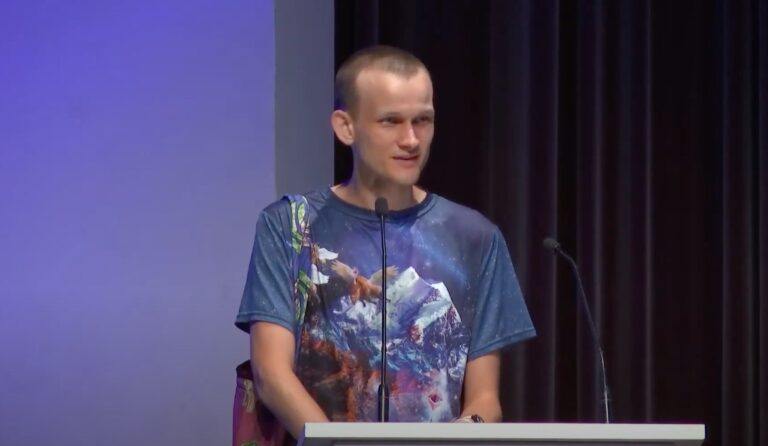

In a recent interview with CNBC’s MacKenzie Sigalos in Prague, Ethereum co-founder Vitalik Buterin shared his thoughts on a range of topics, from the platform’s future to the regulatory landscape affecting the crypto industry.

Buterin began by discussing his nomadic lifestyle, stating that he avoids certain countries, including his native Russia, due to the risks associated with his work in cryptocurrency. He emphasized that the primary challenge for Ethereum is to offer genuine value to its users. According to him, the platform has spent the last decade experimenting and must now focus on building applications that people will actually use.

Buterin also touched upon his public persona. Despite not actively seeking fame, he stated that his primary focus is creating a world where people have equitable access to financial resources, irrespective of location. He added that his transparent communication style and willingness to engage in profound philosophical discussions have made him a trusted thought leader within the crypto community.

Discussing the utility of cryptocurrencies, Buterin said they are most useful in emerging economies where they can solve real-world problems like payments and savings. He cited his experiences in countries like Argentina, where crypto adoption is high, as evidence of its practical utility.

On the topic of regulatory shifts, Buterin observed that as U.S. regulators intensify their scrutiny of the crypto sector, the industry’s focus is shifting overseas. He noted that while U.S. investors often view crypto as a speculative asset, people in developing countries use it for practical purposes.

Buterin expressed concerns about the reliance on centralized platforms like Binance for crypto transactions. He argued that these centralized entities are vulnerable to external pressures and corruption. He also emphasized the importance of privacy and security in the Ethereum ecosystem, stating that people need to have wallets that are secure, and if they lose the keys, they shouldn’t lose everything.

Regarding Central Bank Digital Currencies (CBDCs), Buterin stated that they end up being even less private and break down existing barriers against both corporations and the government. He also revealed that Ethereum is focusing on enhancing privacy and scalability through technologies like zero-knowledge rollups.

Buterin mentioned that Ethereum’s shift to a proof-of-stake model is more likely to withstand government intervention, as it is easier to anonymize and harder to shut down. He added that Ethereum has evolved into a self-governing ecosystem, resilient enough to function even if he or the Ethereum Foundation were targeted. He emphasized that there are entire companies that maintain Ethereum clients, making the platform resilient with no single point of failure.