CCData is an FCA-authorised benchmark administrator and a global leader in digital asset data, providing institutional-grade digital asset data and settlement indices. By aggregating and analyzing tick data from globally recognized exchanges and seamlessly integrating multiple datasets, CCData provides a comprehensive and granular overview of the market across trade, derivatives, order book, historical, social and blockchain data.

CCData has released the November 2023 edition of its Digital Asset Management Review. The report aims to provide a comprehensive overview of the global digital asset investment landscape, focusing on assets under management, trading volumes, and price performance. Targeting institutional investors, analysts, and regulators, the review aggregates data from multiple sources, including the Financial Times, CoinShares, and Bloomberg.

November 2023: A Month of Significant Growth in Digital Asset Investments

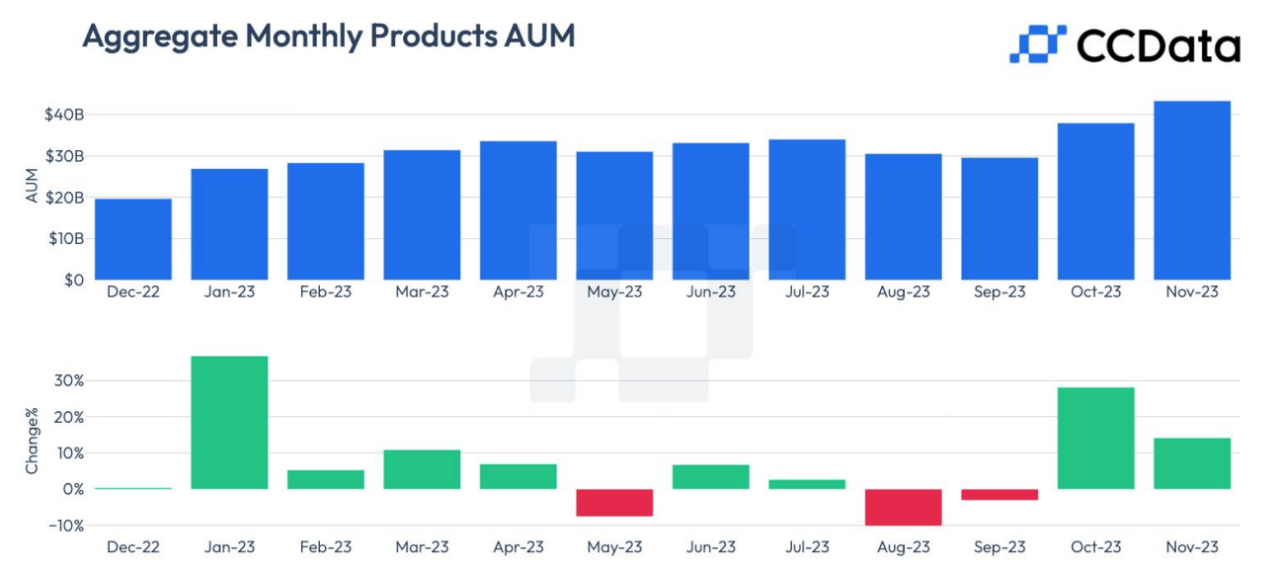

The digital asset investment landscape experienced a remarkable surge in November 2023, with assets under management (AUM) growing by 14.1% to reach $43.3 billion. This increase marks a cumulative rise of 120% throughout the year, a testament to the growing prominence of exchange-traded funds (ETFs) and the increasing participation of institutional investors in the crypto market.

The Catalysts: Bitcoin’s Price Surge and ETF Discussions

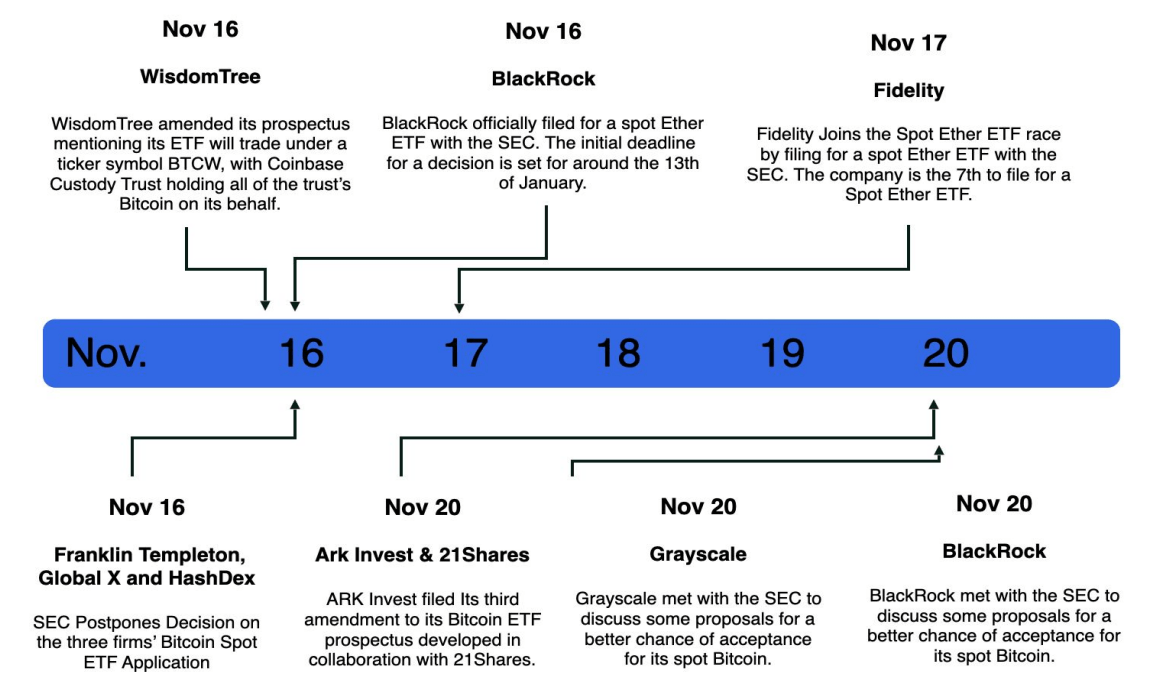

A key driver of this growth was the momentum in Bitcoin’s price, which surpassed $38,000 on November 24th. This price movement acted as a catalyst, significantly contributing to the rise in AUM. Concurrently, the crypto community has been abuzz with discussions about ETFs, particularly those based on Bitcoin and Ether spots. Major firms like WisdomTree, BlackRock, Fidelity, and others have been actively engaging with the SEC, either filing for ETFs or discussing their prospects, signaling a notable surge in efforts for regulatory approval.

Asset-Specific Growth: Bitcoin and Ethereum Lead the Way

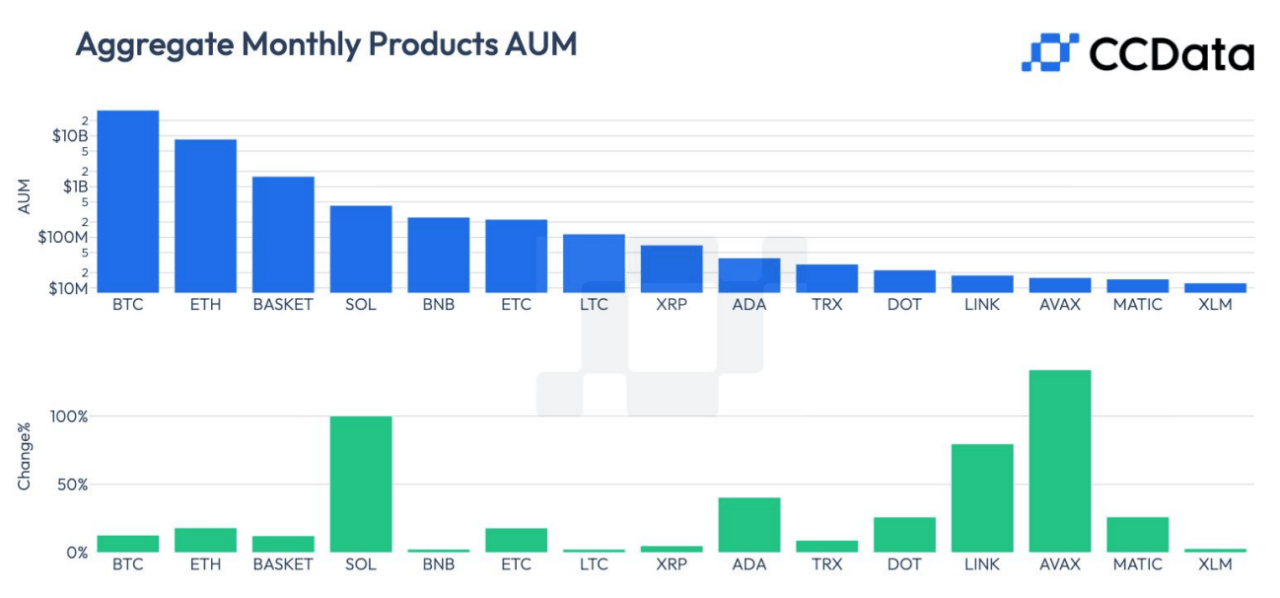

In terms of specific assets, Bitcoin-based products continued their upward trajectory, with AUM increasing by 12.5% to approximately $31.8 billion. This growth further cements Bitcoin’s dominance in the market, with an impressive annual growth of 140%. Ethereum products weren’t far behind, witnessing a significant monthly upswing of 17.8%, pushing their valuation to over $8.55 billion. This marks a 75.6% increase since the previous year. Additionally, the basket category and products based on Solana also recorded substantial growth.

Leading Firms in AUM Growth

Grayscale led the growth among digital asset management companies, registering a 10.3% increase in AUM to $30.4 billion. Other notable firms like XBT Provider, 21Shares, Purpose Invest, ProShares, and ETC Group also saw significant increases in their AUM, with some more than doubling their value from the previous year.

Stock Market Uptick and BTC Futures Interest

The stock market overall showed robust performance, with companies like Coinbase, Marathon Digital Holdings, and Galaxy Digital Holdings experiencing notable gains. This uptick was mirrored in the crypto futures market, where the open interest for BTC futures on CME rose significantly, overtaking Binance in market share.

Regional AUM Growth: USA, Canada, and Germany Lead

Regionally, the USA continued to dominate the market with an 11.5% growth in AUM, reaching $32.5 billion. Canada and Germany also recorded significant growth, further highlighting the dynamic landscape of digital asset products in these regions.

Product-Specific Growth: Grayscale and ProShares in the Lead

Grayscale’s GBTC and ETHE products led the market, with substantial growth in their AUM. ProShares BITO and Purpose Invest BTCC followed, with significant increases in their market share. Other products like ETC Group BTCE, 21Shares ABTC, and CI Galaxy BTCX.B also reported notable advancements.

Grayscale Bitcoin Trust Discount Narrows

An interesting development was the narrowing discount associated with the Grayscale Bitcoin Trust (GBTC), which contracted from a high of 45% to just 8% on November 24th. This trend reflects the market’s optimism surrounding the approval of spot ETFs and the potential for increased institutional adoption.

Record Highs in Daily Volumes

Lastly, the average daily volumes of aggregate products saw a substantial increase of 35.3%, climbing to $481 million. This surge, primarily propelled by companies like Grayscale and ProShares, indicates the profound influence a Bitcoin spot ETF might have on the market and showcases increased investor confidence.