Chainalysis, a leading firm in blockchain analytics, unveiled its 2023 Global Crypto Adoption Index on September 12, 2023. This new index is part of the company’s forthcoming “2023 Geography of Cryptocurrency Report,” scheduled for release in October 2023.

Based on the blog post Chainalysis published yesterday, the primary aim of the index is to amalgamate blockchain-based data with real-world metrics to identify the countries where ordinary citizens are most actively engaging with cryptocurrencies. The index is not focused on countries with the largest transaction volumes but aims to spotlight nations where the general populace is most involved in crypto activities. The index is designed to measure the extent to which people in different countries are investing a significant portion of their wealth in digital assets.

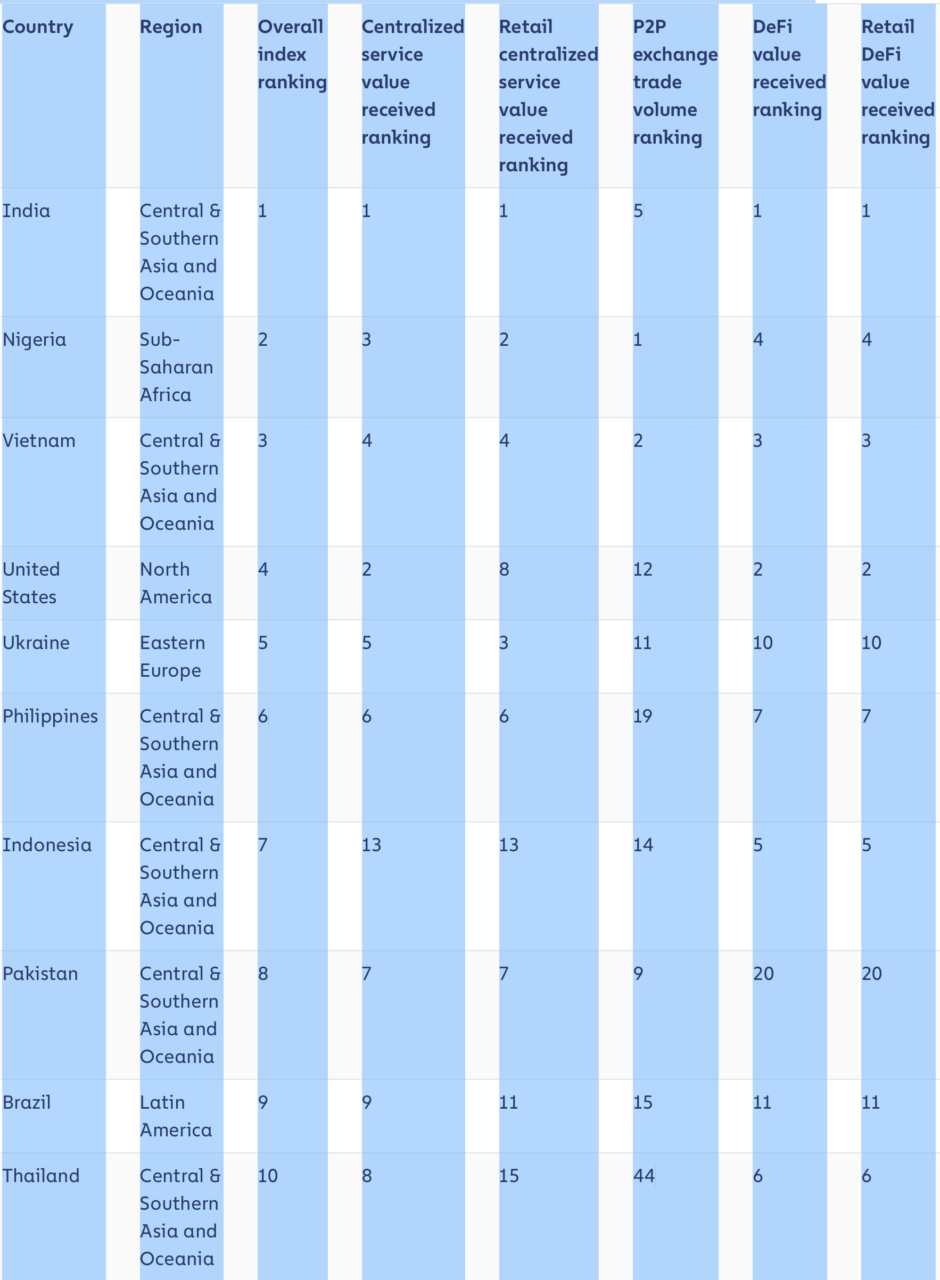

The Global Crypto Adoption Index comprises five distinct sub-indexes, each reflecting different aspects of cryptocurrency usage in various countries. The index ranks 154 countries based on available data for each sub-index. These rankings are then adjusted according to factors such as population size and purchasing power. The geometric mean of each country’s ranking across all five sub-indexes is calculated and normalized on a scale from 0 to 1 to determine the overall rankings. A score closer to 1 indicates a higher rank.

To estimate transaction volumes for different types of cryptocurrency services and protocols, Chainalysis relies on web traffic data. Although the firm acknowledges that this method has limitations, such as the use of VPNs by some users, it believes that the sheer volume of data analyzed minimizes any inaccuracies. The index is also cross-verified with local cryptocurrency experts to enhance its reliability.

These five sub-indexes are

- Centralized Exchanges Value Received, Weighted by PPP Per Capita: This sub-index ranks countries based on the total cryptocurrency activity on centralized exchanges, adjusted for the average wealth of residents in each country.

- Retail Value Received at Centralized Exchanges, Weighted by PPP Per Capita: This metric focuses on non-professional, individual users and their activity on centralized platforms, specifically for transactions under $10,000.

- P2P Exchange Trade Volume, Weighted by PPP Per Capita and Internet Users: This sub-index emphasizes the importance of peer-to-peer trading in emerging markets and is adjusted for the average wealth and internet usage in each country.

- DeFi Protocols Value Received, Weighted by PPP Per Capita: This sub-index aims to highlight countries where decentralized finance (DeFi) plays a significant role in financial activities.

- Retail Value Received from DeFi Protocols, Weighted by PPP Per Capita: Similar to the second sub-index, this one focuses on individual, non-professional users engaging in DeFi activities.

Here are the top 20 Countries in the 2023 Global Crypto Adoption Index:

Featured Image via Midjourney