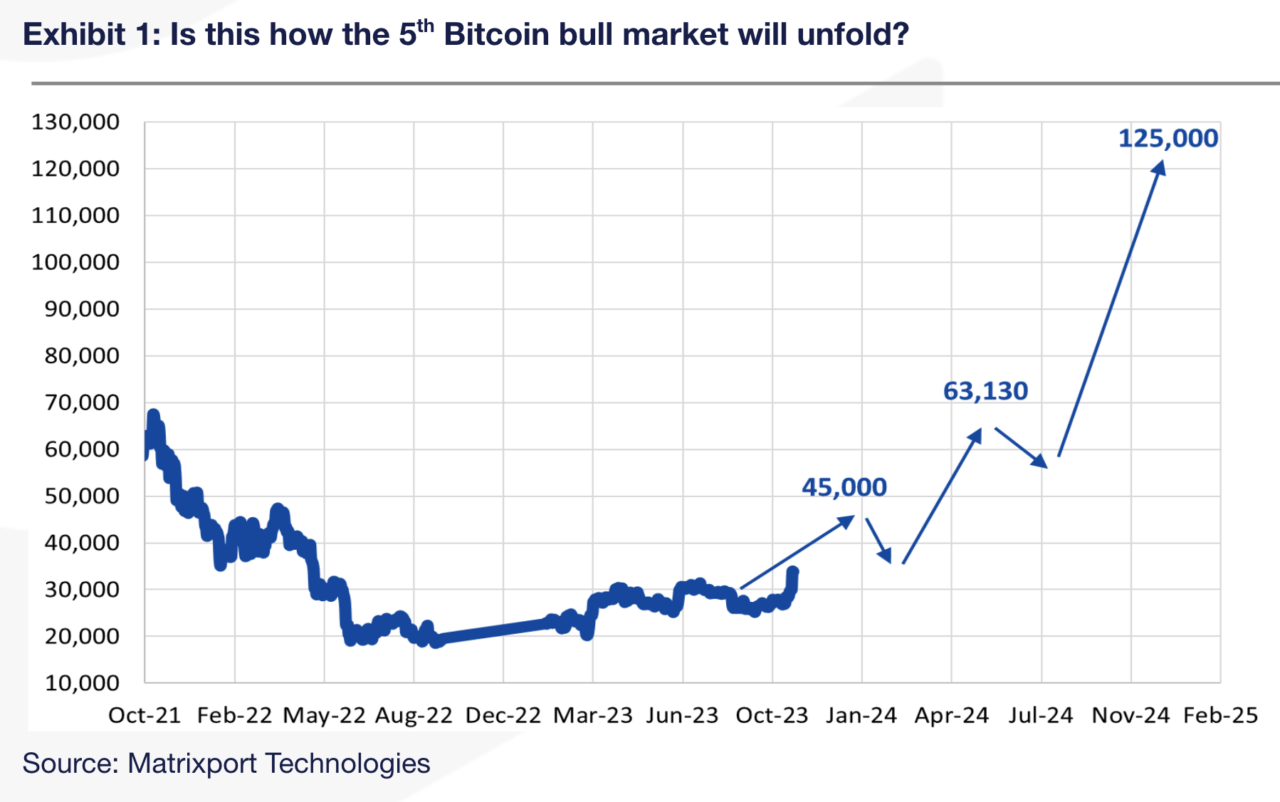

A recently published report from Matricport suggests that the flagship cryptocurrency Bitcoin is now in its fifth bull cycle, and notably includes a BTC price prediction targeting $125,000 by the end of next year.

Matrixport’s latest report details that the cryptocurrency has so far been through four bull market cycle, each driven by a new narrative. The first one came in 2011, and was “propelled by Bitcoin’s emergence as a new payment mechanism,” while the second one was driven by BTC gaining recognition as an alternative form of money, with China leading the pack.

The report adds that the emergence of initial coin offerings (ICOs) as a new way to create and fund ventures marked the third cycle, while the fourth cycle saw the boom of decentralized finance and was followed by the non-fungible token (NFT) frenzy.

The anticipation of institutional adoption, the report adds, seems to be the main driver of the fifth Bitcoin bull market. Institutions are looking at Bitcoin as a way to diversify their asset allocation, as BTC has features that are similar to those of gold and other safe-haven investments like Treasury bonds, the firm wrote.

The surge of Bitcoin coincides with a time when the debt-to-GDP ratio of the United States is reaching levels that are not sustainable. Matrixport writes that the bull market officially started on June 22, when BTC reached a one-year high for the first time in 12 months. Per its report, when this signal was triggered BTC “delivered, on average, returns of 310%.

Taking this into account, Matrixport estimates that the price of Bitcoin could hit $125,000 by December 2024, suggesting that the “optimal entry point to buy Bitcoin was ideally 14-16 months before the next halving event.”

The report concludes that the “end of October 2022 was the perfect entry time” and that as momentum grows “further gains are anticipated.” As CryptoGlboe reported, the firm recently analyzed the potential impact the approval of BlackRock’s spot Bitcoin exchange-traded fund (ETF) could have on the cryptocurrency space, suggesting BTC could surge to $56,000.

A spot Bitcoin ETF would provide a regulated and mainstream investment vehicle for investors to get exposure to Bitcoin without owning the cryptocurrency directly.

Featured image via Unsplash.