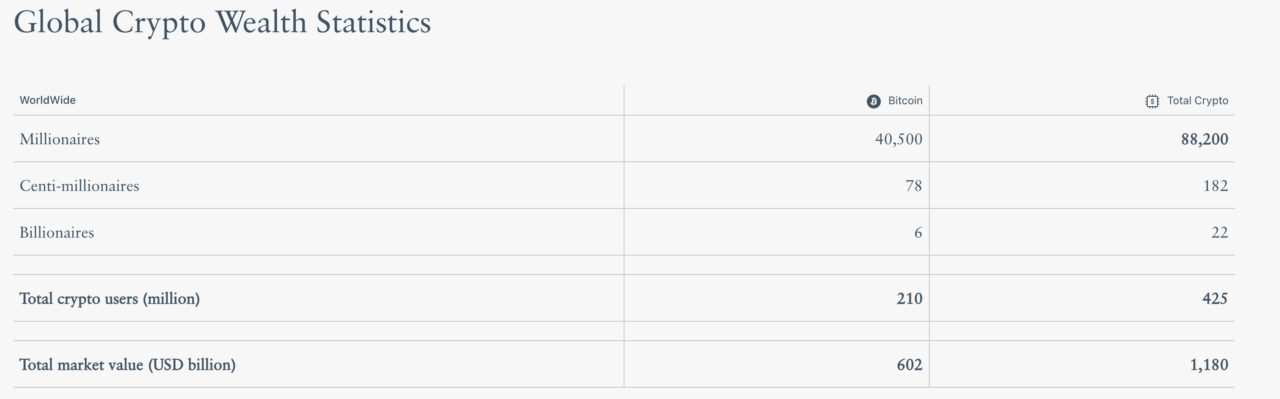

A recent study by Henley & Partners, an investment migration consultancy, has revealed that out of the 425 million people globally who are invested in cryptocurrencies, a select few have reached billionaire status. Specifically, six individuals have amassed a fortune of at least $1 billion in Bitcoin.

According to a CNBC article, which cites Henley & Partners’ Crypto Wealth Report, while the crypto market may not be experiencing the same explosive growth as in its heyday, it remains a popular investment choice. The CNBC article says data indicates that more than half of Gen Z individuals, those between 18 and 25 years old, have invested in cryptocurrencies. However, a Pew Research survey conducted in April apparently found that 75% of Americans are uncertain about the safety of investing in or using cryptocurrencies, with 45% stating their investments have not performed as well as expected.

Henley & Partners’ report further breaks down the demographics of crypto wealth. According to the study, 88,200 individuals globally have crypto assets valued at a minimum of $1 million. Of these, 40,500 hold their wealth primarily in Bitcoin, accounting for just under 46% of these crypto millionaires. The report also identifies a smaller group of 182 “centi-millionaires,” who have crypto assets valued over $100 million, with 78 of them focusing their investments on Bitcoin.

Interestingly, the proportion of Bitcoin billionaires is much smaller compared to the number of crypto millionaires and centi-millionaires. Out of the 22 individuals with crypto holdings exceeding $1 billion, only six have their wealth concentrated in Bitcoin. At the time the report was compiled, the total market value of cryptocurrencies stood at approximately $1.18 trillion.

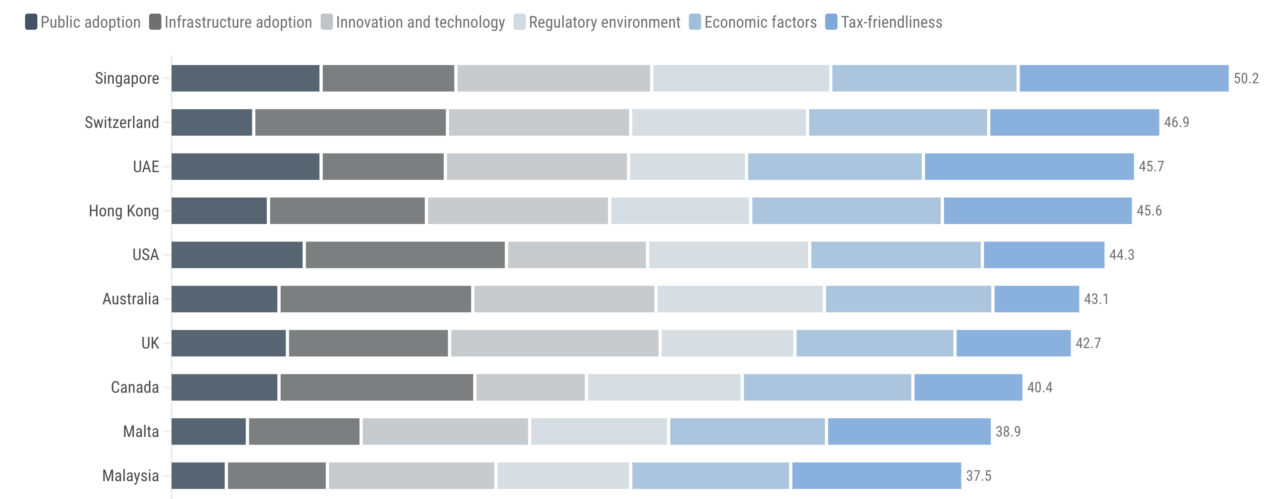

The study also introduced a Crypto Adoption Index, which evaluates various factors such as public adoption rates, regulatory frameworks, and taxation policies related to cryptocurrencies. Singapore emerged as the leader in this index, followed by Switzerland and the United Arab Emirates. The United States and the United Kingdom ranked fifth and seventh, respectively.

In terms of tax-friendliness for crypto investors, both Singapore and the UAE outperformed the U.S. and the U.K., which did not make it to the top 10 in this category. However, public interest and adoption are high in the U.S. and the U.K., ranking them third and fourth, respectively.

The report also highlighted that the U.S. leads in infrastructure adoption, including the prevalence of crypto ATMs and integration by local banks. The U.K. excels in the innovation and technology sector related to cryptocurrencies.

Featured Image Via Midjourney