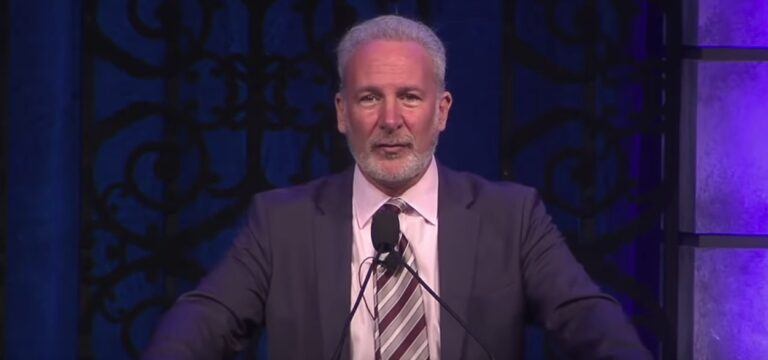

Earlier today, Peter Schiff, the CEO of Euro Pacific Capital, criticized Bitcoin and its supporters in a post on the social media platform X (previously known as Twitter).

In addition to his role at Euro Pacific Capital, Schiff has various other financial responsibilities. He is involved with Euro Pacific Asset Management, an independent investment advisory firm; Schiff Gold, formerly Euro Pacific Precious Metals, a precious metals vendor; and Euro Pacific Bank, a full-reserve banking institution.

Schiff is also a financial commentator and author. Known for his bearish outlook on the U.S. economy, Schiff is a vocal critic of the Federal Reserve’s monetary policies and has predicted economic downturns. He is a strong proponent of investing in gold and precious metals as a safeguard against economic instability. Schiff has authored books like “Crash Proof: How to Profit from the Coming Economic Collapse” and frequently appears on financial news programs.

He has a large following on social media where he shares his economic and financial insights. Notably, Schiff is a controversial figure in the cryptocurrency community due to his skepticism towards Bitcoin and other digital assets. He argues that traditional assets like gold are more reliable long-term investments. His views are both lauded and criticized, making him a prominent figure in financial discussions.

Going back to today’s post on X, Schiff took issue with comments made by Mike Novogratz, the CEO of Galaxy Digital Holdings, about Bitcoin’s nature and how it is sold. Novogratz had previously spoken with Andrew Ross Sorkin, a co-anchor of CNBC’s “Squawk Box,” stating that Bitcoin is an “instrument that is sold, not bought.”

According to Schiff, this statement from Novogratz confirms that Bitcoin lacks inherent utility and is essentially bought because someone else convinces people to purchase it. Schiff went further to compare the behavior around buying and selling Bitcoin to that of a cult, implying that people acquire it only to immediately persuade others to do the same.

The statement from Schiff prompted a series of responses from various individuals on social media, each bringing their own perspective to the table:

- A user going by the handle “empatik.eth” countered Schiff’s argument by suggesting that gold, too, is not inherently needed and is bought only after someone else promotes it. The user likened the behavior around gold to that of a cult, drawing a parallel with Schiff’s critique of Bitcoin.

- In response, Schiff disagreed vehemently, stating that the user’s lack of understanding about gold explains their similar lack of comprehension regarding Bitcoin.

- Another user, identified as “DecodeJar,” argued that gold serves no functional purpose in today’s digital age other than for jewelry.

- Contrary to this, a user named “David Black” emphasized that gold still functions as money, citing Goldbacks as an example of gold’s continued use as currency.

- Dan Victor, CFA, weighed in on the debate by defending Bitcoin’s role as digital gold. He stated that Bitcoin serves as a finite resource and posited that its value will increase over time as it becomes an accepted alternative investment class.

- Peter Schiff retorted that Bitcoin isn’t a resource at all and highlighted the large number of Satoshis (the smallest unit of a Bitcoin), implying that Bitcoin’s claim to value based on scarcity is baseless.

On 2 October 2023, Schiff sounded the alarm about what he perceived as the initial phases of the most significant bond market collapse in U.S. history.

Schiff’s alert was grim, covering multiple economic sectors. He indicated that all organizations—ranging from governments and businesses to property owners and households—that have relied on inexpensive debt for financial stability could face harsh repercussions. Schiff warned that these groups stand on the brink of financial disaster as the bond market implodes.

Moreover, Schiff contended that Federal Reserve intervention could exacerbate the situation. He maintained that if the Federal Reserve attempted to rescue these beleaguered entities, it might unintentionally worsen their plight by triggering inflation. Such inflation would diminish the value of money, complicating these entities’ ability to manage their debt and fulfill other financial commitments.