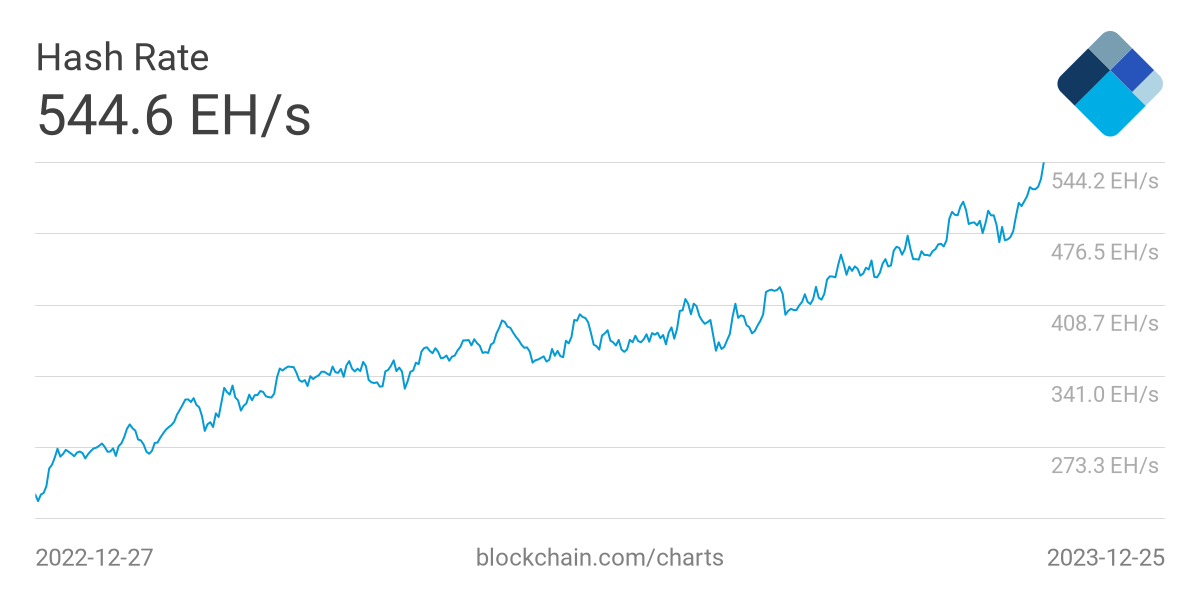

The Bitcoin network’s mining power, known as the hash rate, reached a new peak on Christmas Day, intensifying challenges for miners amid decreasing profitability. On December 25, the hash rate hit 544 exahashes per second (EH/s), marking a 130% growth since the start of the year.

Meanwhile, Bitcoin’s price has surged by over 160% since the beginning of 2023.

Understanding Key Bitcoin Concepts:

- Bitcoin Mining: This is the process by which new Bitcoins are created and transactions are verified and added to the blockchain. Miners use powerful computers to solve complex mathematical problems, and the first to solve the problem gets to add a new block to the blockchain, earning Bitcoin as a reward.

- Hash Rate: This measures the total computational power used to mine and process transactions on the Bitcoin network. A higher hash rate means greater competition among miners to validate new blocks and, generally, a more secure network.

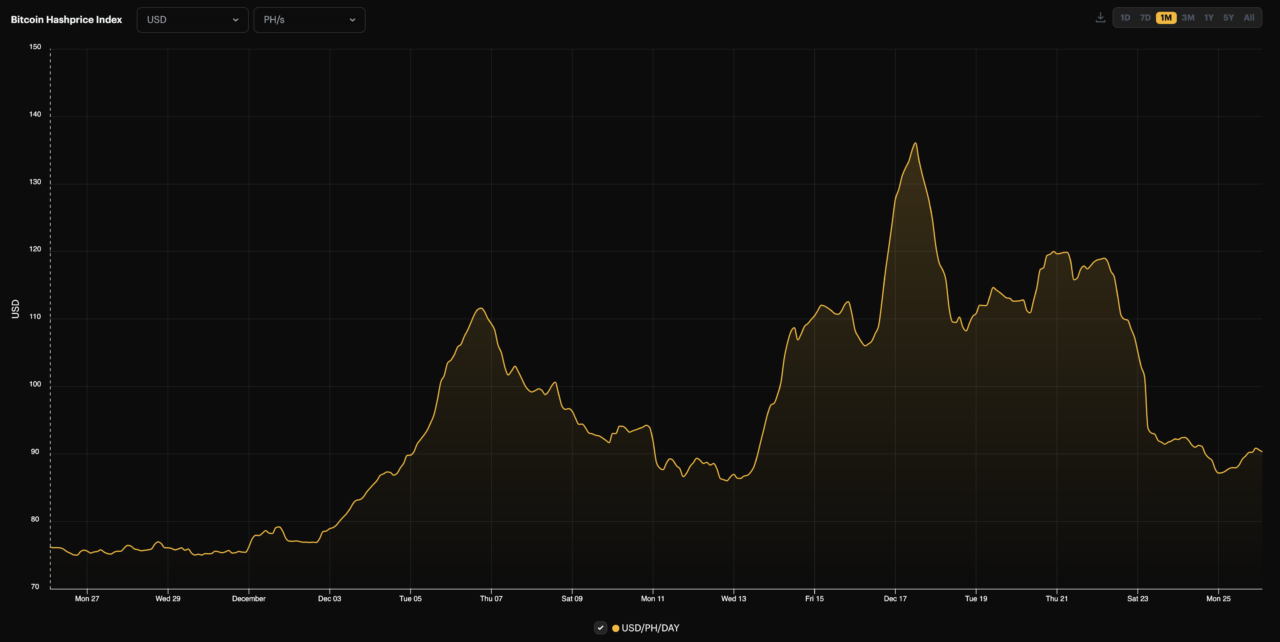

- Hash Price: This refers to the revenue miners earn per unit of computational power. It’s a crucial metric for understanding mining profitability.

- Mempools: These are waiting areas for unconfirmed Bitcoin transactions. A congested mempool with high transaction volume can lead to increased transaction fees and longer processing times.

According to a report by Martin Young for Cointelegraph, Will Clemente of Reflexivity Research observed that despite the 2021 mining ban in China, the network’s robustness remained largely unaffected. He emphasized the resilience and security of Bitcoin as a decentralized monetary system.

The Cointelegraph report also pointed out that the surge in hash rate, while beneficial for network security, has made mining more competitive, thereby impacting profitability. HashrateIndex reported a decline in hash price to $0.09 per terahashes per second per day, a 34% drop from its December 17 high. This decrease often occurs when demand and transaction fees lower, as seen recently with the cooling of the BRC-20 ordinal inscription craze.

Finally, the Cointelegraph article highlighted that a Glassnode analyst, known as “Checkmatey,” has pointed out the ongoing high transaction fees in the Bitcoin network, noting that the Bitcoin mempools have not been fully cleared for almost a year, indicating sustained fee pressure since February.

Featured Image via Pixabay