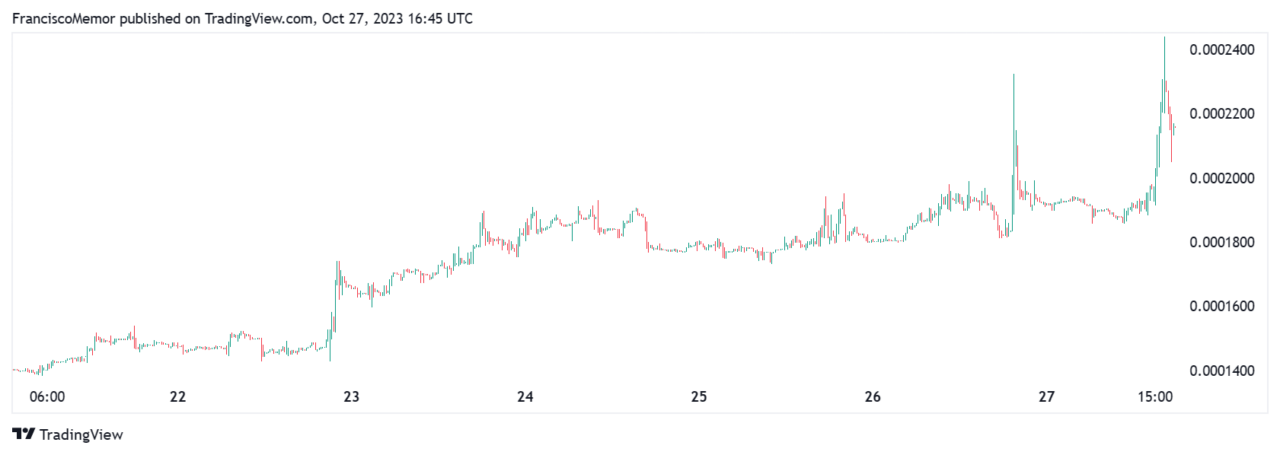

The price of $SNEK, a popular memecoin based on the Cardano ($ADA) ecosystem, has seen its price rise by more than 56% over the past week, and over 16% over the last 24-hour period to outperform the wider cryptocurrency market.

According to available market data, SNEK’s trading volume over the last 24-hour period was of over $770,000 and a fully diluted market capitalization of just $16.8 million, making it a minor cryptocurrency in the space. The memecoin, which claims to be the “chilliest meme coin on Cardano,” aims to foster community, stimulate the decentralized finance sector within Cardano, and reward its holders.

The cryptocurrency’s price rise could likely be attributed to growing demand facing the low liquidity it has been seeing, although it’s worth pointing out the community behind it has been moving to develop the SNEK ecosystem over time.

The SNEK community notes that SNEK is by far the most traded asset within the Cardano ecosystem, which currently has $196.6 million in total value locked at the time of writing. Over $90 million of those funds are in the decentralized exchange Minswap and on the collateralized debt protocol Indigo, according to DeFiLlama.

The community behind SNEK has launched an energy drink, with a 12-pack of cans selling for $45. It also worked on a web3 game that’s set to soon be released, and has launched a staking mechanism for token holders called “Last Snek Standing,” distributing rewards to stakers that keep their funds staked until the end of a staking period.

SNEK’s cryptocurrency community has also been moving to implement a total of seven distinct burning mechanisms in a bid to deflate its current circulating supply of 70.8 billion tokens. These burning mechanism include a token bridge, a staking pool, liquidity provider trading fee rewards, lending, and an ADA raffle system, among others.

The cryptocurrency’s rise comes shortly after Weiss Ratings, which was established in 1971 in the United States and offers analytical research on a broad spectrum of investment options, from stocks and mutual funds to banks and cryptocurrencies, endorsed Cardano as a must-have in any bull market crypto portfolio.

Featured Image via Unsplash