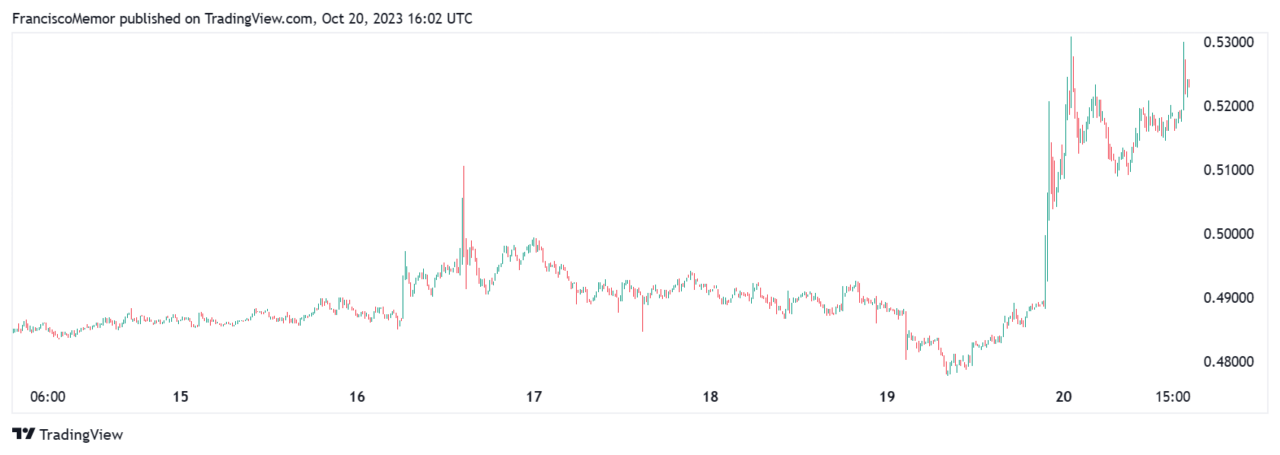

The price of the native token of the XRP Ledger, $XRP, is up by 7.6% today after several positive developments made the cryptocurrency more attractive to investors. The rise saw XRP’s market capitalization surge to $28 billion, and made it the second-best performer in the top 10 behind Solana.

XRP is currently trading at $0.523 after rising over 8.8% over the last seven days. Its rise above the $0.50 mark means it has surpassed a significant psychological barrier for investors, which it had until recently failed to break above.

Why XRP is Up Today

The price of XRP surged today after a court filing revealed that the U.S. Securities and Exchange Commission (SEC) dropped its claims that Ripple’s top executives helped the company break federal securities laws by selling XRP, ending a trial that was set for next year and giving Ripple another win in the ongoing lawsuit.

The filing stated that a mutual agreement was reached between the SEC, Ripple’s CEO Brad Garlinghouse, and Executive Chairman Chris Larsen to permanently drop the charges. However, the SEC’s claims against Ripple will continue to be pursued, as per the filing.

In July, Judge Analise Torres ruled that Ripple did not break federal securities laws by letting retail investors trade XRP on cryptocurrency exchanges. In that same ruling, the federal judge said the firm had violated federal securities laws in selling XRP directly to institutional investors.

The price of XRP also benefitted from a wider cryptocurrency market rise that has seen the price of BTC move up 3.2% to $29,500 and ETH move up 2.8% to $1,610 at the time of writing.

Moreover, according to on-chain analytics firm Santiment, the rise was driven by “smart money” investors who hold between 10,000 and 10 million XRP, which have been accumulating rapidly to now hold 29.5% of the cryptocurrency’s supply.

Coinalyze data shows that as XRP’s price went up, so did cumulative volume delta (CVD) in spot exchanges, which signals more market inflow. In contrast, CVD in stablecoin and coin-margined futures markets stayed the same, with a higher CVD meaning more buying activity, while a lower CVD meaning more selling activity.

Featured image via Pixabay.