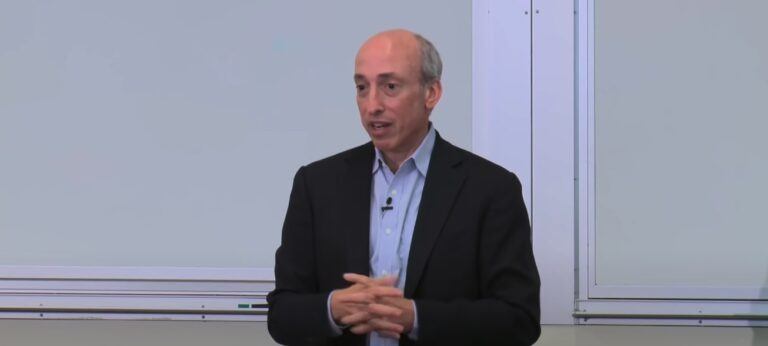

On 21 September 2023, Gary Gensler, the Chair of the U.S. Securities and Exchange Commission (SEC), was interviewed by Kailey Leinz on Bloomberg TV. During the conversation, Gensler touched upon several critical issues, including the potential impact of a government shutdown on market oversight, the SEC’s stance on regulating the cryptocurrency space, and the ongoing debate surrounding climate risk disclosure.

Government Shutdown and Market Oversight

Gensler warned that a government shutdown would severely limit the SEC’s ability to oversee financial markets. He explained that the SEC, like other appropriating agencies, would operate with a minimal staff during a shutdown. This would mean that the agency’s normal oversight functions would be impossible to carry out. For instance, companies looking to go public might find that their filings could not be reviewed by the SEC. Gensler also noted that while the U.S. Treasury and stock markets would continue to function, they would do so without the oversight of market regulators.

Regulation of the Cryptocurrency Space

When asked about recent court decisions affecting the crypto space, Gensler reiterated his commitment to protecting investors. He drew parallels between the current state of the crypto market and the securities markets of the 1920s, emphasizing that the SEC’s securities laws are applicable to crypto security tokens. Gensler argued that investors still benefit from disclosure laws and protections against fraud and manipulation. He also expressed concern about the number of people who have lost money in the crypto space due to fraudulent activities.

Bitcoin Futures ETF

Gensler was questioned about the possibility of the SEC revoking approval for a Bitcoin Futures ETF. While he did not commit to any specific action, he mentioned that the SEC takes court rulings into consideration and deals with filings that are in front of them. He also noted that there are a number of open filings in the Bitcoin exchange-traded product space, indicating that the regulatory landscape is still evolving.

Climate Risk Disclosure

Gensler discussed the topic of climate risk disclosure, particularly the debate surrounding the inclusion of Scope 3 emissions. He stated that the SEC is currently considering public and congressional feedback on this issue. Gensler emphasized that many companies are already making climate risk disclosures and that the SEC’s role is to bring efficiency and comparability to these disclosures. However, he did not commit to any specific course of action regarding Scope 3 emissions.

Final Remarks

Gensler concluded by emphasizing the importance of the U.S. Treasury market as the foundation of the country’s capital markets. He noted that the trust in this market is partly based on the country’s ability to resolve its differences democratically. While he did not anticipate significant market disruptions emanating from a government shutdown, he stressed that the absence of regulatory oversight could have implications.