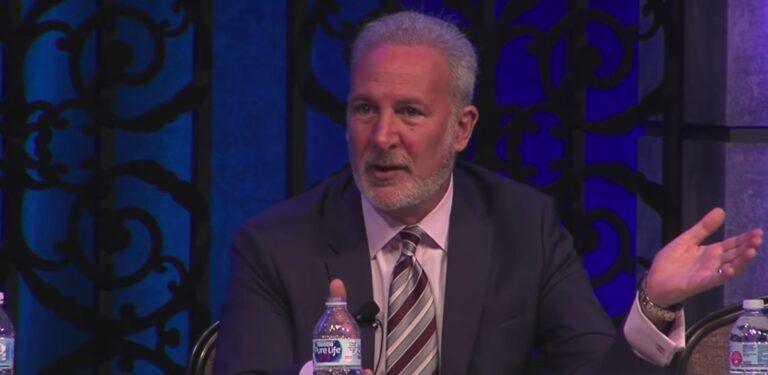

Recently, Peter Schiff, the CEO of Euro Pacific Capital and a long-time critic of Bitcoin, made a series of alarming statements on social media platform X, formerly known as Twitter. He also holds multiple positions in other financial firms, such as Euro Pacific Asset Management, an autonomous investment advisory service; Schiff Gold, previously known as Euro Pacific Precious Metals, a dealer specializing in precious metals; and Euro Pacific Bank, a bank that operates on a full-reserve basis.

Over the course of these two days, Schiff focused on the rising costs of oil, the potential for increased inflation, and a looming financial crisis that he believes will surpass the severity of the 2008 downturn.

On 27 September, Schiff initiated the conversation by highlighting that oil prices had crossed the $92.50 mark. He emphasized that the cost of living is set to escalate rapidly due to the dual impact of rising oil prices and increasing interest rates. According to Schiff, inflation is driving up the costs of energy, debt servicing, and virtually all other commodities. He questioned the continued decline in gold prices in the face of surging oil costs, implying that gold should be rising instead.

In a subsequent post on the same day, Schiff revealed that oil prices had further increased to over $93. He stated that President Biden no longer has the means to curb this upward trend by using the Strategic Petroleum Reserve (SPR). Schiff warned that the current decade will see consumers grappling with inflation rates higher than those experienced in the 1970s. He even predicted that gas prices could soon exceed $10 per gallon.

In his final post on 27 September, Schiff turned his attention to the impending financial crisis, which he believes will be more devastating than the 2008 financial meltdown. He criticized Wall Street and the Federal Reserve, stating that they are more uninformed now than they were during the previous crisis. Schiff argued that if these institutions understood the gravity of the situation, gold prices would be experiencing a significant upswing.

On 28 September, Schiff added to his series of warnings with a new post stating that oil had traded above $95 that night. He asserted that this could be the beginning of a historic surge in oil prices. Schiff drew a comparison to 2008, when oil traded at $150 per barrel, and speculated that given the inflation created by global central banks since then, this bullish trend in oil prices won’t conclude until it reaches at least $300 per barrel.