CCData, a renowned FCA-authorized benchmark administrator and global leader in digital asset data, has unveiled the highly-anticipated August 2023 edition of its Exchange Review report. This comprehensive report serves as a beacon for institutional and retail investors, shedding light on critical developments within the cryptocurrency exchange market.

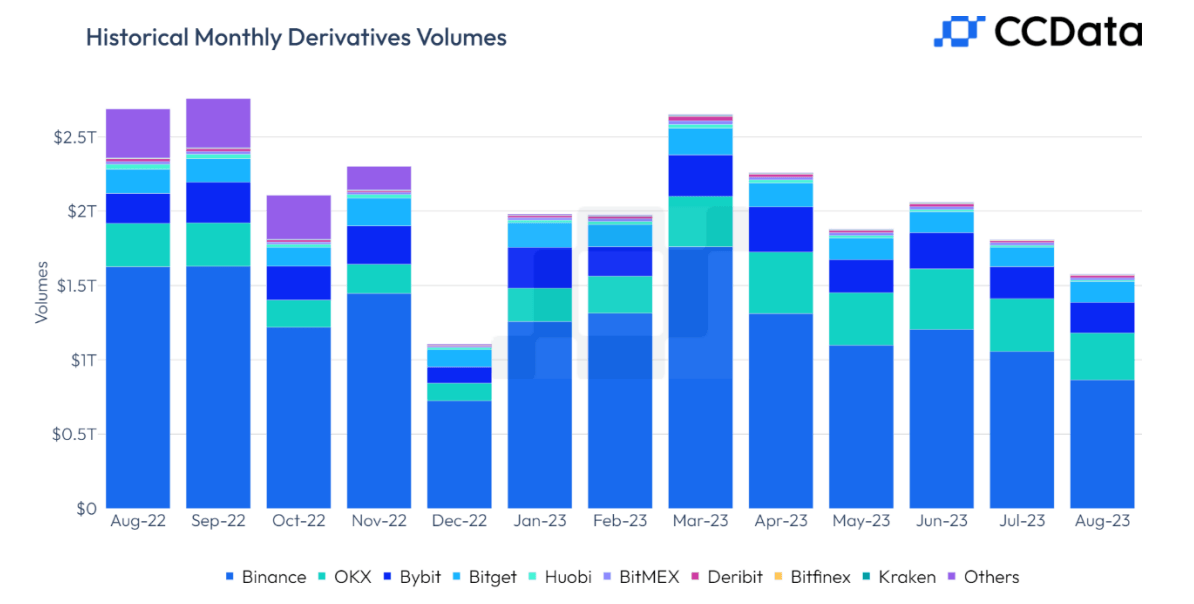

CCData’s August 2023 Exchange Review reveals that in August, the combined trading volume for both spot and derivatives on centralized exchanges decreased by 11.5% to $2.09 trillion. This marked the lowest monthly trading volumes of the year, primarily attributed to price movements, which triggered the largest long liquidation event since the FTX collapse. It’s noteworthy that this was the second-lowest volume recorded on centralized exchanges since October 2020.

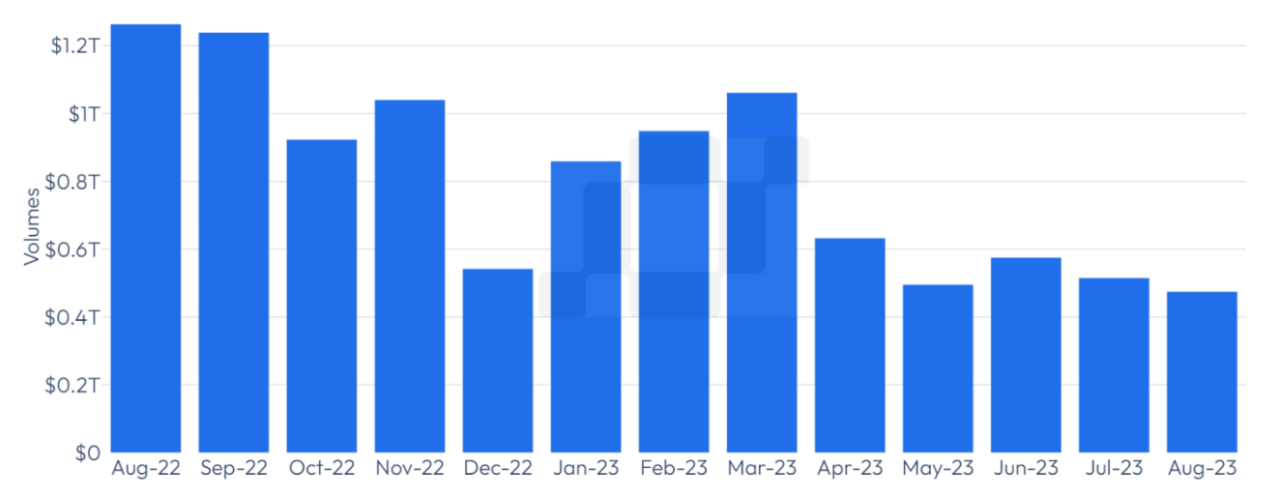

Spot trading volume on centralized exchanges dropped for the second consecutive month, declining by 7.78% to $475 billion. This level represents the lowest monthly spot trading volume since March 2019.

Daily trading volumes on centralized exchanges reached $5.90 billion on August 26th, the lowest point since February 7th, 2019. These reduced spot trading volumes followed Grayscale’s legal victory over the SEC, which, despite its significance, did not result in substantial accumulation of crypto assets. The trading volumes on centralized exchanges have remained low since April, now comparable to the trading activity seen in the bear market of 2019.

Huobi saw a significant increase in spot trading volume in August, rising by 46.5% to $28.9 billion, despite the general market trend. This marked the second consecutive monthly increase in trading volumes for the exchange, following a 79.1% rise the previous month. Consequently, Huobi’s market share reached 6.09%, making it the second-largest exchange after Binance. This is the highest market share Huobi has attained since October 2021. However, this rise in trading activity on Huobi was accompanied by concerns regarding unusual outflows of USDT and WETH in recent months. The exchange attributed this change to the growing popularity of Tron’s RWA product, stUSDT.

While Binance remained the largest venue for spot trading in crypto, recording $183 billion in volumes, its market share declined for the sixth consecutive month, falling to 38.5% in August, marking its lowest market share since August 2022.

On August 17th, open interest on derivatives exchanges witnessed a significant decline of 19.5%, totaling $17.1 billion, leading to a wipeout of $4.13 billion in open interest on selected exchanges. This represented the largest drop in open interest recorded throughout the year. Open interest had been approaching the yearly highs recorded in April before the decline, which followed reports of SpaceX selling its BTC holdings. In August, derivatives trading volume on centralized exchanges also decreased by 12.3% to $1.62 trillion, the second-lowest figure since December 2020.

Consequently, the derivatives market share declined for the third consecutive month, settling at 77.3%. The low spot trading volume and fluctuations in open interest data suggest that the market is currently driven by speculation.

Featured Image via Midjourney