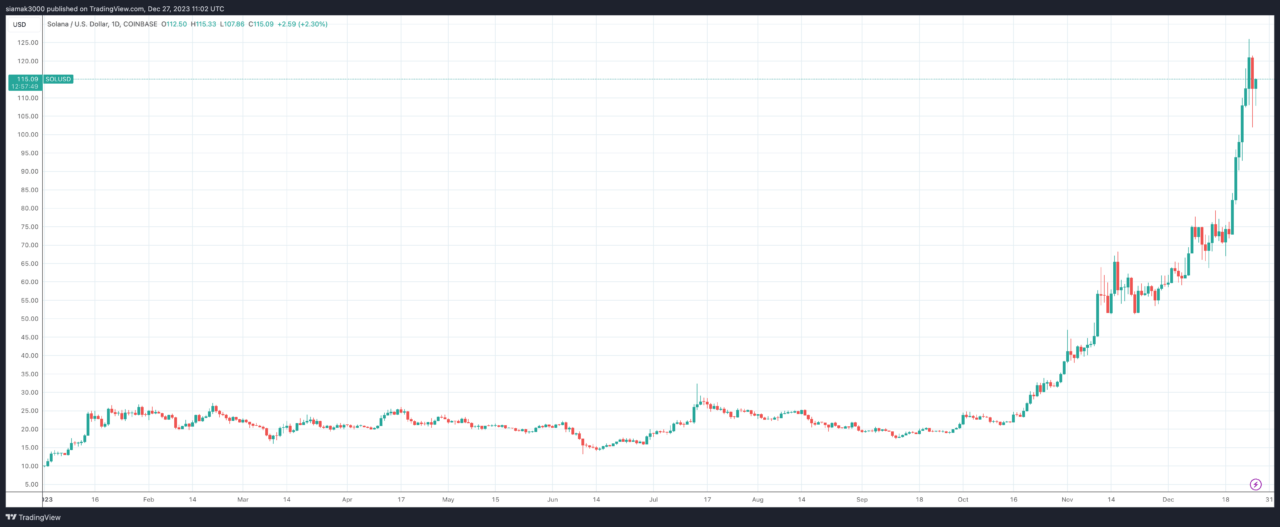

Yesterday, Bluntz, a popular pseudonymous crypto analyst and influencer known for accurately predicting Bitcoin’s 2018 bear market bottom, shared an optimistic outlook for Solana (SOL), an Ethereum challenger. Bluntz, who has a significant following on social media, believes that Solana’s impressive rally this year is far from over and could reach new all-time highs.

Bluntz observes that SOL, the native token of Solana, is still 113% away from its all-time high and criticizes the tendency of some traders to call market tops prematurely. He encourages investors to buy dips in SOL, predicting a potential surge to $400, a significant increase from its current levels. Bluntz emphasizes the long-term gains over short-term fluctuations, suggesting that those who consistently support the uptrend will be remembered more than those who may profit from short-term downturns.

Bluntz’s Technical Analysis:

- Low Time Frame Charts: Bluntz examines Solana’s short-term price movements by looking at charts with lower time intervals. This approach helps identify immediate trends and potential short-term price actions.

- Elliott Wave Theory: This theory is a method of technical analysis that attempts to predict future price movements based on crowd psychology, which often manifests in identifiable patterns or ‘waves’. According to this theory, a bullish asset typically experiences a five-wave uptrend, followed by an ‘ABC’ correction – a three-wave pattern – before the next upward movement.

- SOL/USD and SOL/BTC Pairs: Bluntz analyzes Solana’s value against both the US dollar (SOL/USD) and Bitcoin (SOL/BTC). His analysis suggests that Solana is poised for another upward movement in both pairings.

Based on his analysis, Bluntz believes Solana is set for another leg up in its price against both the US dollar and Bitcoin. He interprets the recent 12% dip in Solana’s value as part of a larger uptrend, advising against betting against this trend. His analysis of the SOL/USD pair indicates that Solana is positioned for a rally after completing its ABC correction phase.

Here’s a breakdown of the ABC correction phase:

- A Wave: This is the first wave in the correction phase, where the price starts to move against the trend of the previous larger wave. For instance, if the market was previously in an uptrend, the A wave would be a downward movement.

- B Wave: Following the A wave, the B wave is a partial retracement or correction of the A wave. It moves in the opposite direction of the A wave but typically does not reach the starting point of the A wave. In our example, this would be a slight upward movement following the initial downward trend.

- C Wave: The C wave is the final part of the correction phase, where the price moves again in the same direction as the A wave, often surpassing the end of the A wave. Continuing the example, this would be another downward movement, potentially going lower than the end of the A wave.

The ABC correction phase is a counter-trend move within a larger trend. In Elliott Wave Theory, after the completion of an ABC correction, the price is expected to resume the main trend. This pattern is used by traders and analysts to predict potential price movements and make trading decisions.

At the time of writing, SOL is trading at around $114.66, down 7.83% in the past 24-hour period.

On 27 October 2023, VanEck, a global asset management company, published a blog post analyzing the future value prospects of Solana’s native token, $SOL. The firm projected that by 2030, the value of $SOL could either soar to $3,211 or plummet to as low as $9.81.

In the post, VanEck highlighted the critical role of Smart Contract Platforms (SCPs) in driving decentralized applications, pointing out the current modest user base of blockchain platforms in comparison to mainstream online services. The firm posited that for blockchain to gain widespread adoption, it must broaden its applications beyond just financial transactions.

VanEck commended Solana for its commitment to scalability and efficiency, noting its focus on technological advancement rather than short-term solutions. The firm underscored Solana’s rapid data processing and high transaction capacity as key contributors to its efficiency.

VanEck argued that for a blockchain to facilitate major future applications, it needs to excel in speed, ease of use, and accessibility. In this regard, Solana’s capabilities make it a strong contender for hosting groundbreaking future applications.

However, VanEck also pointed to financial hurdles facing Solana, observing that its blockchain maintenance costs currently exceed its revenue. The firm emphasized the necessity for Solana to achieve a sustainable balance between its security expenditures and its income.

The blog contrasted Solana’s integrated, high-throughput system with Ethereum’s modular approach to blockchain development, a distinction that could influence their respective market shares.

VanEck noted the challenges posed by Solana’s intricate architecture and the need for Rust programming skills, which might be daunting for developers. Nonetheless, Solana has maintained a steady number of active developers, essential for its continued success.

The firm also discussed potential revenue streams for Solana, such as transaction fees and Miner Extractable Value (MEV), suggesting that Solana could adjust its pricing strategies to better capture value.

In conclusion, while acknowledging the risks associated with Solana, including its experimental technology and stability issues, VanEck sees considerable growth potential for Solana, deeming it an asset worth considering for investment portfolios.

Featured Image via YouTube (Solana Labs)