In a recent blog post dated 11 December 2023, Dr. André Dragosch, Head of Research at ETC Group, provided a detailed analysis of the current state of the cryptocurrency market. His insights reveal a landscape where cryptoassets are increasingly outperforming traditional assets, influenced by a complex interplay of economic indicators, market sentiment, and investment flows.

According to Dr. Dragosch, the past week has seen cryptoassets, once again, outshine traditional assets such as equities. This trend was primarily driven by a notable shift in monetary policy expectations and a flurry of short futures liquidations at the start of the week. However, the momentum of this outperformance encountered resistance, particularly following the release of unexpectedly strong US jobs data last Thursday, which began to temper the recent rally in cryptocurrencies.

Dr. Dragosch points out that the robust US non-farm payroll growth and a lower unemployment rate led to a reversal in US Treasury yields, albeit from low levels. This shift coincided with a decrease in overall risk appetite across traditional financial markets, signaling a more cautious approach from investors.

Bitcoin’s rally experienced a pause, but this was accompanied by a significant surge in altcoin performance. Notably, Avalanche and Cardano each reported over 50% returns last week. Among the top 10 crypto assets, these two, along with Polkadot, were highlighted by Dr. Dragosch as relative outperformers. He also observed a substantial increase in altcoin outperformance compared to Bitcoin, a trend that was not as pronounced in the previous week.

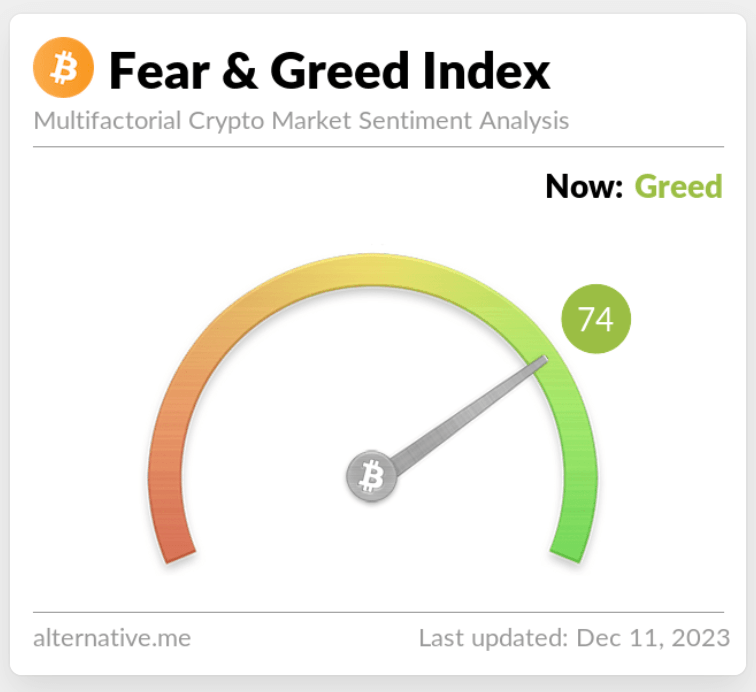

Dr. Dragosch’s analysis extends to market sentiment, where he notes that their in-house Cryptoasset Sentiment Index remains relatively high, with a majority of indicators still above their short-term trend. However, there were major reversals in the Crypto Dispersion Index and the BTC 25-delta 1-month option skew. The Crypto Fear & Greed Index, as of his writing, still indicates a state of “Greed.”

In terms of risk appetite, the Cross Asset Risk Appetite (CARA) indicator, as observed by Dr. Dragosch, has shown a recent decline, suggesting a reduced appetite for risk in traditional financial markets. Despite this, the indicator remains in positive territory.

Dr. Dragosch also sheds light on the dynamics of cryptoasset flows and fund movements. He notes the first week of net outflows from cryptoasset ETPs since early October, with an aggregate of over $18.2 million leaving these funds. This outflow was primarily concentrated in Bitcoin ETPs and thematic & basket ETPs, while Ethereum ETPs and other altcoin ETPs attracted net inflows.

The Grayscale Bitcoin Trust (GBTC) and its NAV discount narrowed to around -10.7%, which Dr. Dragosch interprets as an increased probability of the Trust converting into a Spot Bitcoin ETF. He also mentions that the beta of global crypto hedge funds to Bitcoin remains low, indicating a continued under-exposure to Bitcoin market risks.

On-chain data, a crucial aspect of Dr. Dragosch’s analysis, reveals that a significant portion of BTC and ETH addresses are in profit, with BTC addresses at 88.3% and ETH at 77.6%. He observes an uptick in profit-taking activity, especially among short-term BTC holders, which has exerted pressure on the rally. Long-term holders are also increasingly transferring profitable coins to exchanges, a trend that could pose a challenge to further price increases in the short term.

In the derivatives market, Dr. Dragosch notes that while aggregate open interest across BTC futures and perpetuals remained stable, there was a significant increase in BTC option open interest. He mentions that this was accompanied by a rise in put-buying activity, suggesting an increased demand for downside protection among option traders.

At the time of writing, Bitcoin is trading at $41,812, down 4.47% in the past 24-hour period.

Featured Image via Pixabay