In a detailed analysis, Bloomberg highlights the dramatic shift in the cryptocurrency market from the gloom of 2022’s $1.5 trillion wipeout to a state of avarice by the end of 2023. This transformation is marked by Bitcoin’s significant resurgence and the crypto community’s optimistic outlook on regulatory developments.

Bitcoin’s Impressive Rally

According to Bloomberg, Bitcoin’s value soared by over 160% in 2023, adding approximately $530 billion to its market capitalization.

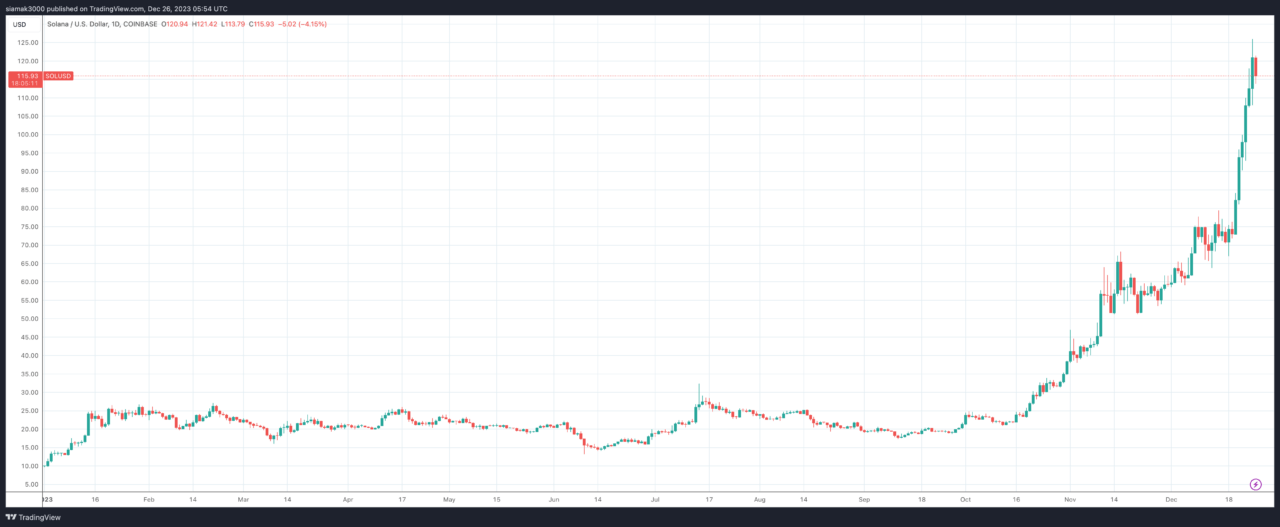

This resurgence led the recovery of the broader cryptocurrency market, with smaller tokens, including Solana and various meme coins, also experiencing substantial gains. Bloomberg notes that an investment of $100,000 in Solana at the beginning of 2023 would have yielded over $800,000 in gains.

Anticipation of US Regulatory Approval for Spot Bitcoin ETFs

Bloomberg reports that a key driver of the market’s optimism is the expectation that US regulators will soon approve the first exchange-traded fund (ETF) investing directly in Bitcoin. The decision, expected by January 10, is seen as a potential major catalyst for mainstream investment in Bitcoin. Michael Saylor, co-founder of MicroStrategy Inc., recently expressed to Bloomberg Television that the approval of spot ETFs would create a demand shock, offering a compliant investment channel for mainstream investors.

Challenges and Controversies

Despite the market’s recovery, Bloomberg points out that detractors continue to question the fundamental value of cryptocurrencies and their association with criminal activities. The report mentions that Binance, the largest crypto exchange, faced a $4.3 billion fine for various violations, leading to CEO Changpeng Zhao’s resignation. The crypto world is still reeling from Sam Bankman-Fried’s imprisonment for fraud at FTX, with liquidity yet to fully recover.

Market Performance and Trends

Bloomberg’s analysis shows that Bitcoin outperformed stocks and gold this year. The upcoming halving event in 2024 is expected to further support its value, alongside potential ETF demand. However, Bitcoin remains below its November 2021 peak. Companies like Marathon Digital Holdings Inc., Riot Platforms Inc., Coinbase Global Inc., and MicroStrategy all jumped as crypto markets recovered. Coinbase, despite facing an SEC lawsuit, contested the allegations and achieved almost a 400% gain.

Derivatives and Decentralized Finance

Bloomberg reports a surge in Bitcoin derivatives in 2023, noting that Bitcoin options open interest on Deribit and Bitcoin futures open interest at CME Group reached landmark levels. However, the Bloomberg report points out that the decentralized finance (DeFi) sector is still recovering from the TerraUSD collapse, except for liquid staking, which saw record growth in locked assets, especially post-Ethereum’s Shanghai update.

NFTs and Ongoing Challenges

According to Bloomberg, nonfungible token (NFT) trading volumes have risen from lows in October but remain far below the 2022 peak. The market, despite its recovery, still bears the scars of FTX’s collapse, with reduced liquidity affecting Bitcoin trading.

Featured Image via Pixabay