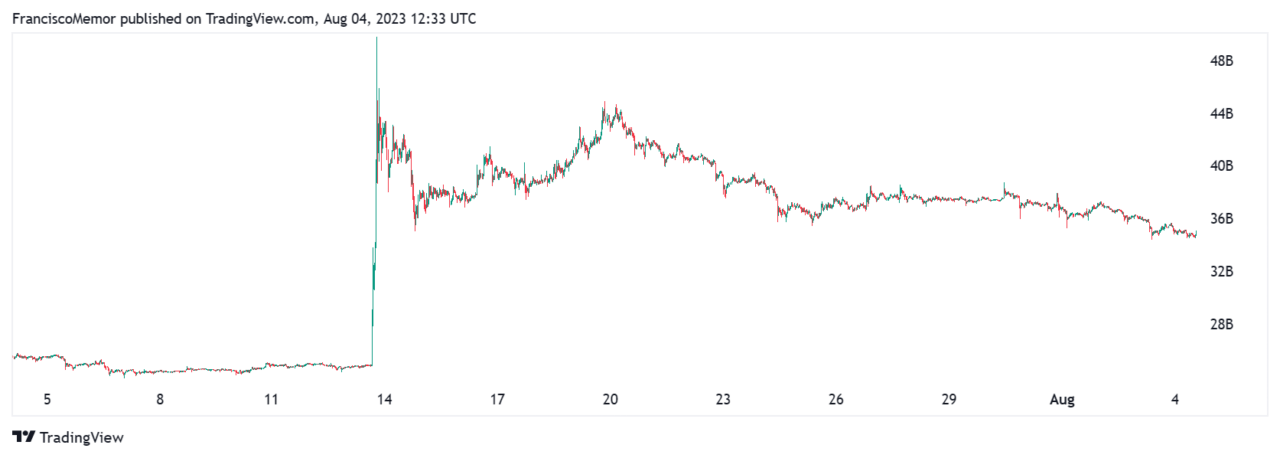

In the latest roller-coaster ride in the cryptocurrency market the native token of the XRP Ledger, $XRP, has seen its market capitalization drop by nearly $10 billion from its peak this year, which was seen shortly after a federal judge ruled the cryptocurrency isn’t necessarily a security.

According to available market data, the market capitalization of XRP umped to $44.32 billion shortly after a federal judge in New York determined that the XRP token “is not necessarily a security on its face.” The ruling came after the U.S. Securities and Exchange Commission (SEC) sued Ripple back in 2020 for alleged violation of U.S. securities laws, arguing that the firm sold XRP without prior registration with the agency.

Judge Analisa Torres ruled in the lawsuit that XRP was a security when Ripple sold it to institutional investors years ago, but not to the public. The judge’s main argument was that institutional investors who bought XRP from Ripple in the past probably knew it had some features of a security, while investors who got XRP from crypto exchanges didn’t have the same information.

XRP’s price jumped after the ruling to a $0.83 high, which helped its market capitalization briefly top the $44 billion mark. At the time of writing, XRP is now trading at $0.66, with a market capitalization of $34.7 billion.

XRP’s price decline is likely a result of recent criticism from U.S. District Judge Jed Rakoff of the Southern District of New York, which contested Judge Torres’ differentiation between institutional sales and sales to retail investors on cryptocurrency exchanges.

Rakoff characterized this as a flawed interpretation of the Howey test, which is commonly utilized to ascertain if an asset classifies as a security, according to analysts headed by Mark Palmer.

The discord generated by Rakoff’s rejection could potentially convolute the acknowledgement of popular crypto exchange Coinbase of the initial ruling in its own ongoing legal battle with the SEC, according to Berengerg analysts, who said Judge Rackoff explicitly referenced Judge Torres’ ruling in his own, saying that the Howey Test does not differentiate between buyers.

XRP was relisted on a number of cryptocurrency exchanges after Judge Torres’ ruling, including on Kraken, Coinbase, and Gemini, which helped its liquidity surge.

Notably, a popular crypto analyst has recently suggested XRP’s price could soon drop below the $0.50 mark to nearly completely retrace the rise it saw after the initial ruling.

Institutional investors have, nevertheless, seemingly started accumulating the token. Cryptocurrency investment products investing in XRP and Cardano ($ADA) have been attracting significant inflows, with institutional investors seemingly preferring altcoins over the past week, with the exception of Ethereum.

Funds investing in Cardano, Solana ($SOL), and XRP have seen significant inflows, raking in $640,000, $600,000, and $500,000 from investors last week. In contrast, Ethereum-focused funds saw $1.9 million in outflows, while Avalanche ($AVAX) investment funds saw $400,000 in outflows.

Featured image via Pixabay.