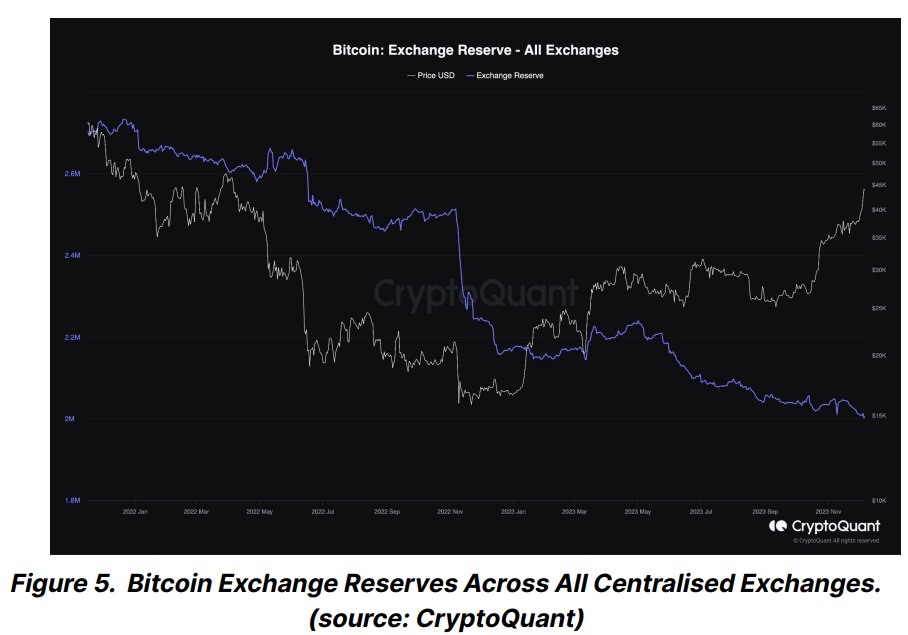

Over the past week, the total supply of Bitcoin (BTC) held on centralized cryptocurrency exchanges dropped to a six-year low, according to CryptoQuant data, with exchanges having net outflows for 45 months in a row now.

According to a recent Bitfinex Alpha report, Bitcoin’s dropping supply on exchanges is viewed as a bullish sign as long-term holders often buy BTC from exchanges and withdraw in a bid to custody their own funds and keep them for a long term. Investors with smaller time horizons deposit their funds to exchanges to either actively trade them or sell them.

The persistent decrease of BTC held by exchanges since 2017 has significantly affected the asset’s fluctuations, availability, and overall market behavior. This also affects BTC deposit transactions to exchanges, which have dropped to the lowest levels in years. Deposits to exchanges are now at a level similar to July 2020, indicating less pressure to sell.

Bitcoin’s lowering supply on exchanges comes shortly after the cryptocurrency’s price surpassed the $40,000 mark for the first time since May 2022, after dropping below it over the collapse of the Terra ecosystem. Bitcoin is now trading at $41,100 after failing to breach the $45,000 level resistance earlier this month.

The cryptocurrency’s price has been rising amid growing expectations a spot Bitcoin exchange-traded fund (ETF) will be approved in the United States, potentially bringing in investors who have been on sidelines as such a fund would make it easier for them to invest in the cryptocurrency without managing their own private keys.

As CryptoGlobe reported various ananlysts have been making bullish BTC price predictions, with well-known on-chain analyst Willy Woo recently sharing his prediction for a potential retest of the $39,900 zone before the bullish trend’s continuation.

Meanwhile London-based multinational banking and financial services firm Standard Chartered has suggested that the price of BTC could surge to $120,000 by the end of next year, after predicting a rise to $50,000 this year.

Featured image via Unsplash.