Christopher J. Waller has been a pivotal figure in the Federal Reserve System since his appointment as a Board of Governors member on 18 December 2020. His term is set to conclude on 31 January 2030. Waller’s journey to this influential position began with his tenure as executive vice president and director of research at the Federal Reserve Bank of St. Louis, starting in 2009.

His expertise extends beyond the Federal Reserve System. Waller has a rich academic background, having served as the Gilbert F. Schaefer Chair of Economics at the University of Notre Dame and a research fellow at the university’s Kellogg Institute for International Studies. His academic journey also included significant roles at the University of Kentucky and Indiana University, where he focused on macroeconomics and monetary economics.

Waller’s educational foundation in economics is robust, having earned a BS from Bemidji State University, followed by an MA and PhD from Washington State University. This blend of academic and practical experience in economic matters positions him as a key voice in the Federal Reserve System.

Waller’s Dovish Stance on U.S. Inflation and Economic Outlook

In a speech earlier today at the American Enterprise Institute in Washington, D.C., Waller expressed a cautiously optimistic view on the U.S. economy and inflation. He referred to his previous speech titled “Something’s Got to Give,” highlighting the juxtaposition of strong economic growth and employment data with a moderation in core personal consumption expenditures (PCE) inflation.

Waller noted that the economy needed to decelerate from its robust growth in the third quarter to align with the Federal Open Market Committee’s (FOMC) target of 2 percent inflation. He observed encouraging signs of an economic slowdown, evidenced by the data for October, which indicated a cooling in consumer spending and a moderation in economic activity forecasts for the fourth quarter.

However, Waller emphasized that inflation remains too high and cautioned that it is premature to confirm a sustained slowdown. He expressed confidence in the current policy positioning to slow the economy and return inflation to 2 percent, but also acknowledged the uncertainty surrounding future economic activity.

Economic Indicators and Future Projections

The speech detailed various economic indicators:

- The real GDP growth rate in the third quarter was a vigorous 4.9 percent, with consumer spending being a major contributor.

- October data showed a decline in retail sales, with decreases in motor vehicle spending and at gasoline stations, hinting at the potential impact of the FOMC’s monetary policy tightening.

- Manufacturing and non-manufacturing activities indicated a slowdown.

- The GDPNow model from the Atlanta Fed forecasted a 2.1 percent growth rate for the fourth quarter.

- Volatile inventory investments, which boosted the third quarter GDP, might not sustain their contribution to future quarters.

Waller also discussed labor market trends, noting a decrease in job creation and a slight rise in unemployment. Despite these signs of a loosening labor market, he pointed out that the market remains historically tight.

Inflation and Monetary Policy

On inflation, Waller expressed satisfaction with the October Consumer Price Index (CPI), noting a broad distribution of moderation in inflation. He highlighted the declining energy prices and a modest increase in core inflation. The speech also covered the FOMC’s preferred measure of inflation based on personal consumption expenditures, which runs slightly below CPI inflation.

Waller underscored the importance of continuous monitoring of various goods and services price pressures to ensure inflation is on a downward trajectory towards the 2 percent target. He emphasized the role of monetary policy in this process, acknowledging the shift from supply-side problems to policy-driven solutions for managing inflation.

Impact on Bitcoin and Financial Markets

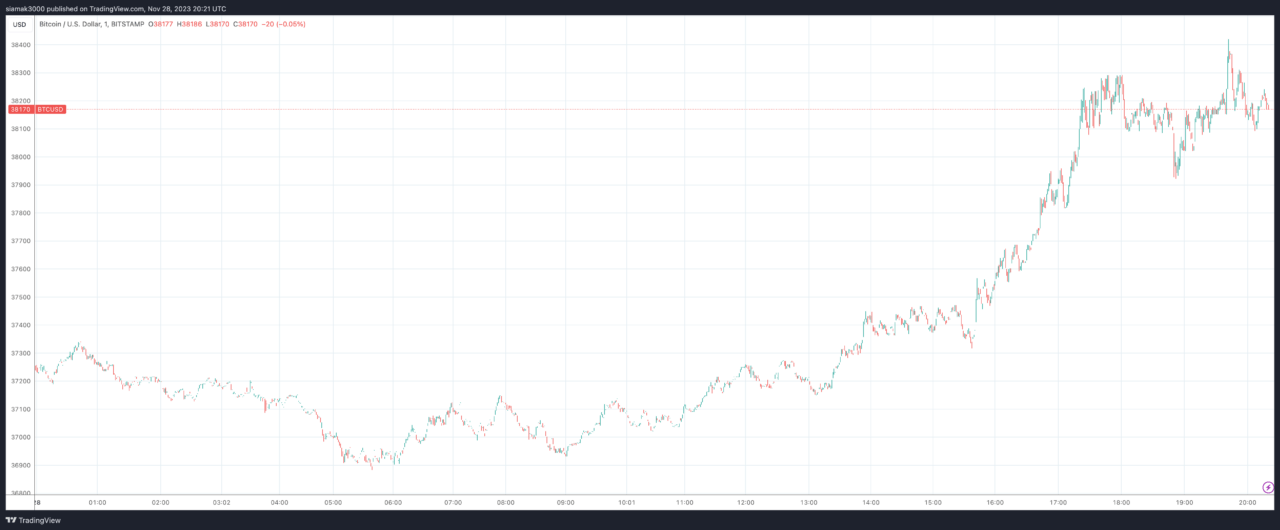

Waller’s dovish remarks, reflecting a potential easing in aggressive monetary policy measures, appear to have positively influenced the financial markets. Notably, the price of Bitcoin surged by nearly 4% to above $38,000 following his speech. This reaction underscores the significant impact of Federal Reserve policies and statements on both traditional and digital financial markets.

At the time of writing, Bitcoin is trading at around $38,126.

Featured Image via Federal Reserve Bank of St. Louis