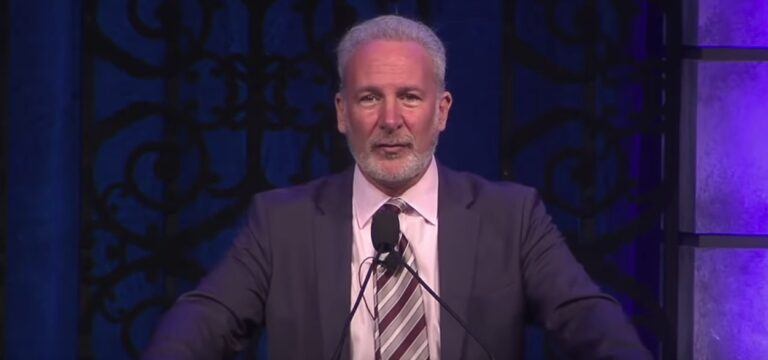

Peter Schiff, CEO of Euro Pacific Capital, recently raised alarm bells about the increasing dangers banks are encountering due to their amplified exposure to the real estate market.

Schiff also holds multiple positions in different financial services firms, such as Euro Pacific Asset Management, an autonomous investment advisory firm; Schiff Gold, previously known as Euro Pacific Precious Metals, a dealer in precious metals; and Euro Pacific Bank, a bank that operates on a full-reserve basis.

One of the key factors Schiff identifies is the effective competition posed by non-traditional lenders in the real estate market. This rise of alternative lending options has led to conventional banks facing increased risks as they attempt to maintain their market share.

Another focal point of Schiff’s discussion is the inflation of real estate prices, particularly in the residential segment. The heightened prices have apparently resulted in less affordability for average buyers, forcing banks to extend their lending criteria and offer more credit.

On the regulatory front, Schiff notes that while financial regulations may appear to have tightened post-2008, they essentially lack the bite to curb risky banking practices effectively. Specifically, he calls out the increased prevalence of adjustable-rate mortgages as a risk factor that existing regulations haven’t adequately addressed.

Schiff also turns the spotlight on government-sponsored entities like Fannie Mae and Freddie Mac. He explains that while these organizations do purchase mortgage-backed securities from banks, reducing the immediate financial risk to these institutions, this essentially transfers the risk to the taxpayer. This, Schiff argues, creates a moral hazard, diminishing the banks’ motivation to adhere to strict lending standards.

Furthermore, Schiff observes that the financial state of banks has deteriorated when compared to the period leading up to the 2008 crisis. He also emphasizes that if another crisis were to occur, its impact could be even more detrimental than what was experienced in 2008.

On October 2, Schiff spoke about the current state of the U.S. bond market, asserting that it’s only in the initial phase of what he anticipates will be the largest bond market crash in American history. Schiff criticized the Federal Reserve’s policies, such as keeping interest rates low and participating in quantitative easing, for inflating a dangerous bubble in the bond market. He forecasted that the burst of this bubble will have a ripple effect, wreaking havoc not just in the bond market, but extending to other asset classes, including stocks and real estate as well.

Schiff is particularly concerned that the yields currently offered in the bond market do not adequately reflect the high levels of risk involved. He argued that these yields are artificially propped up and will not be sustainable in the long term. He says that as a result, investors who are seeking income or stability from bonds could be in for a rude awakening.

For those looking to protect their investments, Schiff advises moving towards alternative assets such as precious metals. He contends that recognizing the gravity of the situation early on provides an opportunity for investors to make changes to their portfolios that could spare them from severe financial consequences down the line.