support for the creation of a spot Ethereum (ETH) exchange-traded fund (ETF). This statement came a day after the launch of the much-anticipated spot Bitcoin ETFs in the U.S.

Fink stated, “I see value in having an Ethereum ETF.” He views this as a progression towards the broader concept of tokenization, which he believes is the future direction of the financial industry.

Featured Image via Pixabay