CCData is an FCA-authorised benchmark administrator and a global leader in digital asset data, providing institutional-grade digital asset data and settlement indices. By aggregating and analysing tick data from globally recognised exchanges and seamlessly integrating multiple datasets, CCData provides a comprehensive and granular overview of the market across trade, derivatives, order book, historical, social and blockchain data.

Earlier today, CCData released the August 2023 edition of its Digital Asset Management Review. The report aims to provide a comprehensive overview of the global digital asset investment landscape, focusing on assets under management, trading volumes, and price performance. Targeting institutional investors, analysts, and regulators, the review aggregates data from multiple sources, including Financial Times, CoinShares, and Bloomberg, among others.

Federal Court Sides with Grayscale

In a landmark decision, the U.S. Court of Appeals for the D.C. Circuit sided with Grayscale, overturning the SEC’s rejection of converting its GBTC fund into an ETF. The court ruling had an immediate impact on the market, causing Bitcoin’s price to surge from $26,000 to $27,600 within minutes. According to CCData, this could serve as a significant catalyst for the U.S., potentially bringing the country closer to launching its first-ever spot Bitcoin ETF.

Europe Takes the Lead in ETF Race

While the U.S. is still contemplating its first Bitcoin spot ETF, Europe has already taken the lead. London-based Jacobi Asset Management launched Europe’s first Bitcoin Spot ETF, which began trading on Euronext on August 15th. CCData notes that the U.S. SEC has postponed its decision on ARK Invest & 21Shares’ application, originally slated for August 13th, with the final deadline now set for January 10, 2024.

SEC Likely to Approve First ETH Futures ETF

CCData’s review also highlights informal reports suggesting that the SEC is on the verge of approving the first Ethereum futures ETF. While the specific fund to receive this approval hasn’t been disclosed, the announcement is expected in October. Companies like Bitwise, VanEck, ProShares, Grayscale, and a partnership between Ark Invest and 21Shares have submitted applications for Ethereum futures funds.

Decline in AUM and Trading Volumes

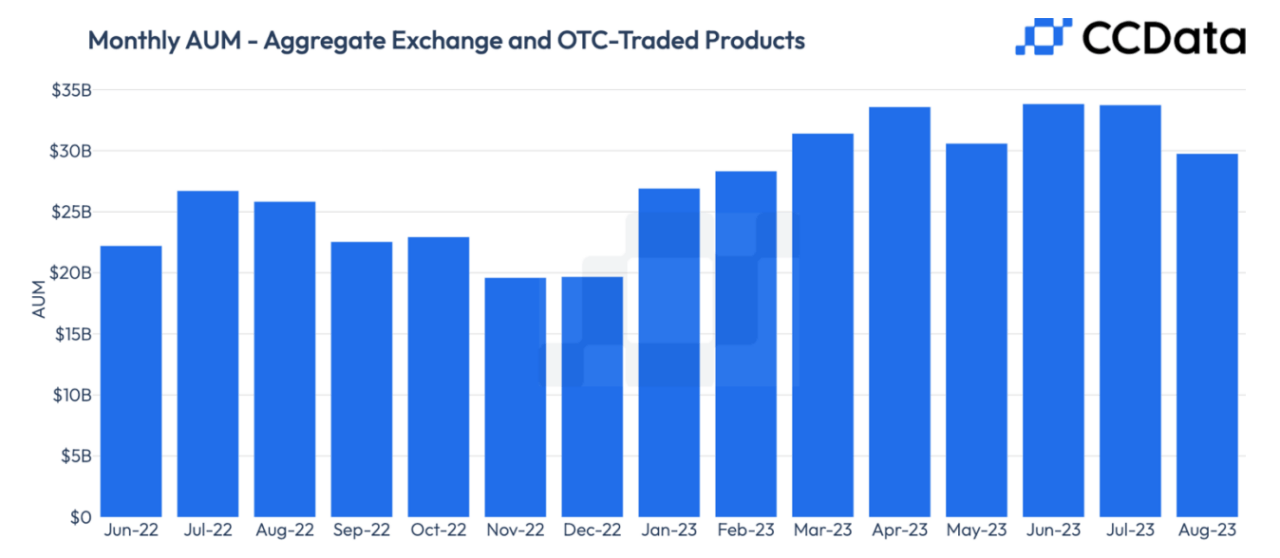

In August, the total assets under management (AUM) for digital asset investment products experienced a significant downturn. This drop was exacerbated by market volatility, largely due to a steep fall in Bitcoin’s value, which reached a low of $25,375 on August 17th, as per CCData’s CCCAGG Reference Price. The situation worsened with the SEC’s postponement of approvals for multiple digital asset ETFs. By August 25th, the total AUM had decreased to $29.7 billion, a 12.7% reduction compared to July, marking the lowest level since February 2023.

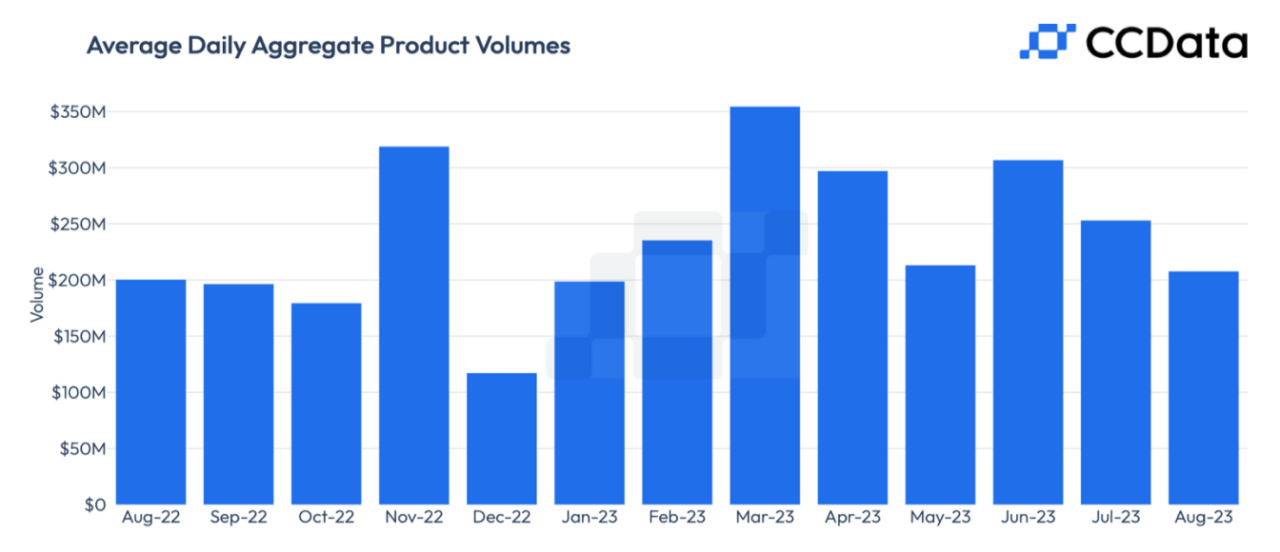

In August, the average daily trading volumes for digital asset investment products experienced a notable reduction, falling by 17.9% to $208 million. This marked the second month in a row of declining volumes and hit the lowest point since January 2023. This downward trend was influenced by a drop in Bitcoin’s price, which led to growing apprehension among market players, dampening the positive outlook that had been prevalent in June and July.