CCData is an FCA-authorised benchmark administrator and a global leader in digital asset data, providing institutional-grade digital asset data and settlement indices. By aggregating and analysing tick data from globally recognised exchanges and seamlessly integrating multiple datasets, CCData provides a comprehensive and granular overview of the market across trade, derivatives, order book, historical, social, and blockchain data.

Yesterday, CCData released the October 2023 edition of its Digital Asset Management Review. The report aims to provide a comprehensive overview of the global digital asset investment landscape, focusing on assets under management, trading volumes, and price performance. Targeting institutional investors, analysts, and regulators, the review aggregates data from multiple sources, including the Financial Times, CoinShares, and Bloomberg, among others.

According to CCData’s October 2023 Digital Asset Management Review, Bitcoin experienced a significant price increase this month. On 16 October 2023, the cryptocurrency reached a high of $30,009, a surge attributed by CCData to rumors surrounding the potential approval of BlackRock’s Bitcoin Spot ETF. Although the price experienced a dip following the initial rumors, CCData notes that Bitcoin has since made a strong recovery. As of 25 October 2023, the cryptocurrency has seen a 28.3% increase from the start of the month and is currently trading around $34,000.

CCData also reports that assets under management (AUM) for Bitcoin-centric products increased by 11.1%, reaching $23.2 billion. This contributed to Bitcoin’s market share rising to 73.3%, up from 70.5% in September. In contrast, CCData observed that Ethereum-based products experienced a decline despite the launch of new ETFs.

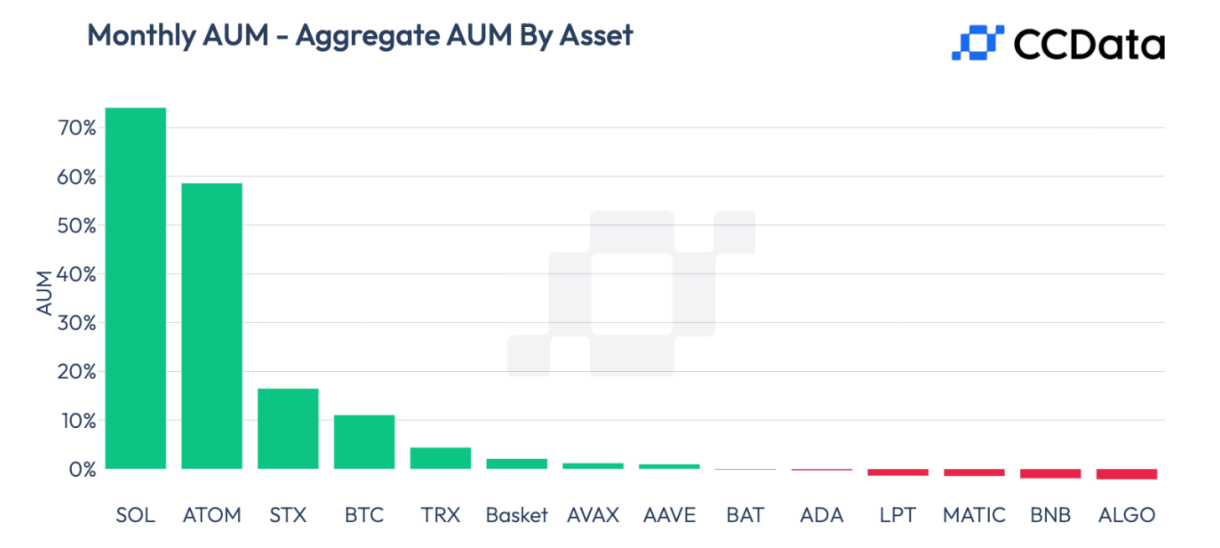

One of the standout points in CCData’s report is the remarkable growth in AUM for Solana-based products. These offerings saw a 74.1% increase in AUM, reaching a total of $140 million. Following Solana, products based on the Cosmos (ATOM) blockchain also saw significant growth, with a 58.6% increase in AUM to $2.15 million, as noted by CCData.

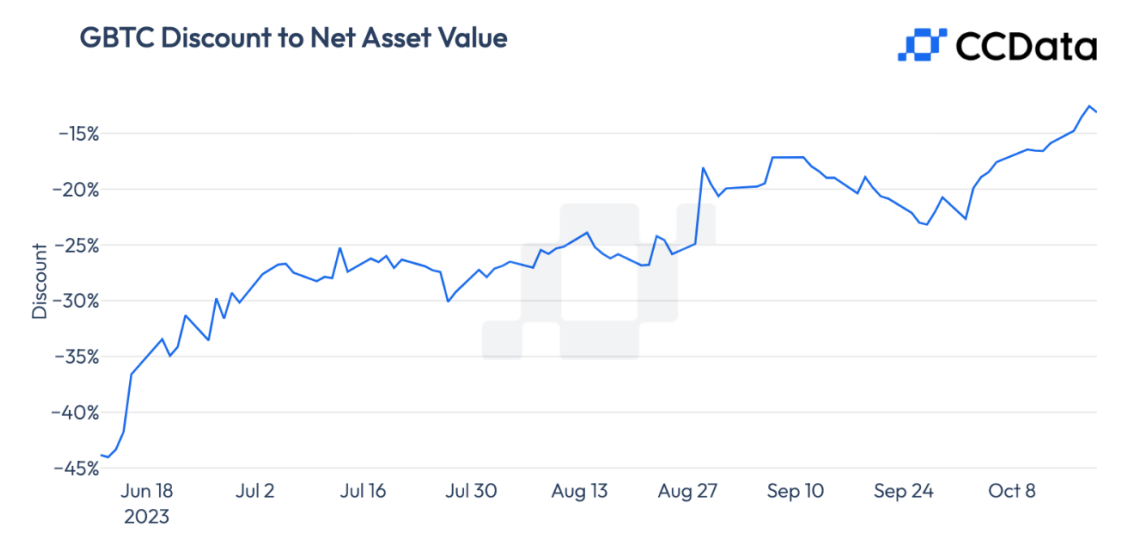

Grayscale’s discount rate reached its lowest point since November 2021, registering at 12.6%, according to CCData. This reduction in the discount rate is seen as a sign of growing confidence in the approval of cryptocurrency ETFs.

However, CCData’s report also highlights some negative trends. Specifically, stocks related to digital assets, including Coinbase Global Inc (COIN), Riot Platforms Inc (RIOT), and Galaxy Digital Holdings Ltd (GLXY), faced significant declines in October. CCData attributes this downturn to a shift toward a more cautious macroeconomic outlook, which has led to setbacks for these companies when compared to Bitcoin.

In a recent blog post, global asset manager VanEck offered a comprehensive analysis of Solana’s potential in the blockchain space, predicting that the price of its native token, $SOL, could reach as high as $3,211 or drop to as low as $9.81 by 2030. According to VanEck, Smart Contract Platforms (SCPs) like Solana are essential for decentralized applications and must offer functionalities beyond financial transactions for widespread adoption. The firm lauded Solana’s focus on scalability, efficiency, and high-speed data processing, stating that these features make it a strong contender for hosting future groundbreaking applications.

However, VanEck also pointed out challenges Solana faces, such as its current financial model where the costs of maintaining its blockchain exceed its revenue. The asset manager emphasized that Solana needs to find a sustainable way to balance its security expenses with its income. VanEck also noted that while Ethereum aims for modular solutions, Solana is geared towards an integrated, high-throughput system, which could influence their respective market shares. Despite the risks associated with its experimental technology, VanEck sees considerable upside potential for Solana, making it an asset worth considering for investment portfolios.