Matrixport is a financial services platform specializing in cryptocurrency. Founded in 2019 by Jihan Wu and John Ge, who were also co-founders of Bitmain, a leading maker of cryptocurrency mining hardware, Matrixport offers a range of services. These include cryptocurrency trading, custody, lending, and structured products. The platform aims to make digital asset management and financial services accessible in a secure and compliant environment.

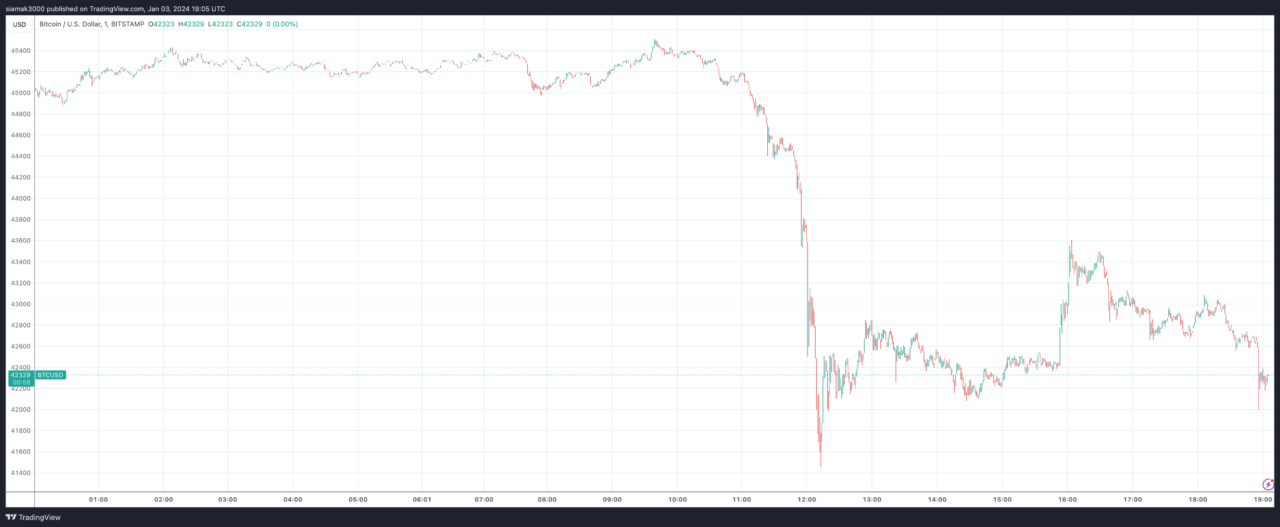

On January 3, Bitcoin’s value experienced a sharp decline, falling from 9% from $45,510 to $41,454 in just a couple of hours.

This significant fluctuation in Bitcoin’s price occurred simultaneously with the publication of a report (titled “Why the SEC will REJECT Bitcoin Spot ETFs again”) by Matrixport for its clients.

Matrixport’s report highlights that the current U.S. Securities and Exchange Commission (SEC), led by a five-member team predominantly consisting of Democrats, plays a crucial role in the approval of spot ETFs. The report notes that SEC Chair Gary Gensler appears to be cautious about fully embracing cryptocurrencies in the United States. It suggests that the likelihood of Gensler supporting the approval of any spot Bitcoin ETF seems quite slim.

The report also mentions that a spot Bitcoin ETF could significantly boost the overall cryptocurrency sector. However, based on Gensler’s remarks in December 2023, which emphasized the need for stricter regulatory compliance in the crypto industry, the report infers that the political climate may not favor the approval of a Bitcoin Spot ETF. Such an approval, the report implies, would serve to validate Bitcoin as an alternative store of value, a step that the current political leadership might be hesitant to take.

This huge drop in Bitcoin’s price, which naturally caused the whole crypto market to start dumping, was blamed by many crypto influencers on the Matrixport analysts and the news outlet that first covered it.

In response to this anger toward Matrixport for allegedly generating FUD in order to manipulate the crypto market, Matrixport co-founder Jihan Wu took to social media platform X to talk about the independence and expertise of the company’s analysts. He emphasized that these analysts operate autonomously, forming their opinions without any influence from the management team. Wu acknowledged that their analytical skills surpass those of himself and other members of the management. He mentioned that his engagement with the recent report was minimal, similar to many others who had only briefly seen its title.

Wu highlighted the work of Markus, a skilled analyst at Matrixport and the author of “Crypto Titans,” a book published last year. The book offers a detailed account of the price history of cryptocurrencies, sometimes recalling events more vividly than Wu’s own experiences, including those where he faced financial losses.

Wu said that at the beginning of 2023, Matrixport was among the few firms that accurately predicted the low point of Bitcoin and maintained a highly optimistic view on its future. Wu pointed out that the recent report — originally intended for Matrixport’s clients — gained widespread media attention, an outcome that was not planned by the company and is outside their control.

He also noted that Matrixport consistently advises its clients to be cautious of risks and leverage, particularly in light of the market’s volatility. Wu claimed that this volatility is driven by expectations surrounding the widely-anticipated potential approval by the SEC of spot Bitcoin ETFs and is reflected in the high funding fees in the perpetual market and the recent downturn in crypto-related stocks in the stock market in the days leading up to his statement.

Wu expressed his views on Bitcoin’s future, stating that the current volatility and the uncertainty surrounding the approval of a spot Bitcoin ETF in January 2024 are inconsequential in the long run. He believes that Bitcoin will continue to thrive over time. Wu is confident that the SEC’s approval of a spot Bitcoin ETF, which he sees as inevitable, will attract new investments into Bitcoin. He envisions Bitcoin further establishing itself as a superior store of value and risk-hedging asset, even surpassing gold.

As the day went on, more and more came to the realization that maybe it was not Matrixport’s negative report that was to blame for Bitcoin’s price drop but rather the record-high Bitcoin perpetual funding rate:

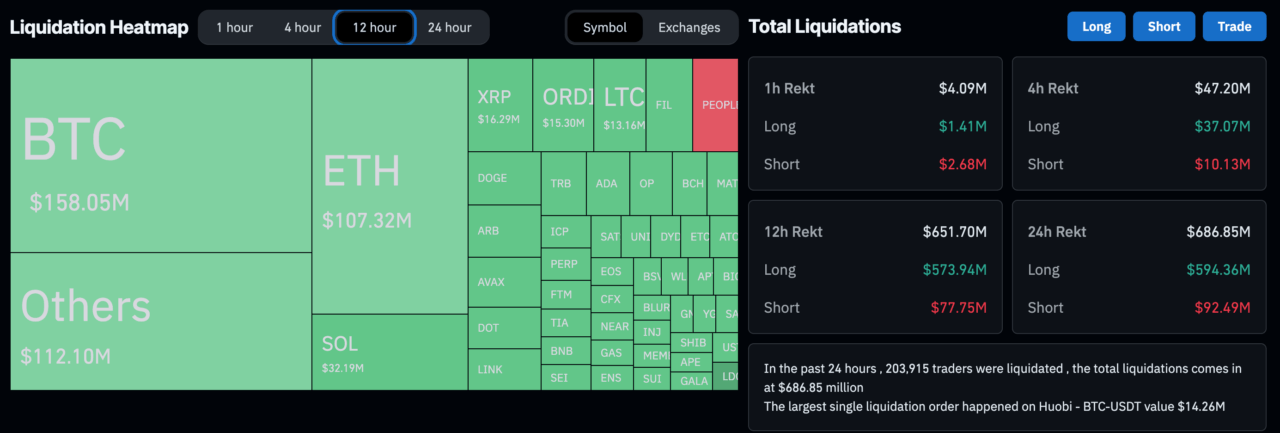

In the cryptocurrency market, particularly in the context of perpetual futures contracts, funding rates are a crucial mechanism that influences market dynamics. Perpetual futures are derivative contracts that, unlike traditional futures, do not have an expiry date, allowing traders to hold positions indefinitely. To ensure the price of these perpetual contracts aligns with the spot price of the underlying asset, such as Bitcoin, a funding rate is employed.

The funding rate is a periodic fee paid by one side of the market (long or short) to the other, depending on market conditions and the difference between the perpetual contract price and the spot price. A positive funding rate implies that the market is predominantly long (betting on price increases) and long position holders pay short position holders. Conversely, a negative rate means the opposite. High funding rates suggest a market heavily skewed towards long positions, often indicating over-leverage.

This over-leveraging can lead to significant market implications, particularly liquidations. When traders use high leverage for their positions, they are susceptible to margin calls or liquidations if the market moves against them. In a highly leveraged long market, a drop in Bitcoin’s price can trigger a wave of forced liquidations. These occur when traders’ positions are automatically closed because their margin is insufficient to cover the loss. This scenario can create a domino effect: as prices drop, more long positions get liquidated, adding downward pressure on the price. This cascade of liquidations can significantly exacerbate a market downturn, leading to sharp corrections as seen in Bitcoin’s price movements.

Galaxy Digital’s Head of Research, Alex Thorn, offered this criticism of Matrixport’s hated report:

Featured Image via Pixabay