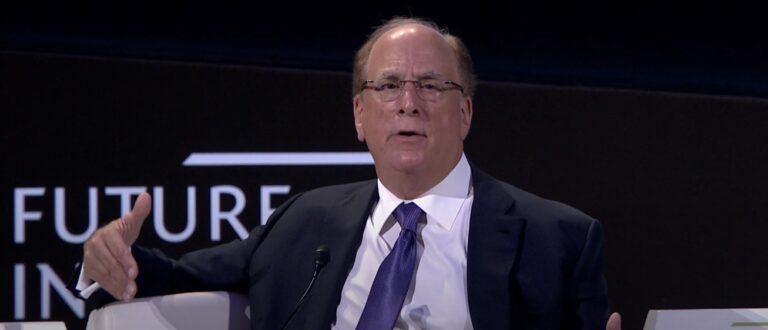

Earlier today, during a conversation with CNBC’s Andrew Ross Sorkin, Larry Fink, CEO of BlackRock, the world’s largest asset manager, expressed support for the creation of a spot Ethereum (ETH) exchange-traded fund (ETF). This statement came a day after the launch of the much-anticipated spot Bitcoin ETFs in the U.S.

Support for a Spot Ethereum ETF

Fink stated, “I see value in having an Ethereum ETF.” He views this as a progression towards the broader concept of tokenization, which he believes is the future direction of the financial industry.

BlackRock’s Spot Bitcoin ETF Debut

BlackRock’s iShares Bitcoin Trust (IBIT) was among the several Bitcoin ETFs that debuted in the U.S. on Thursday, following the U.S. SEC’s approval on January 10. IBIT contributed approximately $1 billion to the total $4.6 billion trading volume generated by these ETFs on their first day.

Exploring a Spot Ethereum ETF

BlackRock, now considering an Ethereum-based ETF, is furthering its journey into the realm of tokenization. Tokenization involves representing assets, whether real-world or digital, as tokens on a blockchain. Fink sees tokenization as a means to address issues like money laundering and corruption.

Cryptocurrency as an Asset Class

Fink clarified his view of cryptocurrencies, not as currencies but as asset classes. He compared Bitcoin to gold, noting its role as a protective asset against geopolitical risks. Fink highlighted Bitcoin’s unique position, stating, “It’s no different than what gold represented over thousands of years.” He also pointed out a key difference between Bitcoin and gold, emphasizing the near completion of Bitcoin’s supply, which is capped, unlike gold.

On January 11, Samar Cohen, the Chief Investment Officer of ETFs and Index Investments at BlackRock, joined CNBC’s “Squawk on the Street” alongside Bob Pisani to talk about the new US-listed spot Bitcoin ETFs.

Trading Dynamics and Investor Interest

Cohen was enthusiastic about the smooth trading observed during the ETFs’ launch, seeing it as a favorable indicator. She mentioned that BlackRock’s ETF witnessed high trading volumes, pointing to substantial investor interest.

ETF Tracking and Performance

The key concern for investors, according to Cohen, is how accurately these ETFs mirror Bitcoin’s performance. She stressed the significance of market quality, liquidity, spreads, and precise tracking to provide investors with direct exposure to spot Bitcoin, and was optimistic about BlackRock’s ETF fulfilling these criteria.

Market Conditions and Liquidity

Cohen observed narrow spreads in the market, a sign of robust liquidity, which is beneficial for the ETF’s health and reflects strong investor engagement.

Investor Participation and Trends

While it’s premature to determine exact inflows, Cohen noted that they are currently monitoring secondary market volumes. She expects the patterns of investor engagement with Bitcoin ETFs to become more apparent over time.

Institutional Involvement and Learning Curve

Cohen sees the introduction of Bitcoin ETFs as a significant educational journey for all investor types, including institutions. She underscored the investor demand for Bitcoin access via ETFs as a key factor in the SEC’s decision to approve them.

Educational Efforts and Risk Awareness

BlackRock is concentrating on informing partners about the features and convenience of the ETF wrapper. Cohen highlighted the necessity for investors to understand the volatility and risk profile of the underlying asset, as with any ETF.

Competition and Pricing Strategy

Acknowledging the competitive landscape, Cohen mentioned that pricing is a vital aspect. BlackRock’s ETF has a fee structure of 12 basis points initially, increasing to 25 basis points after the first $5 billion in assets or 12 months. She noted that some rivals are offering zero fees for a limited period. Cohen believes that performance, especially tracking precision and market quality, will be crucial factors for investors when choosing between ETFs.