HK, HONG KONG, November 1st, 2023, Chainwire

Molecular Future (MOF), a leading digital asset investment service, invites the world to revisit its dynamic journey in the cryptocurrency sphere. Recent events, notably its delisting from the OKEX (OKX) exchange, have spurred the organization to offer a comprehensive analysis of its path, encompassing the intricate capital operations that have shaped its trajectory.

Molecular Future, A 2017 Dark Horse

In 2017, the Molecular Group launched MOF via an Initial Coin Offering (ICO), making waves with its innovative vision and vast potential. MOF secured funding from respected institutions and publicly traded companies, including Collinstar Capital and China Fortune (0110.HK). At the helm was Jason Tso, CEO of the Molecular Group, and the ICO raised over 20,000 Ether, approximately $20 million USD, establishing MOF as a project of significant interest.

The MOF Framework: Bridging Digital Assets and Traditional Finance

Molecular Future set out to deliver a comprehensive digital asset investment service that seamlessly integrated blockchain technology with traditional financial systems, culminating in the creation of a decentralized exchange. Its whitepaper presented ambitious plans for real-time on-chain trading and effective liquidity management. The introduction of the Mega Operation System (MOS) and the user-friendly Molecular App further extended its reach, offering an array of investment services, including real-time market analysis and tailored asset management plans.

Exponential Rise and Exchange Traction

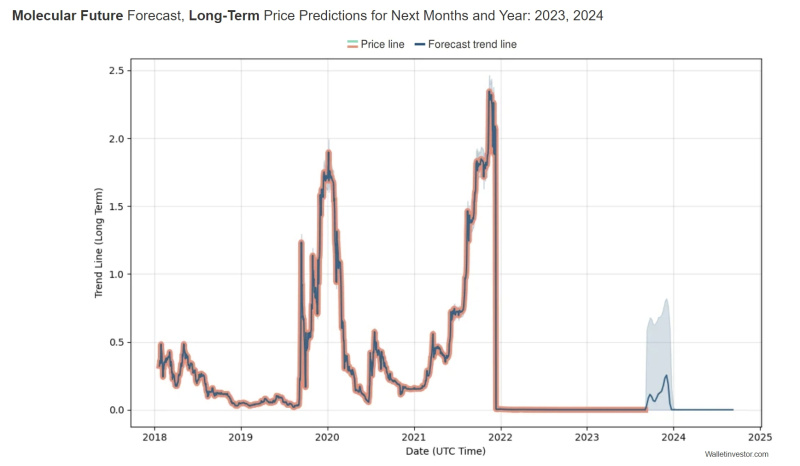

MOF’s journey was characterized by remarkable milestones. Post-ICO, MOF swiftly earned listings on several renowned exchanges, including OKEX, BitFarm, and Bittrex. In the face of a challenging bear market, MOF defied the odds, surging into the global top 30 cryptocurrencies. Its value soared, casting it into the limelight of the altcoin arena, with substantial trading volumes recorded on OKEX.

Strategic Capital Operations: A Key to Success

A pivotal moment in MOF’s history was its strategic sale to Australia’s HCASH Foundation at its peak, for nearly tens of millions of dollars USD. The transition ushered in new leadership with Jayden Wei as CEO, Jason Christopher as CTO, and Ryan XU as Chairman of Molecular Future, showcasing the Molecular Group’s adept capital operations in the volatile cryptocurrency landscape.

A Fall from Grace: Post-Acquisition Challenges

Notably, despite the acquisition by the HCASH Foundation and various attempts to reinvigorate the project, MOF faced persistent challenges. Even with significant updates and main chain alterations, it could not regain its previous momentum, leading to its delisting from OKX.

Lessons in Capital Operations and Blockchain Investments

The MOF journey serves as a poignant reminder of the pivotal role that capital operations play in blockchain projects. It underscores that strategic financial maneuvering is imperative, even for projects with market recognition and high potential. In the rapidly evolving blockchain arena, success hinges not only on short-term gains but also on meticulous long-term planning. This insight extends to both investors and entrepreneurs as they navigate the dynamic world of blockchain technology.

The MOF journey offers invaluable insights into the vital role that capital operations play within the blockchain industry. Sustainable long-term success should be a central focus, complementing the pursuit of short-term achievements. As the blockchain sector continues to evolve, a shrewd approach to capital operations remains an indispensable component of any project’s journey.

About Molecular Future (MOF)

Molecular Future (MOF) is a forward-thinking digital asset investment service provider, dedicated to merging blockchain technology with traditional financial systems. MOF’s mission is to create a decentralized exchange offering real-time on-chain trading, liquidity management, and innovative investment services, all accessible through the Molecular App.

Contact

Jackson Huang

[email protected]