Andrei Jikh, a prominent finance expert, recently discussed the future of Bitcoin, focusing on Kathy Wood’s price predictions and the potential approval of spot Bitcoin ETFs in the U.S.

Jikh is a well-known figure in the world of financial education, primarily through his YouTube platform where he delves into subjects like personal finance, investment strategies, and digital currencies. He has garnered a following for his straightforward approach to demystifying intricate financial matters, frequently employing visual tools and practical examples to clarify concepts for his viewers. His channel offers a broad spectrum of content, ranging from stock market insights to cryptocurrency discussions and tips on managing personal finances.

Before becoming a content creator, Jikh had a professional background in the financial sector. His educational style is lauded for its ability to cater to a diverse audience, from financial novices to those with a more advanced understanding of the subject. The educational material he produces is often rooted in his personal financial journey and extensive research.

In a YouTube video released yesterday, Jikh begins by noting the current excitement around Bitcoin, which recently reached around $35,000 per coin, attributing the surge to the likely approval of a spot Bitcoin ETF by the U.S. SEC.

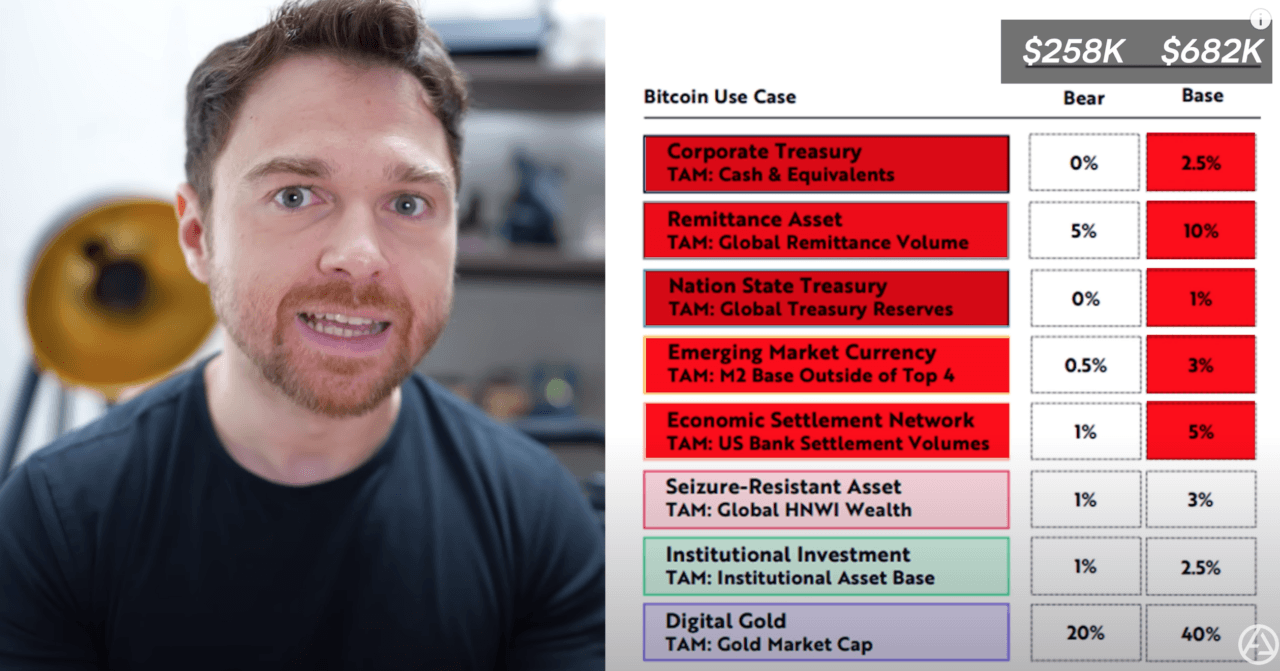

According to Jikh, Catherine Wood, Founder, CIO, and CEO at ARK Investment Management, LLC (aka “ARK” or “ARK Invest”), has predicted that Bitcoin could be worth between $258,000 to $1.5 million by 2030. Jikh explains Wood’s base case scenario, which estimates that each Bitcoin will be worth over $682,000 by 2030.

Jikh says that, according to Wood, several conditions must be met for this prediction to materialize:

- Corporate Treasuries: 2.5% of corporate treasuries should be held in Bitcoin.

- Global Remittance: Bitcoin should represent 10% of the total global remittance volume.

- Nation-State Treasury: 1% of a nation’s treasury should be held in Bitcoin.

- Emerging Market Currencies: 3% of all emerging market currencies — excluding the top four (Brazil, Russia, India, China) — are held by the people in BTC.

- Economic Settlement Network: Bitcoin should represent 5% of the economic settlement network.

- High Net Worth Individuals: 3% of seizure-resistant assets should be held by individuals worth between $1 to $5 million.

- Institutional Investors: 2.5% of their money should be in Bitcoin.

- Gold’s Market Cap: Bitcoin should capture 40% of Gold’s market cap.

Jikh also discusses the imminent approval of Bitcoin ETFs, particularly spot Bitcoin ETFs. He mentions that at least 8 to 10 wealth management companies have filed for their chance to launch Bitcoin ETFs. The SEC’s recent decision not to appeal a court ruling in favor of asset management company Grayscale indicates a higher likelihood of approval.

Jikh offers three warnings for potential investors:

- Short-term Volatility: Bitcoin is more likely to decrease in value in the short term as people buy on rumors and sell on news.

- Expense Ratios: Investors should be cautious of the fees associated with Bitcoin ETFs. A 2% expense ratio could end up costing a significant amount over 30 years.

- Management Style: Different ETFs will manage Bitcoin differently, some may use cold storage, some may have lower fees, and some may even pay out dividends.

Jikh concludes by stating that while Bitcoin has a bright future, it’s essential to be cautious. He suggests that Bitcoin is not recession-proof and its value could be significantly affected by economic downturns. He also mentions that if the Federal Reserve stimulates the economy, it could set Bitcoin up for success, especially with the halving event expected in 2024. Jikh emphasizes the importance of diversification and advises investors to stay informed and make cautious decisions.