Cantor Fitzgerald is a prominent American financial services firm that was founded in 1945. It operates as both a brokerage firm and an investment bank, offering a wide range of financial services, including bond trading, investment banking, asset management, market data, and brokerage services.

The firm is well-known in the financial industry for its expertise in fixed-income sales and trading, particularly in government securities. Cantor Fitzgerald has a significant presence in the global financial markets and is one of the 24 primary dealers that are authorized to trade U.S. government securities with The Federal Reserve Bank of New York.

Howard Lutnick, who is the CEO of Wall Street firm Cantor Fitzgerald, has publicly expressed his support for the stablecoin issuer Tether (USDT), referring to himself as a “big fan” of the firm. According to a report by Brayden Lindera for Cointelegraph, in a December 11 interview with CNBC, Lutnick detailed his admiration for Tether, highlighting Cantor Fitzgerald’s role in managing Tether’s substantial Treasury portfolio.

Lutnick stated, “I’m a big fan of this stablecoin called Tether…I hold their treasuries. So I keep their treasuries, and they have a lot of treasuries.” He acknowledged Tether’s significant growth, noting that the firm’s holdings are now over $90 billion. This partnership between Cantor Fitzgerald and Tether, as reported by Cointelegraph, began in late 2021, according to a Wall Street Journal report citing anonymous sources.

Per the report, Cantor Fitzgerald stands out as one of the few brokerage firms capable of trading Treasury bonds, alongside others like Charles Schwab, Fidelity, and Vanguard. This capability uniquely positioned the firm in its relationship with Tether, especially as many Wall Street firms have hesitated to engage with crypto businesses, particularly following events like the Silicon Valley Bank crash.

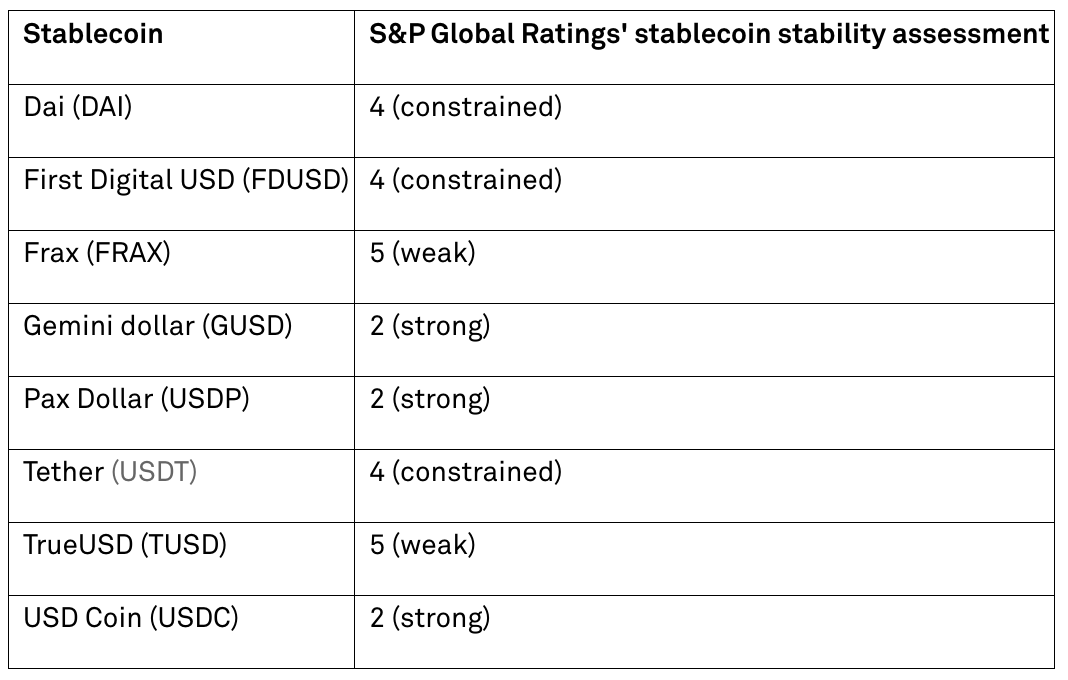

Despite Tether’s position as the largest stablecoin by market cap, it has faced criticism for its lack of transparency regarding its reserves. Cointelegraph notes that Tether recently received a low ranking in S&P Global’s stablecoin stability assessment, which evaluated factors such as asset management, audits, risk appetite, and track record in maintaining its U.S. dollar peg.

Lutnick suggested that Tether could be beneficial for countries experiencing currency collapse, like Argentina. He referenced Argentina’s new Bitcoin-friendly president Javier Milei, who has pledged to abolish the country’s central bank and transition to the U.S. dollar.

While initially claiming to be a “fan of crypto,” Lutnick later specified his praise for Bitcoin, expressing skepticism about other cryptocurrencies. He mentioned, “These other coins, they’re not a thing […] They’re kind of make-believe, Maybe Ethereum is OK.” Lutnick highlighted Bitcoin’s halving cycles and the absence of a centralized entity as key reasons for its value, stating, “The only asset people could have held where no one could take it? Bitcoin […] it is uncontrollable.”

Lutnick pointed out the differences in control mechanisms between Bitcoin, Ethereum, and Tether. He noted that Tether could be frozen upon request, and Ethereum’s control could be influenced by contacting its co-founder, Joe Lubin, contrasting these with Bitcoin’s uncontrollable nature.

Featured Image Courtesy of Cantor Fitzgerald via YouTube