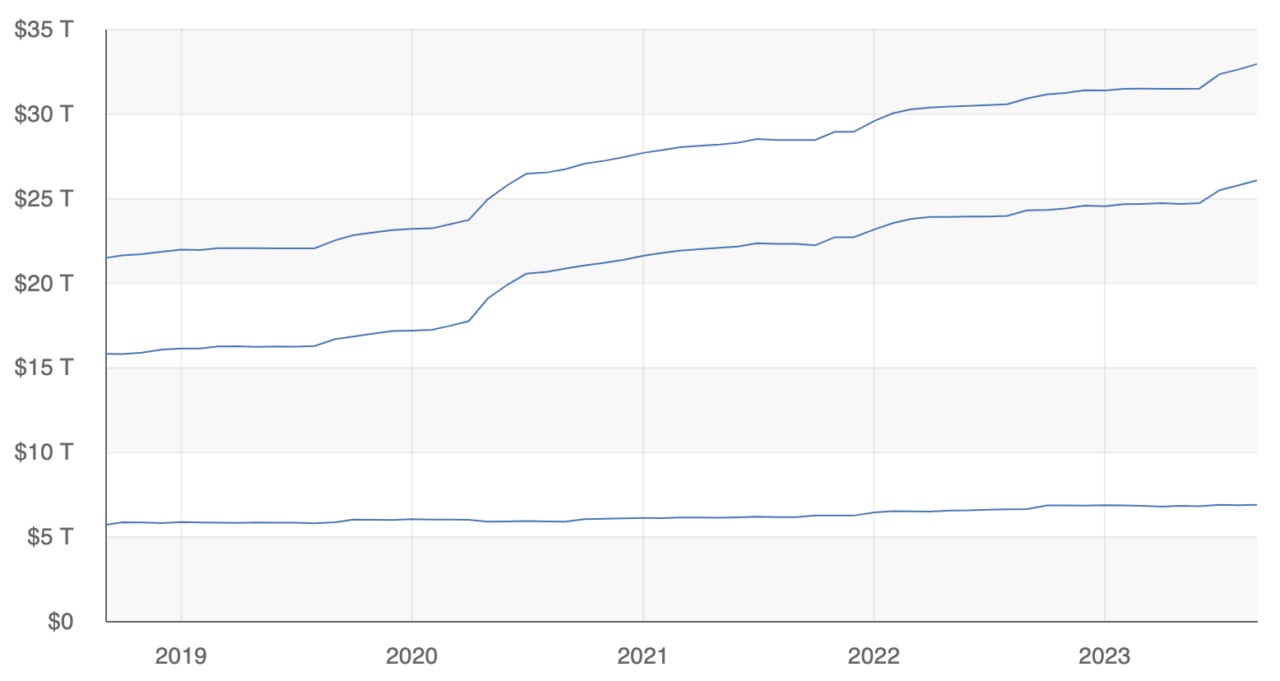

The United States is on the brink of reaching a staggering $33 trillion in national debt, according to the latest data from the U.S. Department of the Treasury’s Bureau of the Fiscal Service. In the past month, the U.S. Total Public Debt Outstanding has ballooned by $306 billion, settling at approximately $32.91 trillion. This rapid increase comes after the debt surpassed the $32 trillion mark on June 15th.

What does the term “Total Public Debt Outstanding” signify, and why is it significant? Essentially, it refers to the cumulative debt that the U.S. federal government is obligated to repay to both external and internal lenders. This encompasses public debt, like U.S. Treasury bonds owned by private individuals, companies, and foreign nations, as well as intragovernmental holdings, which are securities held by various federal agencies. The magnitude of this public debt is vital because it has the potential to sway interest rates, alter the nation’s creditworthiness, and influence economic expansion.

According to a report by The Daily Hodl, a recent survey conducted by the Peter G. Peterson Foundation reveals that the American public is increasingly anxious about the country’s fiscal stability. The study indicates that 91% of Democrats and 89% of Republicans are urging lawmakers to address the national debt and prevent future government shutdowns.

The concern is not just partisan; it’s nationwide. The report went on to say that a significant majority of Americans are deeply worried about the economic repercussions of a potential government shutdown next month. Specifically, apparently, 70% of voters fear that Congress will fail to reach a budget agreement by the end of the current fiscal year on September 30th, thereby triggering a shutdown.

Moreover, there is bipartisan support for taking decisive action to reduce the national debt. About 69% of Democrats and 67% of Republicans are in favor of establishing a bipartisan commission tasked with recommending comprehensive strategies for debt reduction.

The urgency to address the debt issue is palpable among voters. Eighty percent want the national debt to be among the top three priorities for both the President and Congress. This sentiment is shared across party lines, with 71% of Democrats, 78% of independents, and 92% of Republicans agreeing.

The Peter G. Peterson Foundation’s survey involved 1,013 registered voters across the nation and was conducted between August 21st and August 23rd. The poll has a margin of error of plus or minus 3.1%.

On July 27, 2023, the Cato Institute, a libertarian public policy research organization, labeled the escalating U.S. debt as a matter of national security. The institute contends that persistent procrastination in enacting sound fiscal policies amid rising federal debt could set the stage for economic downturn and a possible fiscal emergency.

The organization also cautions that a faltering economy, coupled with growing apprehensions among global bondholders regarding the U.S. government’s capability to manage its debt, could adversely affect America’s global reputation. They assert that the mounting federal debt in the U.S. has the potential to stifle private investment, diminish income levels, and elevate the risk of an abrupt fiscal catastrophe.

Additionally, the Cato Institute underscores the immediate necessity for reforms in entitlement programs. Programs like Social Security, Medicare, Medicaid, and other needs-based initiatives consume half of the federal budget, while defense expenditure accounts for a fifth. To address this, the institute advocates for the establishment of a debt commission whose recommendations would automatically be enacted into law upon receiving presidential approval.

The Cato Institute stresses that imprudent fiscal practices jeopardize both the economic and military prowess of the United States. They argue that by overhauling entitlement schemes and curtailing expenditures, lawmakers can avert the detrimental effects of soaring debt on America’s affluence and safety. The institute is confident that a well-structured debt commission could aid Congress in accomplishing these objectives.

Featured Image by Mackenzie Marco via Unsplash