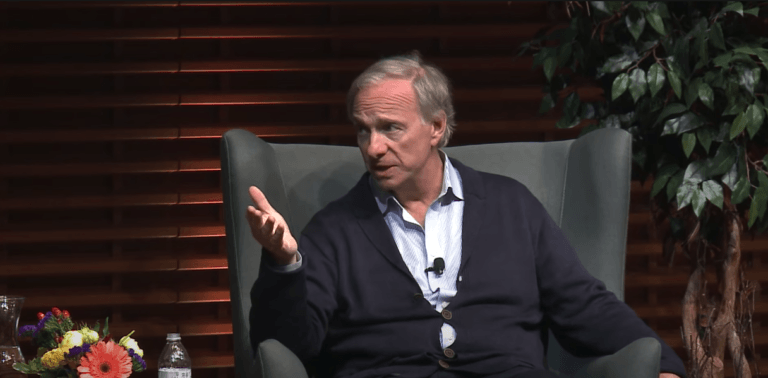

Earlier today, Ray Dalio, the founder of Bridgewater Associates, expressed a pessimistic outlook for the global economy in 2024 during a panel discussion at the Future Investment Initiative event in Riyadh, Saudi Arabia (24-26 October 2023). David Rubenstein, the co-founder of Carlyle, moderated the discussion.

The 74-year-old American, whose net worth is estimated by Forbes to be around $15.4 billion (as of 24 October 2023), created the asset management firm Bridgewater Associates from his New York City apartment just two years after receiving his MBA from Harvard Business School.

Dalio highlighted multiple factors contributing to his negative outlook, including political instability, monetary policies, and a conflict-ridden environment. He stated that these elements make it difficult to maintain an optimistic perspective on the global economy for the next year.

Despite acknowledging the incredible advancements in technology that have the potential to produce wonderful outcomes, Dalio cautioned that these could also become problematic. He indicated that the monetary policies expected to be implemented will have significant impacts on the world, further fueling his pessimism.

Dalio also touched upon the widening gaps in the world, presumably referring to inequalities, although he did not elaborate further. He emphasized that the real issue moving forward is how people deal with each other. He suggested that maintaining peace and fostering a healthy, competitive environment without conflict would be crucial for the world to adapt and thrive.

Earlier this month, Dallio spoke on the state of the global economy and emphasized the importance of diversification in investment portfolios. Dalio cautioned investors against relying solely on market predictions, using the saying, “He who lives by the crystal ball is destined to be ground glass,” to highlight the limitations of forecasting. Instead, he stressed the importance of understanding how to balance and diversify a portfolio effectively.

According to Dalio, a well-diversified portfolio should include a mix of countries, currencies, and asset classes. He advised against making investment decisions based solely on opinions, particularly those heard at conferences. Bridgewater Associates, he revealed, has invested up to a billion dollars in technology to gain a competitive edge in the market.

Dalio also discussed the benefits of diversification, stating it could reduce investment risk by up to 80% without affecting expected returns. He encouraged investors to consider the appeal of different asset classes when making investment choices.

In a significant departure from his previous view that “cash is trash,” Dalio now sees cash as a relatively attractive asset class. He explained that cash currently offers a real return of about 1.5%, making it a viable option for investors. Unlike other asset classes, cash doesn’t come with price risk, adding to its appeal.

In a Yahoo Finance interview from December 2021, Dalio expressed strong views on diversification and the role of cash in an investment portfolio. He mentioned that although he’s been quoted as saying “cash is trash,” he believes cash is actually the riskiest investment option because it loses purchasing power over time. Dalio advised investors to evaluate their returns and assets in terms of inflation-adjusted dollars rather than nominal terms. He warned that holding cash could result in a loss of 4% or 5% due to inflation, making it, in his opinion, the least advisable investment.