The cryptocurrency-focused arm of the renowned investment titan Fidelity Investments, which has over $4.5 trillion in assets under management, has recently suggested the second-largest digital asset by market capitalization Ethereum ($ETH) is trading at a discount.

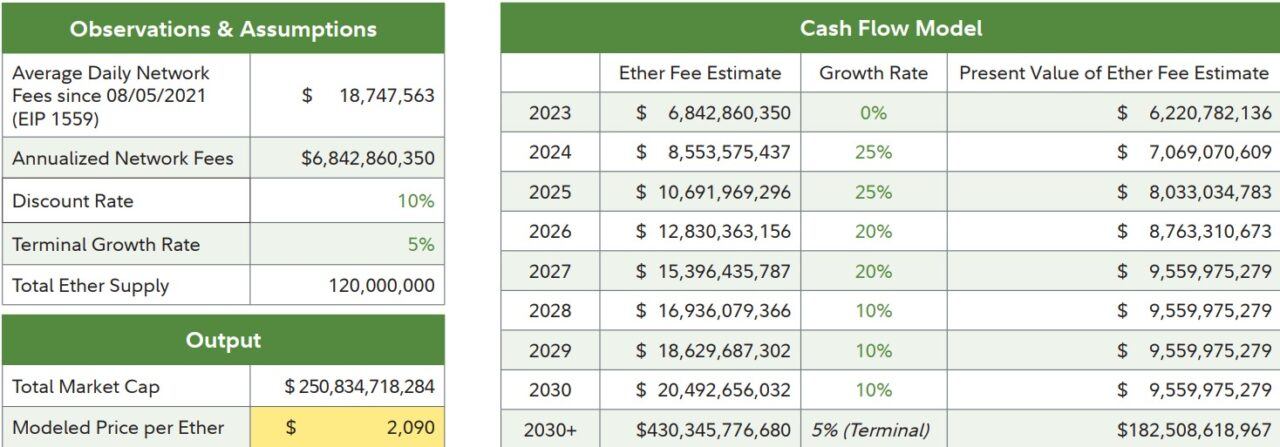

According to a new report titled “Ethereum Investment Thesis,” Fidelity Digital Assets has noted that Ethereum’s current circulating supply is around 120 million ETH and that the network’s annualized fees surpass $6.8 billion, and calculated that the price of ETH should be around $2,090, applying a discounted cash flow model.

Further analysis from the asset manager also revealed that Ethereum’s valuation seems to dance in tandem with its network activity, especially the fees it accumulates. Fidelity Digital Assets foresees this figure, already impressive, embarking on a double-digit ascent over the ensuing seven years, potentially crossing the $20 billion threshold by 2030.

Elaborating on the underlying dynamics, the report explains that the value of Ether is “more easily modeled following the network’s shift to proof-of-stake,” adding that demand for block space “can be measured via transaction fees” which are both burned or passed on to validators.

Per the firm, this means that “fees and ether value accrual should be inherently related over the long term,” with an increasing number of Ethereum use cases creating greater demand for block space, which in turn leads to higher fees and greater value and utility.

Potential roadblocks affecting the Ethereum network, Fidelity Digital Assets noted, include a weakening in the “relationship between ether and the value it provides to network users” if “scaling technology erodes fee revenue unless volumes increase and offset this margin compression.”

The report comes at a time in which large Ethereum whales have bought over $400 million worth of the second-largest digital asset by market capitalization over just 24 hours as their accumulation of ETH is seemingly picking up steam.

The accumulation comes at a time in which the cryptocurrency lost around 4.7% of its value over the course of 7 days amid a wider cryptocurrency market correction that has seen the space’s market capitalization drop to near the $1 trillion mark.

Featured image via Unsplash.