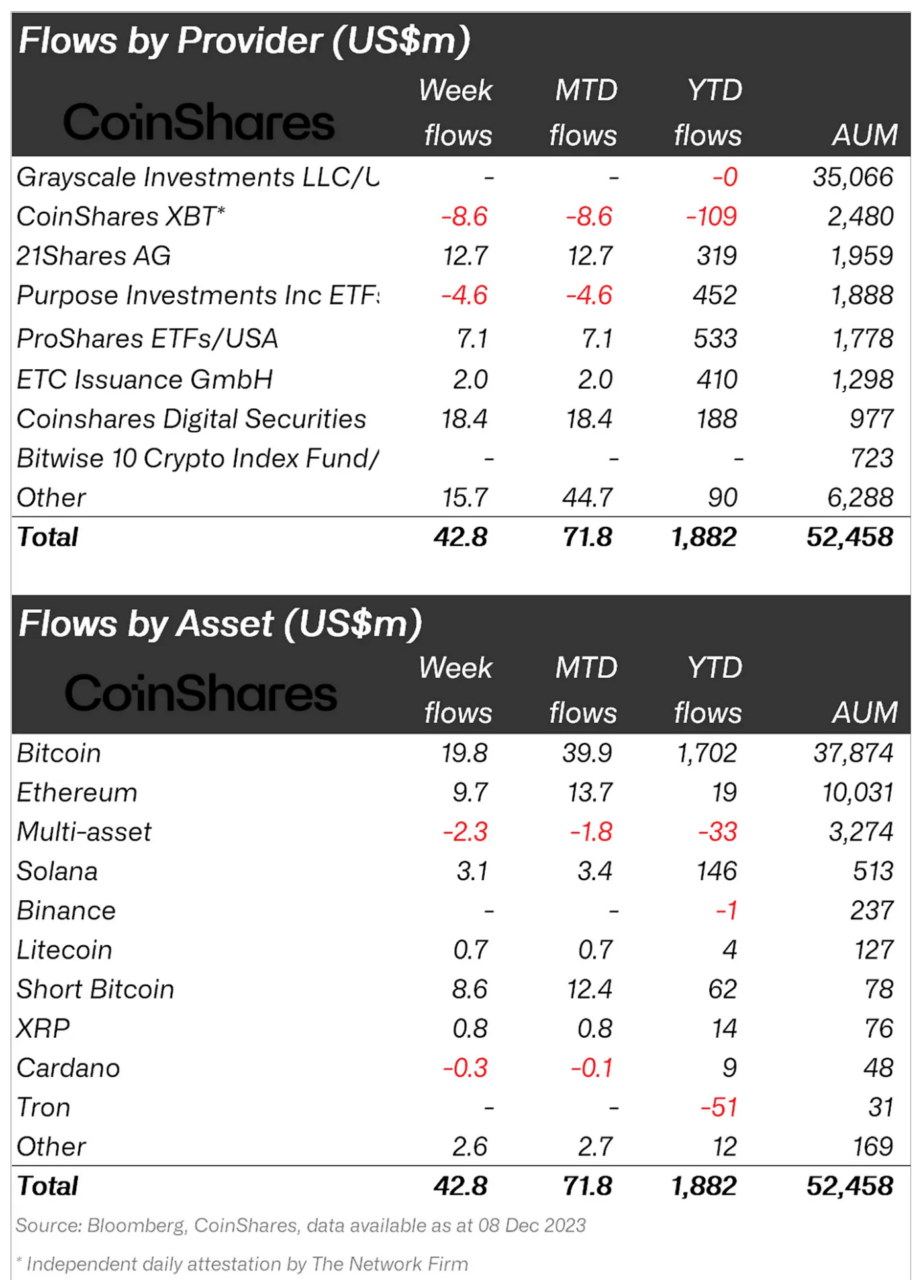

Earlier today, James Butterfill, Head of Research at CoinShares, shared insights into the investment flows in digital assets for the week ending 8 December 2023. According to Butterfill’s analysis, this period marked the 11th consecutive week of inflows into digital asset investment products, totaling $43 million. However, he notes a significant decline in these inflows compared to previous weeks.

Butterfill observes a growing trend towards investments in short positions, driven by recent price appreciations in the market and investors’ anticipation of potential price declines. He reports that Europe continues to lead in inflows, contributing $43 million, while the United States saw a modest $14 million, with half of this amount being directed into short positions. In contrast, Hong Kong experienced its second consecutive week of outflows, amounting to $8 million, and Brazil also witnessed minor outflows of $4.6 million.

In his blog post, Butterfill highlights Bitcoin’s continued attraction for investors, with inflows of $20 million for the week, bringing its year-to-date inflows to a substantial $1.7 billion. He also points out the significant inflows of $8.6 million into short-bitcoin positions, suggesting skepticism among some investors about the sustainability of Bitcoin’s current price increases.

Butterfill remarks on Ethereum’s notable turnaround. After experiencing year-to-date outflows of $125 million just seven weeks ago, Ethereum has now seen its sixth consecutive week of inflows, totaling $10 million, recovering to a positive inflow total of $19 million for the year.

He also notes the continued popularity of altcoins such as Solana and Avalanche, which saw inflows of $3 million and $2 million, respectively.

Furthermore, Butterfill reports a record-breaking week for blockchain equities, with the largest weekly inflows ever recorded at $126 million. This surge, as he indicates, reflects growing confidence and interest in blockchain technology and its associated companies.

Featured Image via Pixabay