The smart contract platform Solana ($SOL) has been outperforming the wider cryptocurrency market, and recently managed to break through the $35 barrier as institutional investors keep betting on it, to the point it’s up 70% over the last 30 days.

According to available market data, SOL is, at the time of writing, trading at $36.3, which means that year-to-date, the cryptocurrency is up more than 260% as it keeps on recovering from the effects of the collapse of FTX.

Solana’s price was negatively impacted at the end of last year with the collapse of FTX, as the collapsed exchange’s former CEO Bankman-Fried was a well-known Solana supporter who had invested in various projects within the cryptocurrency’s ecosystem.

His involvement in these projects has affected investors’ confidence in them in the wake of FTX’s collapse, to the point SOL traded as low as $11 before it started recovering. Its price performance has since also been drawing in institutional investors betting on it.

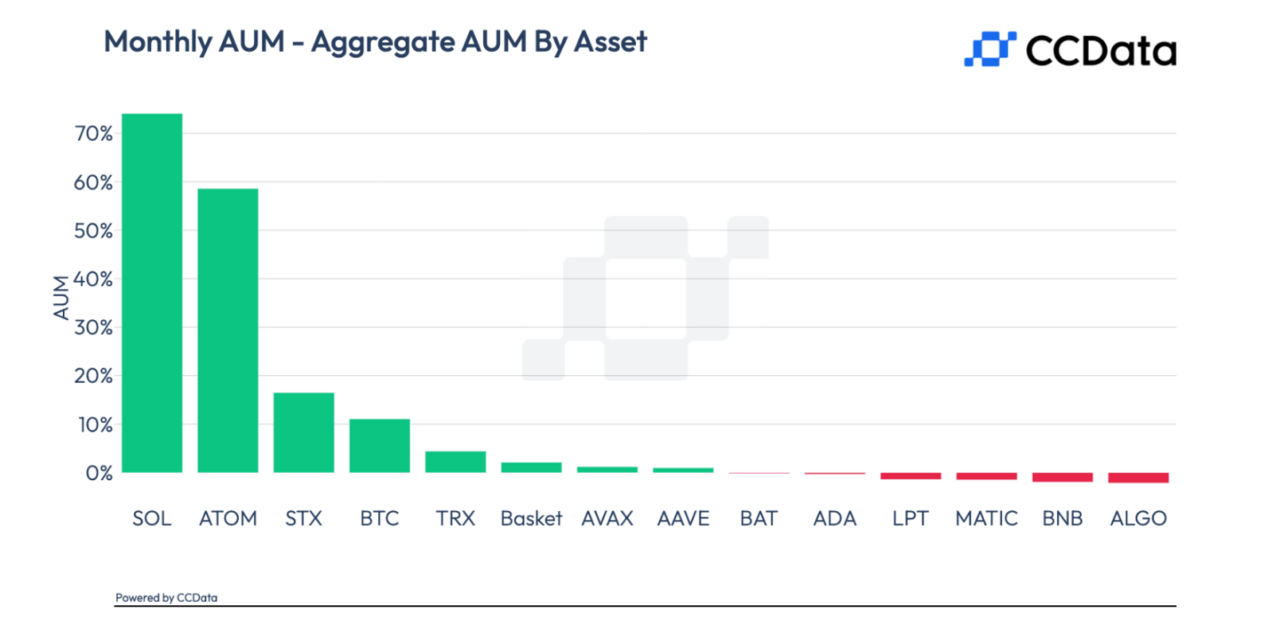

According to CCData’s latest Digital Asset Management Review report, Solana-based investment products saw their assets under management rise by 74.1% in October to $140 million.

Today’s rise is aligned with the relative strength index (RSI) breaking past the 74.00 barrier, now positioned past 77. According to Investopedia, the RSI is a momentum indicator that’s used in technical analysis to measure the “magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset.”

The RSI can have a reading between 0 and 100, with values above 70 indicating that an asset is starting to become overbought or overvalued, and values below 30 indicating an asset is becoming oversold or undervalued.

Featured image via Unsplash