The cryptocurrency Over-The-Counter (OTC) market, a crucial yet often overshadowed component of the digital finance world, is thoroughly explored in CCData’s latest report, “Crypto OTC Markets: Primer & Insights”. Unlike traditional exchanges, OTC trading involves direct transactions between parties, offering a distinctive market structure and operational dynamics.

CCData, a benchmark administrator sanctioned by the Financial Conduct Authority (FCA), stands at the forefront of digital asset information, delivering top-tier data and indices for settlement purposes. The firm excels in compiling and interpreting tick data from internationally recognized trading platforms, offering a detailed and extensive view of the digital asset market. This view encompasses a wide array of data points, including trading activities, derivatives, order books, historical insights, social media trends, and blockchain analytics.

CCData’s latest research report was created in partnership with Finery Markets, which is also regulated by the FCA.

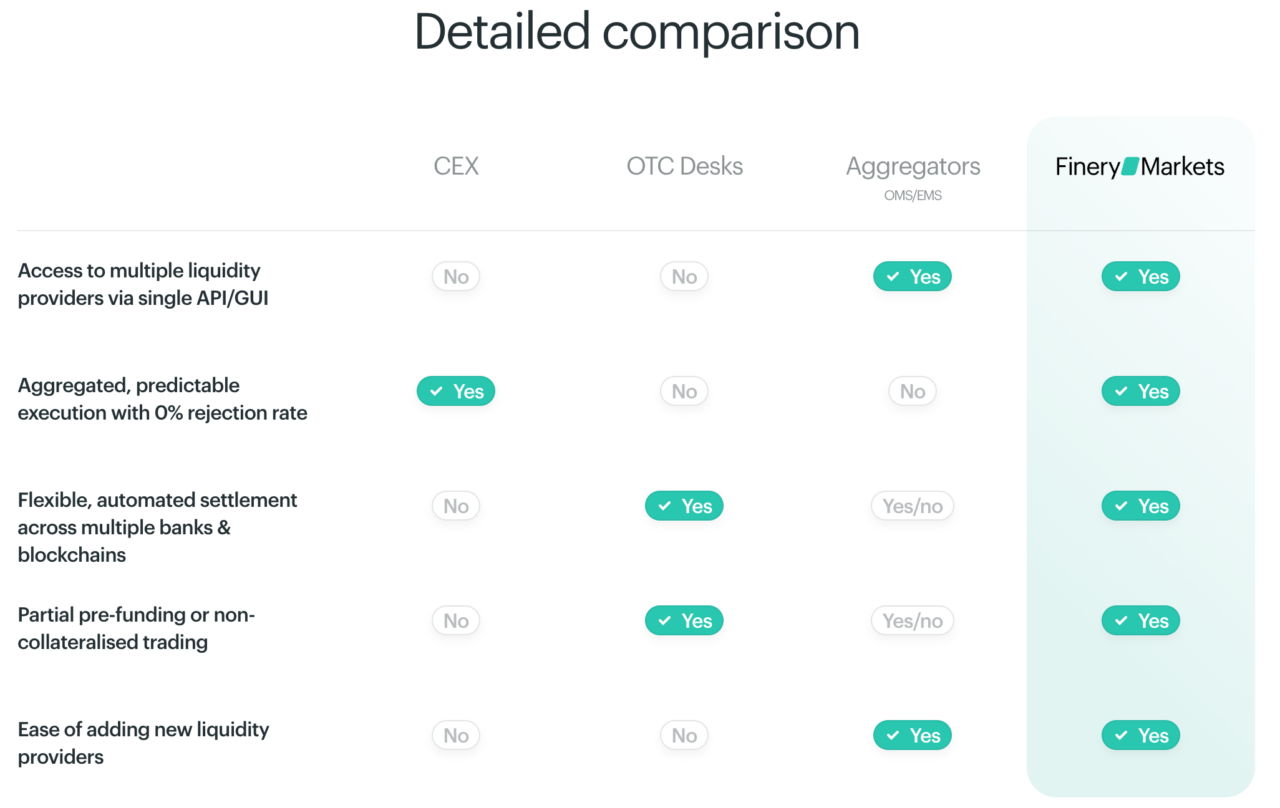

Finery Markets operates as an institutional crypto liquidity marketplace, primarily serving capital markets. It functions as a multi-dealer electronic marketplace for institutional participants, offering a range of trading solutions for the crypto markets. The platform is designed to deliver efficient and secure trading experiences, focusing on providing comprehensive solutions for managing digital assets and trading processes. Finery Markets emphasizes innovation in trading management and market data analytics, aiming to reshape the operations of crypto markets with its advanced technological infrastructure and strategic partnerships.

The report begins by dissecting the market infrastructure, emphasizing how the crypto OTC market caters to both institutional and individual investors. Different market types, ranging from order-driven to quote-driven, are examined, along with the various order types and trading protocols. These aspects significantly influence the market’s efficiency and fairness.

A central theme of the report is the indispensable role of technology in today’s trading landscape. It ensures swift, secure transactions and is instrumental in evaluating various trading platforms and tools. These technological advancements are pivotal in executing trades efficiently and safeguarding market integrity.

Liquidity providers (LPs) emerge as key players in the report. They ensure sufficient market activity for buying and selling, thus facilitating efficient trading and better pricing. The report also addresses the crucial aspect of risk management, particularly in the volatile realm of crypto trading. It suggests strategies to manage these risks, including comprehensive risk assessments and robust security measures.

The report presents insightful findings from comprehensive market research. It explores the duration of organizations’ involvement in crypto trading, the estimated size of the OTC market, client trends, and the impact of regulatory changes. A significant observation is the dynamic nature of the OTC crypto market, underscored by a growing client base and optimistic projections for future trading volumes.

In conclusion, the report highlights the OTC crypto market as an evolving ecosystem shaped by technological, regulatory, and market participant-driven factors and says that the increase in client base and anticipated growth in trading volumes reflect an expanding market. However, the report also notes the heterogeneous impact of regulatory changes, underscoring the multifaceted nature of regulatory influences on the crypto OTC market.