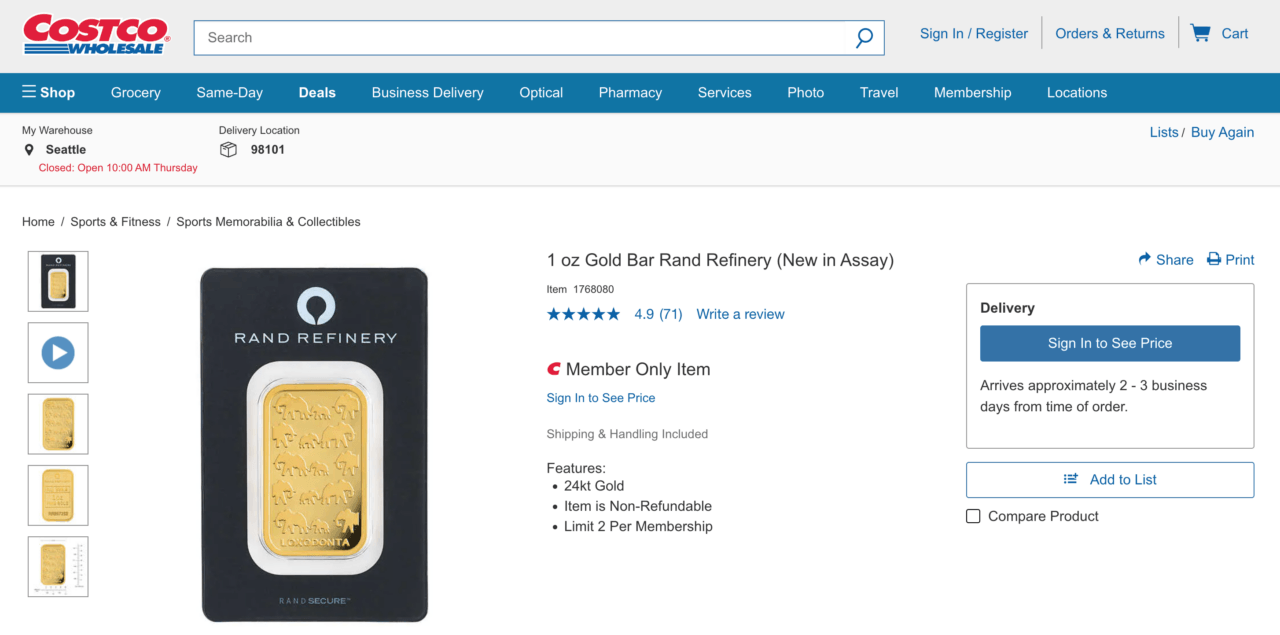

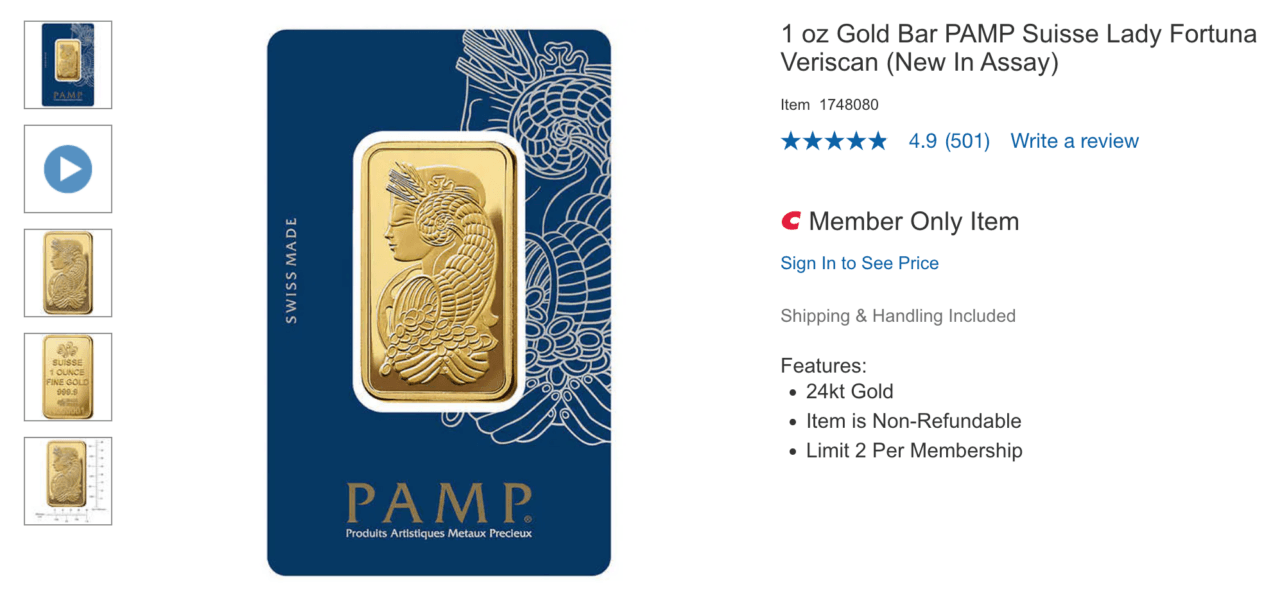

Costco, the retail giant renowned for offering a wide range of products at discounted prices, has recently added an unexpected item to its inventory: 1-ounce gold bars.

While the exact price is available only to Costco members, online discussions suggest that the bars were priced at just under $1,900. As of 1:30 p.m. UTC on 28 September 2023, the spot gold price stood at $1,874.50 per ounce.

On 26 September 2023, during Costco’s Q4 2023 Earnings Call, Richard Galanti, who is Costco’s Executive Vice President and Chief Financial Officer, had this to say:

“I’ve gotten a couple of calls that people have seen online that we’ve been selling one-ounce gold bars, yes, but when we load them on the site, they’re typically gone within a few hours and we limit two per member.“

The gold bars are exclusively available online and can be purchased only by Costco members. Membership fees for the retail giant range from $60 to $120 per year, depending on the chosen program.

According to a report by CNBC published yesterday, Jonathan Rose, co-founder of Genesis Gold Group, sees this move as a strategic promotion that could attract a specific segment of Costco’s customer base. According to Rose, Costco has recently expanded its range of survivalist goods, including a 150-serving emergency food preparedness kit and he addition of gold bars aligns well with these products, especially at a time when concerns about economic stability are high:

“They’ve done their market research. I think it’s a very clever way to get their name in the news and have some great publicity. There is definitely a crossover of people living off the land, being self-sufficient, believing in your own currency. That’s the appeal to gold as a safe haven as people lose faith in the U.S. dollar.“

Earlier this month, during a recent discussion with Michelle Makori, the Editor-in-Chief at Kitco News, Michael Lee, founder of Michael Lee Strategy, forecasted that gold prices could escalate to $5,000 per ounce within the next three years. Lee attributes this prediction to the current recessionary state of the U.S. economy and the impending wave of defaults. He pointed out that the yield curve has inverted, a historically reliable sign of an upcoming recession, and noted that both businesses and consumers are already overleveraged, making defaults likely.

Lee also questioned the current gold price, which remains under the significant psychological threshold of $2,000 per ounce. He suspects market manipulation by banks and financial institutions, citing the buying activities of BRICS nations and past manipulations in the silver market. Lee further speculated that China and Europe would be the first regions to seek safety in gold, driving its price up. He views gold as a long-term investment, serving as a hedge against inflation and economic instability.

Additionally, Lee expressed skepticism about the accuracy of labor market data, noting that reports have consistently been revised downward. He questioned whether this pattern is due to government bureaucracy, flawed models, or intentional manipulation. Finally, Lee criticized the Federal Reserve’s decision to raise interest rates, arguing that it would exacerbate the recession and that other methods, like quantitative easing, should be employed to control inflation.

Featured Image via Unsplash